IHS iSuppli announced its research suggests that global inventories held by semiconductor suppliers surged to their highest level in 2 1/2 years during the fourth quarter of 2010.

IHS iSuppli announced its research suggests that global inventories held by semiconductor suppliers surged to their highest level in 2 1/2 years during the fourth quarter of 2010.

For more information visit: www.isuppli.com

Unedited press release follows:

Semiconductor Inventories Swell to Alarming Level

El Segundo, Calif., February 16, 2011—Global inventories held by semiconductor suppliers surged to their highest level in two-and-a-half years during the fourth quarter of 2010, a development that could spell trouble if chip industry growth loses steam this year, new IHS iSuppli research indicates.

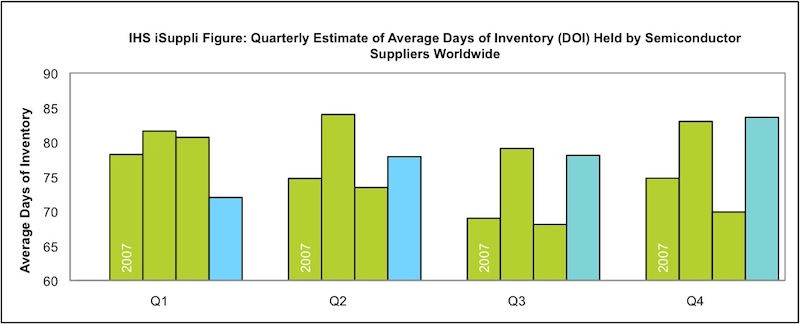

Semiconductor suppliers had 83.6 days of inventory (DOI) at the end of the fourth quarter of 2010, up 5.5 days, or 7 percent, from 78.1 days in the previous quarter. Inventory was at its highest level since the second quarter of 2008—right before the onset of the last semiconductor downturn—when DOI reached 84 days.

“Inventory levels arguably now are high by any standard, illustrating the difficulty of controlling chip stockpiles even with semiconductor suppliers’ arduous efforts to keep them in check,” said Sharon Stiefel, analyst, semiconductor market intelligence, at IHS. “The sharp increase of semiconductor inventory during the fourth quarter defied expectations of a decline for the period. This inflated level of inventory could become a concern if semiconductor industry growth falls short of expectations in 2011.”

The rise in inventory came as a surprise, given that IHS iSuppli forecasts had predicted stockpiles would decrease by 2.5 DOI in the fourth quarter. The actual fourth-quarter results indicate an eight DOI swing compared to expectations.

The current IHS iSuppli semiconductor forecast calls for revenue growth of 5.6 percent in 2011, following a 31.8 percent increase in 2010. Assuming our forecast holds, the current inventory level should be manageable.

However, if growth is lower, the high inventories could cause oversupply in the market, causing chip prices to decline faster than normal. This could amplify the size and duration of a downturn or slowdown in the semiconductor market.

Hot segments like smart phones and media tablets continue to generate strong growth for semiconductors. Furthermore, other segments like the automotive and industrial markets, which tend to get less visibility also are generating encouraging chip sales.

The attached figure presents the IHS iSuppli estimate of quarterly global semiconductor DOI in 2008, 2009 and 2010.

Learn more with IHS iSuppli’s latest report entitled, Semiconductor Inventory Oversupply Not Ringing Alarm Bell

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.