DisplaySearch announced that it estimates more than 190 million LCD TVs shipped worldwide in 2010.

DisplaySearch announced that it estimates more than 190 million LCD TVs shipped worldwide in 2010.

For more information visit: www.displaysearch.com

Unedited press release follows:

Global LCD TV Market to Grow 31% in 2010, Slowing to 13% in 2011

LCD TV Shipments Expected to Reach 190 Million Units in 2010 as Surging Japan Growth Balances Flat North America; Plasma TV Shipment Outlook Improves

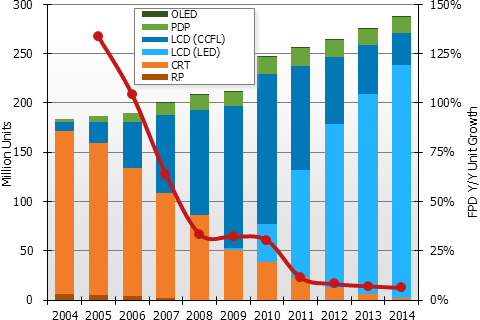

SANTA CLARA, CA, January 3, 2011 — According to the latest DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report, total TV shipments in 2010 will reach more than 247 million units, a staggering 17% increase from 2009 and the best growth seen since the start of the flat panel TV transition. This comes despite a very slow recovery from the Great Recession of 2008-2009, and weakness in regions like North America reflecting continued caution on the part of some developed market consumers. Innovations like 3D were introduced to capture consumers’ attention and drive strong growth in 2010, but sales of 3D TVs will likely disappoint many brands and retailers at around 3 million units worldwide.

“North America continues to be a tough market for TV sales, with total TV shipments rising just 0.4% year over year through the first three quarters of 2010,” noted Paul Gagnon, Director of North America TV Research for DisplaySearch. “As unemployment remains high and consumers remain sensitive to price, budget-conscious consumers have been surprised by limited price declines, partially influenced by a much stronger mix of advanced TV technologies introduced this year like LED backlights, 3D, and internet connectivity which offset any price declines,” continued Gagnon. Average TV prices in North America are only expected to fall 6% Y/Y in 2010 compared with a 22% decline in 2009.

LCD continues to dominate TV shipments worldwide, accounting for at least half of all TV shipments in all regions except Asia Pacific. Even with the strong demand growth for LCD TVs worldwide, shipments have been lower than manufacturers expected, and the resulting rise in global LCD TV inventory during Q3’10 has led to more vigorous price erosion during Q4’10. LCD TV shipments will rise from 190 million in 2010 to 215 million in 2011, although an increase in the rate of ASP erosion will lead to the first ever revenue decline in the LCD TV category. Japan has been a spotlight market for LCD TV growth in 2010, with LCD TV shipments forecast at 22.6 million units, an increase of 80% from 2009 due to the Eco-Points stimulus program. That program will end in 2011, so shipments are expected to fall sharply. European shipments have been fairly robust in 2010, but growth will fall from double- to single-digit rates over the next few years. Also a first in 2011, emerging regions will overtake the developed regions (Japan, North America, and Western Europe) in total LCD TV unit volume as the growth focus shifts to countries with lower flat panel TV penetration.

LED backlights have been a key trend for LCD TVs in 2010, and their penetration into LCD TV shipments will rise to 20% globally due to more attractive pricing, especially in the second half of the year. In 2011, LED-backlit models are expected to account for the majority of LCD TV shipments worldwide as manufacturers continue to transition away from fluorescent backlights. This is possible due to the rapidly decreases in the premium for LED models from highs of 100% during 1H’10, to less than 50% in 2011; for some sizes and frame rates it will fall to nearly 20%.

Plasma TV demand continues to be very robust in 2010, helped by the fact that consumers are still looking for strong value and plasma TV has maintained its rate of price decline. Plasma TV shipments are now expected to exceed 18 million units in 2010, a 28% increase from 2009, when shipments actually declined Y/Y.

Figure 1: Worldwide TV Market by Technology

Source: DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report

The DisplaySearch Q4’10 Quarterly Advanced Global TV Shipment and Forecast Report includes panel and TV shipments by region and by size for nearly 60 brands, and also includes rolling 16-quarter forecasts, TV cost/price forecasts and design wins. This report is delivered in PowerPoint and includes Excel based data and tables. For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.