IHS iSuppli announced it forecasts that more than two-thirds of large-sized (10″+) liquid crystal display (LCD) panels shipped worldwide in 2011 will incorporate light-emitting diode (LED) backlights, up from less than one half in 2010.

IHS iSuppli announced it forecasts that more than two-thirds of large-sized (10″+) liquid crystal display (LCD) panels shipped worldwide in 2011 will incorporate light-emitting diode (LED) backlights, up from less than one half in 2010.

For more information visit: www.isuppli.com

Unedited press release follows:

Two Out of Three Large-Sized LCDs to Use LED Backlights in 2011

El Segundo, Calif., January 20, 2011—More than two-thirds of large-sized liquid crystal display (LCD) panels shipped worldwide in 2011 will incorporate light-emitting diode (LED) backlights, up from less than one half in 2010, according to new IHS iSuppli research.

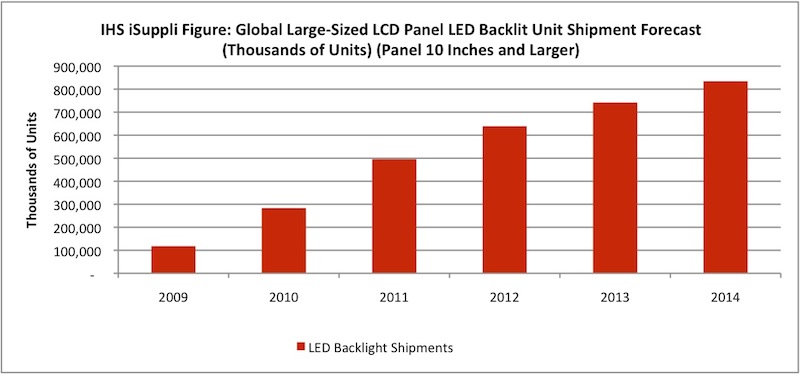

An estimated 67 percent of large-sized LCD panels will use LEDs in 2011, compared to 44 percent in 2010. Shipments of large-sized LCD panels with LED backlighting will reach 495.6 million units in 2011, up 74.9 percent from 283.3 million units in 2010, as presented in the attached figure.

For notebook and netbook panels, LED backlight adoption will rise to 100 percent in 2011, up from 91 percent in 2010. LED penetration in television and monitor panels will rise to slightly less than 50 percent in 2011, up from about 20 percent in 2010.

By 2014, shipments of large-sized LCD panels with LED backlights will reach 834.6 million units, growing at a compound annual growth rate (CAGR) of 47.9 percent from 117.8 million in 2009.

IHS defines large-sized LCDs as panels with a diagonal dimension of 10 inches or larger.

“LED-backlit panels have emerged as the main driver of large-sized LCD panel shipment growth in 2010, representing the fastest-expanding—and soon to be the largest—portion of the LCD market,” said Sweta Dash, senior director of LCD research at IHS. “Consumers increasingly are demanding LED-backlit televisions as the costs of such sets decline, allowing more users to take advantage of their superior image quality, lower power consumption and thinner form factors.”

Panel oversupply looms

Despite the strong growth in shipments of LED-backlight products, the large-sized panel market in 2011 faces the specter of oversupply, which could result in falling prices.

Based on an analysis of the current production plans of panel suppliers, manufacturing capacity may significantly exceed market demand in the first half of 2011. However, capacity expansion in the second half of 2011 may decrease to a lower level than demand.

“If panel suppliers can control production skillfully and rationally, 2011 can be very positive year for the LCD industry,” Dash said. “On the other hand, excessive production in the first half may lead to an inventory buildup and oversupply in 2011.”

3-D panel market transforms in 2011

Outside of LED backlights, another major trend for the large-sized LCD market in 2011 will be the transformation of the 3-D television panel market. The acceptance of 3-D televisions in 2010 fell short of industry expectations, partly because of the high cost of the panels and the sets.

Many panel suppliers in 2011 are planning to introduce television panels using film-based pattern retarder technology, rather than the current shutter glass technology. Patterned retarder technology works with 3-D eyeglasses composed of polarizer films that are lighter in weight and lower in cost. This technology yields an eyewear cost of about $10, making it easier for consumers to own multiple glasses, compared to the $100 cost for shutter glasses.

Besides low cost, patterned retarder technology claims to have less crosstalk and may be brighter than panels using shutter glass technology. It can also be used with lower frame rates (60Hz) and even with cold cathode fluorescent lamp backlights to offer lower-end, lower-priced products. However, the shutter glass method has the advantage of higher resolution, along with other benefits such as wider vertical viewing angles. Panel suppliers and some brands, especially Chinese firms, are hoping to offer lower-cost patterned retarder technology with polarizer glass to increase 3-D adoption rates in 2011.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.