RealD Inc. announced financial results for its fiscal 2011 second quarter and six months ended September 24, 2010.

RealD Inc. announced financial results for its fiscal 2011 second quarter and six months ended September 24, 2010.

RealD trades on the NYSE under the symbol RLD.

For more information visit: www.reald.com

Unedited press release follows:

RealD Inc. Reports Second Quarter Fiscal 2011 Financial Results

LOS ANGELES–RealD Inc. (NYSE: RLD), a leading global licensor of 3D technologies, today announced the Company’s financial results for the three and six months ended September 24, 2010.

Second Quarter Fiscal 2011 Results

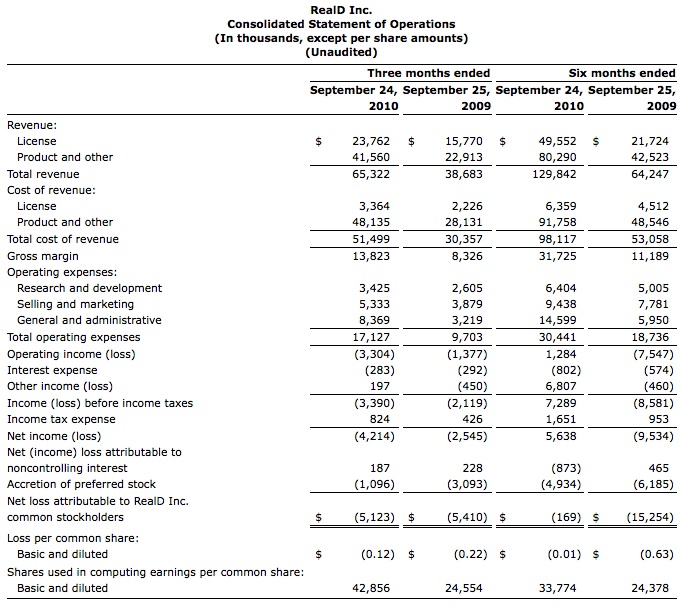

For the second quarter of fiscal 2011, RealD reported net revenue of $65.3 million, compared to $38.7 million for the second quarter of fiscal 2010, an increase of 69 percent.

GAAP net loss attributable to common stockholders for the second quarter of fiscal 2011 was $5.1 million, or $0.12 per diluted share, compared to a GAAP net loss attributable to common stockholders of $5.4 million, or $0.22 per diluted share, for the second quarter of fiscal 2010.

Adjusted EBITDA for the second quarter of fiscal 2011 was $16.5 million, compared to $3.9 million for the second quarter of fiscal 2010, an increase of 327 percent. Adjusted EBITDA, which is a non-GAAP financial measure, is defined below and reconciled to net income (loss), the most comparable measure under GAAP, in the section entitled “Use of non-GAAP financial measures.”

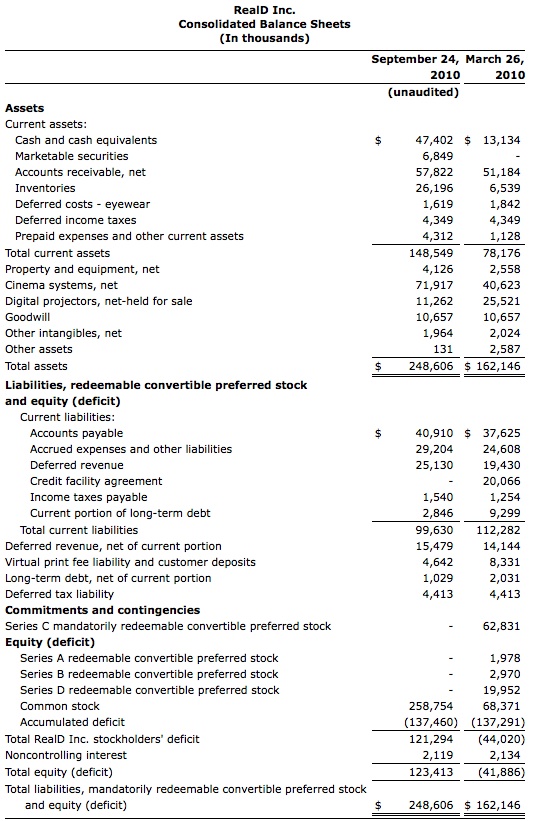

As of September 24, 2010, the Company had deployed approximately 9,300 RealD enabled screens, comprised of 5,600 domestic (United States and Canada) RealD-enabled screens and 3,700 international RealD-enabled screens, and representing an increase of 182% from 3,300 screens at September 25, 2009 and an increase of 24% from approximately 7,500 screens at June 25, 2010.

During the second quarter of fiscal 2011, the Company generated $1.0 million in cash from operating activities and closed the period with overall cash, cash equivalents and marketable securities of $54.3 million.

Management Comments

“RealD delivered solid results in the second quarter of fiscal 2011 led by the strength of the RealD platform and our expanding global footprint,” said Michael V. Lewis, Chairman and Chief Executive Officer of RealD. “As our second quarter performance validates, consumer demand for a premium 3D visual experience continues to accelerate. As a global leader in licensing 3D technologies, we believe RealD is uniquely positioned to capture this growing opportunity in 3D cinema. We remain committed to building upon our industry leadership, and during the quarter, we expanded our 3D cinema platform both domestically and in key international markets, including Europe and Asia.”

