DisplaySearch announced that the major LCD TV brands have lowered their first quarter 2011 production plans.

DisplaySearch announced that the major LCD TV brands have lowered their first quarter 2011 production plans.

For more information visit: www.displaysearch.com

Unedited press release follows:

LCD TV Brands Adjust Production Downward in Q1’11, While OEMs/ODMs Increase Shipments

SANTA CLARA, CALIF, January 11, 2011—The LCD TV industry looked forward to reduced inventories as a result of strong sales in Q4’10, and based on that, had started to plan for a strong 2011. However, results from the newly published DisplaySearch MarketWise—LCD Industry Dynamics report indicates that the major LCD TV brands have adjusted their Q1’11 production plans downward.

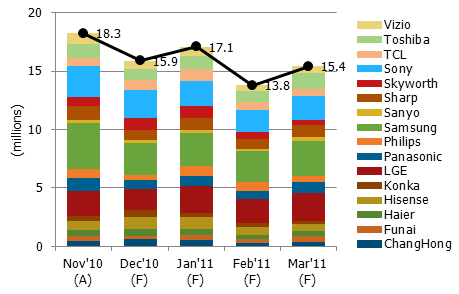

The top 16 LCD TV brands, including global brands, such as Samsung and regional players like Konka in China, have reduced their combined monthly production plan from 18.3 million in November 2010 to 15.4 million units in March 2011 (Figure 1). Overall, Q1’11 production is forecast to be 46.3 million units, a 12% Q/Q decline from Q4’10.

Figure 1: Top 16 LCD TV Brands Monthly Production Plan

Source: DisplaySearch MarketWise—LCD Industry Dynamics

“The unstable market environment in many regions is creating uncertainty regarding TV demand. Despite this, some TV brands reportedly are increasing production quantities in January 2011 because of demand anticipated from Q1 product launches,” noted Deborah Yang, Research Director of Monitor and TV for DisplaySearch.

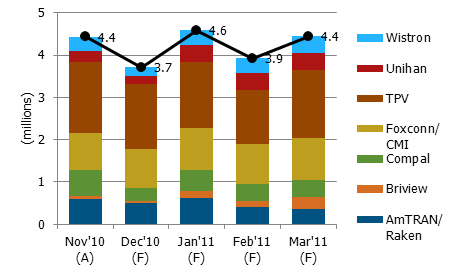

Despite the cautious stance of the TV brands, LCD TV sub-contract manufacturing (OEM/ODM) companies are increasing their monthly shipments from December 2010 to March 2011. This indicates that TV brands are increasing outsourcing manufacturing to OEM/ODM companies, which is driven by cost management, logistics, manufacturing scale, and in some cases, access to panel supply.

Figure 2: Major LCD TV OEM/ODM’s Monthly Shipment Plan

Source: DisplaySearch MarketWise—LCD Industry Dynamics

Analysis in the DisplaySearch MarketWise—LCD Industry Dynamics also includes other observations about LCD industry dynamics:

* The supply of key TFT LCD panel components, such as glass substrates, color filters, polarizers, LED and light guide plates, is generally in balance in Q1’11.

* January large-area TFT LCD panel shipments will fall 2% from December 2010, due to adjustments in capacity utilization rates, and decline a further 7% M/M in February due to fewer working days in China. However, panel makers expect a big jump in March, with shipments passing 60 million units.

* Panel inventories at the top five TFT LCD makers (Samsung, LG Display, AUO, Chimei Innolux, and CPT), fell to safe levels at the end of 2010.

* TFT LCD makers will reduce their utilization rates in January and February, but expect to be over 90% on a global scale by March.

* The top ten LCD monitor OEMs plan to increase their production in January by 4.3% M/M, to more than 14 million units. However, they plan to reduce February and March production to just over 12 million units.

* LCD TV panel shipments to China were 5.1 million units in November, and fell to 5.0 million units in December. DisplaySearch forecasts shipments will continue to fall to 4.6 million in January and 3.2 million units in February.

The new DisplaySearch MarketWise—LCD Industry Dynamics report provides clear and accurate monthly status and dynamics updates on the entire large-area TFT LCD supply chain, from components to the end market. Clients of this report have access to monthly updates on panels, brands, capacity, production, prices and more. Please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.