DisplaySearch announced it forecasts that demand for TFT LCD glass substrates will increase significantly in 2011 and Corning continues to expand its manufacturing capacity for Gorilla Glass.

DisplaySearch announced it forecasts that demand for TFT LCD glass substrates will increase significantly in 2011 and Corning continues to expand its manufacturing capacity for Gorilla Glass.

For more information visit: www.displaysearch.com

Unedited press release follows:

DisplaySearch Forecasts 11% Demand and 13% Capacity Increases for TFT LCD Glass Substrates in 2011

Corning Rapidly Expanding Capacity for Gorilla Glass

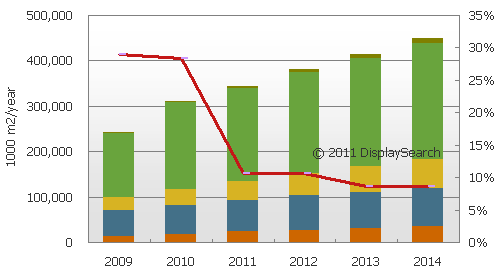

SANTA CLARA, CALIF, January 18, 2011—As the transition to flat panel TV nears completion, TFT LCD TV panel demand is slowing, from 41% Y/Y in 2010 to 8.3% in 2011. According to the DisplaySearch Quarterly LCD Glass Substrate Report, total TFT LCD panel area demand is expected to increase 10.4% in 2011, resulting in 11% TFT LCD glass area demand growth, accounting for time shifts and production yields.

Coming out of a tight supply situation in 2009, TFT LCD glass substrate manufacturers have significantly increased capacity in 2010, with area growth estimated to be 32% Y/Y. Capacity is expected to continue increasing, with DisplaySearch forecasting 13% Y/Y growth in 2011. With panel makers cutting back on utilization, DisplaySearch forecasts an oversupply situation in Q1’11, with a glut of 12.8%.

Because each tank investment is enormously expensive, the recent increase in capacity has been largely accomplished through increases in existing tank capacity. This is accomplished through improvements in production yields and increasing the speed of production processes. For fusion glass makers, a key part of the improved productivity has been a shift to thinner glass substrates—most importantly from 0.7 to 0.5 mm in Gen 6 and larger fabs. From Q2’09 to Q2’11, the quarterly area capacity of TFT LCD glass production is expected to increase by 42%. The growth will be accomplished with a 15% increase in the number of tanks.

“Out of the forecasted 13% growth in 2011 capacity, new tank investments will account for 7% of the growth, while existing tank capacity increases will account for the remaining 6%,” noted Tadashi Uno, Director of Materials and Component Research for DisplaySearch. “As a result, glass makers are going to supply an 11% demand increase with 7% new tank investments. The increase in capacity of existing tanks should lead to stronger financial results.”

Table 1: Quarterly Glass Substrate Demand Forecast by Application

Source: DisplaySearch Quarterly LCD Glass Substrate Report

Since the market began to recover in Q2’09, there has also been a divergence in capacity expansion strategies among the top three glass makers: Corning (including its wholly-owned production and Samsung Corning Precision production in Korea), Asahi Glass, and NEG. With Corning giving up share in TFT LCD glass by shifting existing capacity to production of its Gorilla glass, Samsung Corning Precision and Asahi have maintained their market share, while NEG continues to gain share.

Since Q2’09, Corning has shifted all of its glass melting tanks in the US, as well as a few in Taiwan, to the production of Gorilla glass. In addition, the company has added new tanks for Gorilla glass production in Japan, and Samsung Corning Precision is shifting some tanks in Korea. Corning has added capacity for TFT LCD glass as well, but the shift of existing capacity means that, from Q2’09 to Q2’11, Corning (including Samsung Corning Precision), will grow its TFT LCD glass capacity area by 29%, compared to 54% for Asahi and 71% for NEG.

The DisplaySearch Quarterly LCD Glass Substrate Report is ideal for panel makers, glass makers, and product planners interested in details of glass substrate technology and market dynamics. This report covers basic introductions, technical evolutions, market forecasts, capacity profiles, supply/demand modeling, and value chain relationships, as well as cost and price for TFT LCD glass substrates. Please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at www.displaysearch.com/. Read our blog at www.displaysearchblog.com and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit www.npd.com/ and www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.