DisplaySearch announced that shipments of TFT LCDs for portable navigation devices (PND) and automotive monitors (used in car navigation and in-console monitors) increased in the second half of 2009 and first half of 2010.

DisplaySearch announced that shipments of TFT LCDs for portable navigation devices (PND) and automotive monitors (used in car navigation and in-console monitors) increased in the second half of 2009 and first half of 2010.

For more information visit: www.displaysearch.com

Unedited press release follows:

TFT LCD Shipments for Automotive Applications Indicate Strong Rebound

Automotive Electronics for Electric and Hybrid Vehicles, as Well as Government Tax Deductions and Subsidies, are Driving Display Demand

SANTA CLARA, Calif., October 26, 2010—Shipments of TFT LCDs for portable navigation devices (PND) and automotive monitors (used in car navigation and in-console monitors) increased in the second half of 2009 and first half of 2010. This indicates that the automotive market has rebounded since the economic crisis of 2008. According to the latest DisplaySearch Quarterly Small/Medium Shipment and Forecast Report, TFT LCD shipments rebounded from Q3’09 as a result of automotive sales driven by government tax deductions and subsidies. In addition, demand for automotive displays has grown in China and emerging regions.

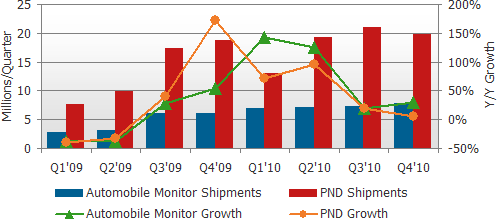

In the first half of 2010, TFT LCD shipments for automotive monitor applications were more than twice the levels of the first half of 2009. Specifically, shipment growth was 143% Y/Y from Q1’09 to Q1’10 and 125% Y/Y from Q2’09 to Q2’10. TFT LCD shipments for portable navigation devices also experienced a strong rebound in the first half of 2010, up 72% Y/Y from Q1’09 and 96% Y/Y in Q2’10. Strong growth is forecast for the second half of 2010 in both segments.

“The forecasted growth in navigation and GPS in the automotive market presents significant opportunities for TFT LCD manufacturers in the near future,” noted Hiroshi Hayase, lead analyst for small and medium displays. “In addition, the emergence of hybrid and electric cars is driving demand for energy-efficient automotive monitors that support energy efficiency and safety efforts.”

Figure 1: TFT LCD Shipments for Automotive Monitor & Portable Navigation Devices (2009-2010)

Source: DisplaySearch Quarterly Small/Medium Shipment and Forecast Report

Source: DisplaySearch Quarterly Small/Medium Shipment and Forecast Report

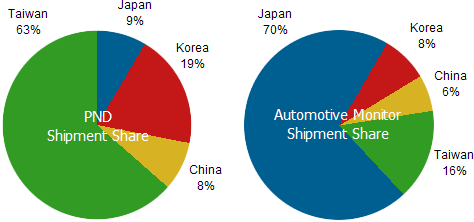

According to DisplaySearch results, 70% of TFT LCD automotive monitors are produced by Japanese LCD manufacturers, while 60% of TFT LCD portable navigation devices are from Taiwan LCD manufacturers. The demand for automotive displays has had a positive effect on manufacturers in these regions. For example, Japanese manufacturers of automotive displays have been operating at full capacity in 2010, and some car navigation products have been delayed due to the tight supply of automotive TFT LCDs.

Figure 2: TFT LCD Manufacturers Market Share by Region for Automotive Monitor & Portable Navigation Devices (1H’10)

Source: Quarterly Small/Medium Shipment and Forecast Report

Source: Quarterly Small/Medium Shipment and Forecast Report

The market outlook for automotive and PND TFT-LCD shipments is covered in the DisplaySearch Quarterly Small/Medium Shipment and Forecast Report, which provides results of all FPD shipments for the automotive market, including automotive monitor LCD and PND LCD shipments. The report also tracks shipments of all flat panel display technologies such as TFT LCD, PM LCD, AM, PM OLED and EPD for all applications using FPDs up to 9.0”. EPD reporting also includes displays for e-books over 9”, including market share of e-books by size and resolution. The report also provides comparisons between applications, suppliers, size, resolution and pricing for FPD technologies using panels that are 9.0” or smaller. This report is delivered in PowerPoint and includes Excel pivot tables.

In addition, DisplaySearch has released the 2010 edition of its Automotive Displays Report. This comprehensive report contains detailed historical and forecast data for all displays used in automobiles, including navigation displays, monitors, and in console displays. Display technologies covered include LCD (liquid crystal display) broken down into TFT (both amorphous-silicon and low temperature polysilicon), passive matrix, twisted nematic, vertical alignment, super twisted nematic (both monochrome and color), as well as OLED (organic electroluminescent display), both passive and active matrix. The report includes automotive and PND display shipments by supplier, as well as value chain information for each application. Forecasts of the automotive display market by screen size through 2014 are also included.

For more information on the DisplaySearch Quarterly Small/Medium Shipment and Forecast Report and 2010 Automotive Displays Report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

Register Now for the DisplaySearch Taiwan TV Supply Chain Conference—November 3, 2010 (Taipei, Taiwan).

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless.