DisplaySearch announced that LCD TV panel manufacturers have developed cost-conscious product designs with lower specifications to target emerging markets.

DisplaySearch announced that LCD TV panel manufacturers have developed cost-conscious product designs with lower specifications to target emerging markets.

For more information visit: www.displaysearch.com

Unedited press release follows:

LCD TV Panel Manufacturers Developing Unique Specifications for Emerging Markets

At the High End, Sharp Plans to Produce 6-Up 70”W in its Gen 10 Fab

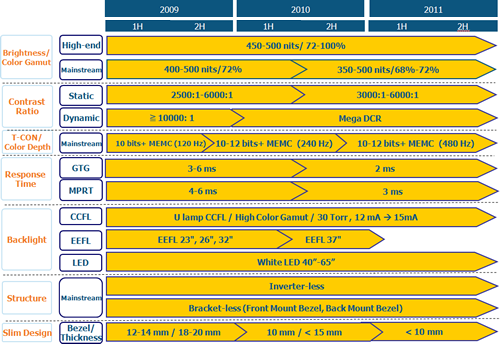

SANTA CLARA, CALIF., December 21, 2010 — LCD TV panel manufacturers introduce advanced features and enhancements such as 3D, 480 Hz frame rate, ultra-slim form factors, and direct-lit LED backlights, but they are also adding a category at the other end of their product roadmaps targeting emerging markets. These lower-cost panel designs with lower brightness and color gamut have been developed, and they are re-shaping the panel technology and business.

According to the DisplaySearch Quarterly Large-Area TFT LCD Product Roadmap Report, panel makers are designing for emerging markets like India, Brazil, China, and Russia with lower specifications than for developed markets. Brightness can be in the range of 350-400 nits, versus the 450-500 nits standard, and color saturation can be 65-68% of NTSC versus 72-75%.

As LCD TVs move closer to reaching 200 million shipments per year, they are facing maturity in some developed countries. Two crucial tendencies are seen in panel makers’ roadmaps. One is a shift to high-end features in order to stimulate replacement demand in dev3eloped countries. At the same time, they are creating a market segment with lower specifications and lower costs to satisfy the new demand from emerging countries.

“Because of the variation in consumer preferences among developed and emerging regions in 2011, it will be more important to target the right market segments and regions with the right specifications and appropriate cost, instead of simply adding new features to product roadmaps,” noted Shawn Lee, Senior Analyst for DisplaySearch.

Figure 1: LCD TV Panel Development Trends

Source: DisplaySearch Quarterly Large-Area TFT LCD Product Roadmap Report

Panel manufacturers such as LG Display, AUO, Chimei Innolux and BOE are all investing in the emerging TV market segment. Lower specifications will be achieved through restructuring LCD backlights by swapping prism films with diffusers, using larger LED packages for better efficiency, reducing LED light bars and packages, minimizing glass substrate thickness from 0.7 mm to 0.5 mm, and modifying the color filter structure.

Additional findings on about LCD TV panel roadmaps in the Quarterly Large-Area TFT LCD Product Roadmap Report include the following:

* Sharp, the only company with a Gen 10 fab, is planning to produce 6-up 70”W panels. Sharp is currently producing 40”W, 60”W and 65”W in Gen 10.

* AUO is working on a 58”, 21:9 aspect ratio, 120 Hz panel, called ‘Cinema Scope HD’, targeted to 3D, home cinema, and smart TV markets. LG Display and Samsung are also working on 21:9 LCD TV panels.

* Samsung is producing 43” 4:1 panels for public displays in its Gen 7 fab. The company has also developed a new LCD cell structure called PLS, which combines the horizontal and vertical electric fields and has impressive off-axis image quality.

* With the ramp up of its Gen 6 fab, BOE has entered the 32”+ LCD TV panel market and will apply FFS technology for wide viewing angle.

* The 120 Hz frame rate has become the mainstream solution for 40”+ LCD TV panels. 240 Hz panels have been introduced for shutter glass-based 3D TV, and panel makers are developing 480 Hz with direct type LED backlight with local dimming, targeting high end markets.

* Sharp has strengthened its UV2A technology, which can achieve 20% higher aperture ratios, over 5000:1 contrast ratio, and 4 ms response time.

* LG Display is aggressively promoting 3D LCD panels using a pattern retarder, and plans to offer 32”, 37”, 42”, 47”, and 55” FHD panels. AUO is developing 32” HD and 65” FHD pattern retarder panels. Other panel makers are focusing on the shutter glass approach. Chimei Innolux is developing a 120 Hz solution for 3D TV.

The DisplaySearch Quarterly Large-Area TFT LCD Product Roadmap Report includes TFT LCD panel roadmaps, product technology trends by applications by companies by size by fabs and by different time frames. Please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless.