IHS Screen Digest announced that it expects U.S. movie Internet Video-on-Demand (iVOD) revenue to exceed that of Electronic Sell-Through (EST) in 2013.

IHS Screen Digest announced that it expects U.S. movie Internet Video-on-Demand (iVOD) revenue to exceed that of Electronic Sell-Through (EST) in 2013.

For more information visit: www.screendigest.com

Unedited press release follows:

iVOD to Exceed EST in US Online Movie Market in 2013

El Segundo, Calif., February 14, 2011—Reflecting consumers’ increasing preference for renting movies rather than owning them, U.S. movie Internet video on demand (iVOD) revenue will rise to exceed that of electronic sell-through (EST) for the first time ever in 2013, according to new IHS Screen Digest research.

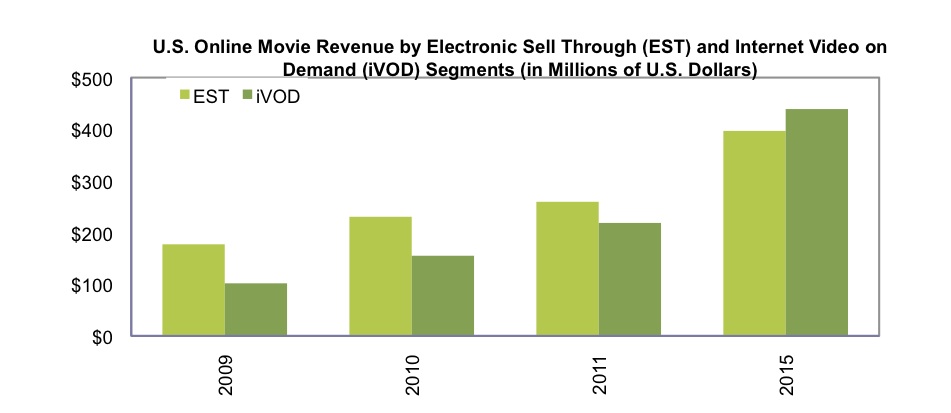

U.S. movie iVOD revenue will increase to $341.7 million in 2013, up 120.2 percent from $155.2 billion in 2010. Meanwhile, U.S. movie EST revenue will rise at a much lower rate, expanding by 43.6 percent to reach $331.1 million in 2013, up from $230.6 million in 2010. iVOD movie growth will continue to outpace that of EST to reach $439.1 million in 2015, compared to $396.8 million for EST. These revenues do not include consumer spending on Netflix subscriptions, which provide a complementary subscription-streaming proposition for older movies not in the new release window.

The attached figure presents the latest IHS Screen Digest forecast of U.S. online movie revenue.

“EST historically has dominated transactional online movie revenue,” said Arash Amel, research director, digital media, for IHS. “However, starting in 2010, U.S. online consumers began to embrace iVOD and shift their spending from buying movies to renting them. The switchover from EST to iVOD also has been driven by online movie providers’ efforts to promote the rental model. Together with the continued popularity of subscription-streaming service Netflix, we are witnessing a new ‘access’ model appear for online movies in which library titles are consumed as part of an all-you-can-eat subscription, while new releases are rented.”

The Apple iTunes store, the leader in the online movie market, has seen its new devices—the iPad and new Apple TV—significantly drive the iVOD business. iTunes held its 55 percent share of U.S. movie iVOD in 2010 in the face of tough competition, although its movie EST market share eroded to 74 percent by Microsoft’s entry into that business. Other players also are throwing their weight behind iVOD, including Wal-Mart, which finds itself in the unusual position of being an emerging player.

The relatively slow growth for movie EST revenue in 2010 is chiefly attributed to the inconvenience and limitations of the current business model, which provides a more cumbersome consumer solution than both rental streaming and illegal downloading.

The market in 2010 witnessed service providers offering increased bundling and price promotions, in an effort to bolster movie EST unit sales.

“Unless there are major changes in the current model for movie EST, the U.S. market is destined to never reach the half-billion-dollar level,” Amel said. “In the absence of something happening, like selling the movies more quickly after theatrical release—even ahead of Blu-ray and DVD—or making the EST experience as convenient for consumers as the type of ‘anytime, anywhere, any device service’ that Netflix currently provides, the U.S. EST market for movies will run out of steam.”

About IHS Screen Digest online movies research

Information in this release was derived from the IHS Screen Digest Broadband Media Intelligence service. This market intelligence service provides comprehensive data and analysis on the global market for online movies, TV and music, including market size and share in 26 global regions.

About IHS Screen Digest Products & Services

IHS Screen Digest products and services cover global media markets including film, television, broadband media, mobile media, cinema, home entertainment, gaming and advertising. IHS Screen Digest offerings deliver the most complete and insightful analysis of the global technology, media and telecommunications (TMT) markets. More information is available at www.screendigest.com.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.