IHS announced it reckons that consumer demand for Ultra High Definition 4K LCD televisions will remain negligible for the foreseeable future.

IHS announced it reckons that consumer demand for Ultra High Definition 4K LCD televisions will remain negligible for the foreseeable future.

For more information visit: www.isuppli.com

Unedited press release follows:

4K Televisions to See Marginal Share of LCD-TV Market Through 2017

El Segundo, Calif. (Oct. 4, 2012) — Despite some high-profile product introductions, consumer demand for televisions with the ultra-high-definition 4K resolution will remain negligible for the foreseeable future, with shipments never accounting for more than 1 percent of the global liquid crystal display (LCD) TV market during the next five years.

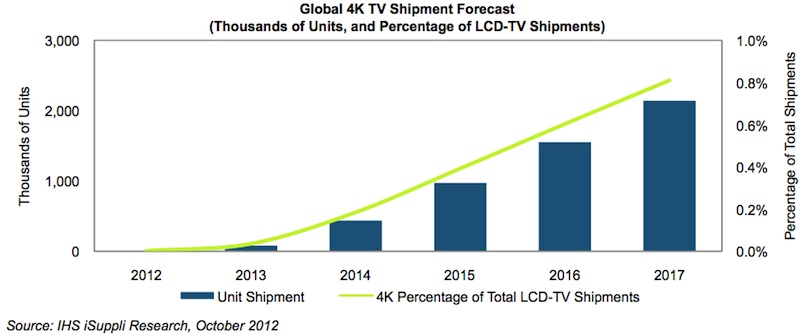

Worldwide shipments of 4K LCD-TVs will rise to 2.1 million units in 2017, up from 4,000 in 2012, according to an IHS iSuppli Television Market Tracker Report from information and analytics provider IHS (NYSE: IHS). Despite the large increase over the years, 4K will account for only 0.8 percent of the global LCD-TV shipments by 2017, as presented in the figure attached. The sets are known as 4K because the televisions sport a pixel format of 3,840 by 2,160 — four times that of a typical high-definition set at 1,920 by 1,080 pixels.

The 4K television segment recently has garnered attention with Japanese manufacturer Sony Corp. announcing an 84-inch 4K LCD-TV priced at $25,000. LG Electronics of South Korea also launched an 84-inch LCD-TV for $20,000. Japan’s Toshiba Corp. is offering a 55-inch model priced at $10,000.

For their part, Chinese brands Hisense and Konka announced that they will launch 84-inch 4K sets this year.

However, IHS believes that neither consumers nor television brands will have the interest required to make the 4K LCD-TV market successful.

“If you have a television that is 60-inches or larger and are watching video that has a 3,840 by 2,160 resolution, then a 4K television makes sense,” said Tom Morrod, director, TV systems and technology research for IHS.

“However, a very limited amount of content is available at the 4K resolution. Meanwhile, because of high prices and other issues, the market for super-sized, 60-inch and larger sets is very small—at only about 1.5 percent of total television shipments in 2012. Furthermore, for most people, the 1,080p resolution is good enough. Because of these factors, combined with the massive price tags, the market for 4K sets during the next few years will be limited to very wealthy consumers or to commercial uses.”

On the road to OLED

On the other side of the equation, leading television brands may be viewing 4K merely as a transitional product.

“The 4K sets can fill the gap at the high-end of television brands’ product lines until the arrival of the next-generation active-matrix organic light-emitting diodes televisions (AMOLED TVs),” Morrod said. “Japanese brands are offering 4K product because they need to have a competitive alternative to the AMOLED TVs being sold by their rivals in South Korea, Samsung and LG Electronics. Meanwhile, the South Korean companies are having difficulties producing AMOLED panels, saying they will need two more years to achieve competitive volume and pricing.

Therefore, the Korean brands are offering 4K sets as a transitional step until their AMOLED televisions are more widely available.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.