DisplaySearch announced it forecasts that manufacturer shipments of LCD TV cells will increase 30% in 2011.

DisplaySearch announced it forecasts that manufacturer shipments of LCD TV cells will increase 30% in 2011.

For more information visit: www.displaysearch.com

Unedited press release follows:

Shipments of Cell-Type LCD TV Panels Forecast to Increase 30% in 2011

Chimei Innolux Forecast to Lead in Cell Shipments, While Samsung’s Cell Strategy Could Shake up the Supply Chain

SANTA CLARA, CALIF, January 24, 2011—In an effort to meet growing customer demand, LCD panel manufacturers are planning to grow their cell businesses 30% in 2011 to support the increasing needs of their TV manufacturer customers, according to the DisplaySearch Quarterly LCD TV Value Chain Report. In the cell business model, TFT LCD panel makers provide only the liquid crystal cell – which includes the TFT and color filter glass substrates, as well as liquid crystal with timing controller and driver ICs, but not the backlight module or additional optical films – to the set manufacturer, who completes the module as they build the TV set. This business model allows for more flexibility in panel production, and also enables set makers to customize their designs and add more value.

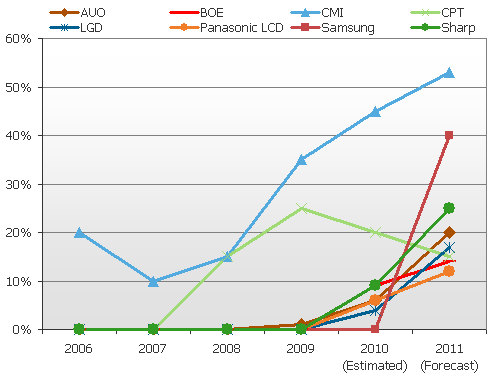

“In 2010, Chimei Innolux led the cell business, while other LCD manufacturers had a very minor share of cell shipments. However, in order to meet the tough market environment surrounding the TV business as a result of severe price wars, even Samsung plans to increase cell shipments to their internal TV division. This may change the supply chain and market share in 2011,” noted Deborah Yang, Research Director of Monitor and TV for DisplaySearch.

The DisplaySearch 2011 forecast for the cell business indicates that Chimei Innolux will lead the cell market, achieving 50%+ of cell shipments, with their major customers being Chinese TV brands. Samsung plans to target around 40% of its cells shipments for its internal TV division. Other panel makers also plan to increase cell shipments 10-20% in 2011. In addition, some OEMs and TV brands plan to leverage Backlight Module System (BMS) assembly in an effort to reduce the overall cost of production.

Figure 1. Cell Shipment Forecast

Source: DisplaySearch Quarterly LCD TV Value Chain Report

Analysis in the DisplaySearch Quarterly LCD TV Value Chain Report includes other observations of LCD TV value chain dynamics:

* The share of LCD TVs outsourced reached a record high of 34% in Q3’10, as Sony and LGE increased their outsourcing ratio to more than 50% and 20%, respectively.

* Among OEM shipments in Q3’10, excluding TV manufacturers, TPV ranked #1 with a 23% share, followed by Foxconn/Chimei Innolux at 15% and Vestel at 13%. Taiwanese OEMs (Compal, Wistron, and AmTran/Rakern) each have shares of about 8-9%.

* In 2011, the top three panel makers, Samsung, LG Display, and Chimei Innolux, will be aggressive with their plan to ship more than 60M units of LCD TV panels. In total, LCD TV panel makers plan to ship more than 270M units in 2011.

* Sales targets for the top seven Chinese TV brands for 2011 total 60M units. Although Chinese brands report little excitement in the China TV market, their aggregate shipment plans show 33% Y/Y unit growth on average in 2011.

The DisplaySearch Quarterly LCD TV Value Chain Report maps the relationships between LCD TV brands, OEMs, and panel suppliers with actual shipment information. Suppliers can determine market share and benchmark against their competitors. Buyers can identify and evaluate key panel makers or OEMs to improve their purchasing decisions. The report covers the latest trends and cell business forecasts for 2011. New report upgrades include analysis and insight into all aspects of the LCD TV value chains by covering panel makers, OEMs and TV brands. All business plan targets for LCD TV panel makers, OEMs, and LCD TV brands for 2011, including sourcing information and allocations, are updated quarterly in this report.

Recent upgrades to the December report provide LCD TV value chain forecasts and a 12 month outlook. Analysis and implications for TV OEM business outlooks as well as special topics in the LCD TV supply chain.

For more information contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.