First Half Fiscal 2011 Results

For the six months ended September 24, 2010, RealD reported net revenue of $129.8 million, compared to $64.2 million for the six months ended September 25, 2009, an increase of 102 percent.

GAAP net loss attributable to common stockholders for the six months ended September 24, 2010, was $169,000, or $0.01 per diluted share, compared to a GAAP net loss attributable to common stockholders of $15.3 million, or $0.63 per diluted share, for the six months ended September 25, 2009.

Adjusted EBITDA for the six months ended September 24, 2010 was $27.5 million, compared to $6.1 million for the six months ended September 25, 2009, an increase of 349 percent.

Source: Rentrak

Conference call information

Members of RealD management will host a conference call to discuss its second quarter fiscal 2011 financial results beginning at 4:30 pm ET (1:30 pm PT), today, November 2, 2010. The conference will be broadcast live over the Internet, hosted at the Investor Relations section of the company’s website at www.reald.com, and will be archived online upon completion of the call.

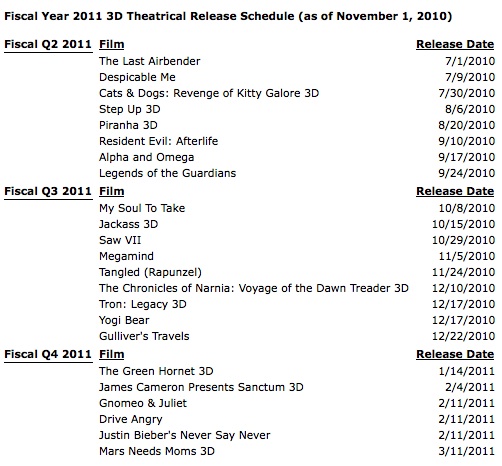

Cautionary note on forward-looking statements

This press release includes forward-looking information and statements, including but not limited to: statements concerning anticipated future financial and operating performance; RealD’s ability to continue to derive substantial revenue from the licensing of RealD’s 3D technologies for use in the motion picture industry, as well as RealD’s ability to generate substantial revenue from the licensing of RealD’s 3D technologies for use in the 3D consumer electronics market; 3D motion picture releases and conversions scheduled for 2010 and 2011; our ability to supply our solutions to our customers on a timely basis; the progress, timing and amount of expenses associated with RealD’s research and development activities; market and industry trends, including growth in 3D content; and RealD’s projected operating results. These statements are based on our management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our management’s control that could cause actual results to differ materially from the results discussed in the forward-looking statements. The company’s quarterly report on Form 10-Q for the three months ended September 24, 2010 includes a more detailed discussion of the risks and uncertainties that may cause that could cause actual results to differ materially from the results discussed in the forward-looking statements.

RealD undertakes no obligation to update publicly the information contained in this press release, or any forward-looking statements, to reflect new information, events or circumstances after the date they were made, or to reflect the occurrence of unanticipated events.

Use of non-GAAP financial measures

To supplement RealD’s financial statements presented on a GAAP basis, RealD provides Adjusted EBITDA as a supplemental measure of its performance. The company defines Adjusted EBITDA as net income (loss), plus net interest expense, income taxes and depreciation and amortization, as further adjusted to eliminate the impact of share based compensation expense, exhibitor option expense and certain other items not considered indicative of the company’s core operating performance.

RealD presents Adjusted EBITDA in reporting its financial results to provide investors with an additional tool to evaluate RealD’s operating results in a manner that focuses on what RealD’s management believes to be its ongoing business operations. RealD’s management does not itself, nor does it suggest that investors should, consider any such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Adjusted EBITDA is used by management for planning purposes, including the preparation of internal budgets, forecasts and strategic plans; in analyzing the effectiveness of business strategies; to evaluate potential acquisitions; in making compensation decisions; in communications with its Board of Directors concerning financial performance; and as part of the company’s credit agreement in which Adjusted EBITDA is used to measure compliance with certain covenants.

About RealD Inc.

RealD is a leading global licensor of 3D technologies. RealD’s extensive intellectual property portfolio is used in applications that enable a premium 3D viewing experience in the theater, the home and elsewhere. RealD licenses its RealD Cinema Systems to motion picture exhibitors that show 3D motion pictures and alternative 3D content. RealD also provides its RealD Display, active and passive eyewear, RealD Format and gaming technologies to consumer electronics manufacturers and content producers and distributors to enable the delivery and viewing of 3D content. RealD’s cutting-edge 3D technologies have been used for applications such as piloting the Mars Rover.

RealD was founded in 2003 and has offices in Beverly Hills, California; Boulder, Colorado; London, United Kingdom; Hong Kong; and Tokyo, Japan. For more information, please visit our website at www.reald.com.

(1) Includes amortization of debt issue costs, unrealized foreign currency exchange gains and losses and gain of $6.7 million from the sale of digital projectors in the three month period ended June 25, 2010.

(2) Represents share-based compensation expense of nonstatutory and incentive stock options to employees, officers, directors and consultants.

(3) Represents stock options granted to some of our motion picture exhibitor licensees. The amounts are recorded as contra revenue in the condensed consolidated financial statements.

(4) Represents impairment of long-lived assets, such as fixed assets, theatrical equipment and identifiable intangibles.

(5) Represents taxes incurred by us for cinema license and product revenue.

(6) Represents property taxes on RealD Cinema Systems and digital projectors.

(7) Represents payment of management fees to our Series C mandatorily redeemable convertible preferred stockholder (included in general and administrative expense, which was terminated upon the completion of our initial public offering).