IHS iSuppli announced that, according to its latest research, pricing for flat-panel televisions in the United States fell for a third consecutive month in February.

IHS iSuppli announced that, according to its latest research, pricing for flat-panel televisions in the United States fell for a third consecutive month in February.

For more information visit: www.isuppli.com

Unedited press release follows:

US Television Prices Decline to Make Way for New Models

El Segundo, Calif., March 9, 2011—Pricing for flat-panel televisions in the United States fell for a third consecutive month in February as manufacturers sought to clear old inventory and make room for new 2011 models, according to the latest IHS iSuppli research.

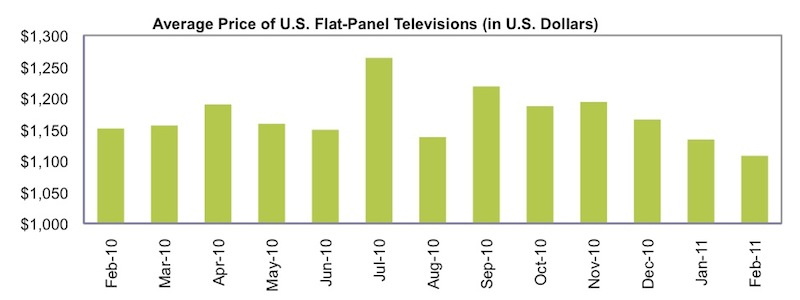

Average U.S. TV pricing in the month of February dropped to $1,108, down 2.3 percent from the January level of $1,134, with the biggest percentage decrease occurring in sets sized 21-29 inches and in those larger than 50 inches. February’s pricing also was 3.7 percent down from $1,151 during the same month a year ago, as shown in the attached figure, continuing a trend that started in December 2010, a month after TV prices shot up and temporarily reversed a long course of steady decline.

“The ongoing retreat in U.S. TV pricing reflects a determined push among television manufacturers to woo consumers into buying new sets, ostensibly to replace older models for newer upgrades that take advantage of the latest display technologies and connectivity solutions,” said Riddhi Patel, director for television systems and retail services at IHS. “And with numerous competitively priced models expected to be released soon, many basic-level models from 2010 have been discounted to push out inventory.”

TV brands also are building on a strategy to widen their pool of offerings to further draw in shoppers. Consumers now have more choices—from models providing the latest premium features such as 3-D, Internet connectivity and light-emitting diode (LED) backlighting, to sets in which advanced features have been left out or scaled back in exchange for a lower price.

For liquid-crystal display televisions (LCD TV) overall, pricing fell on every size group by approximately 1 to 2 percent, declining to $1,037 on average. The 50-inch and larger LCD TVs featuring the older technology of cold cathode fluorescent lamps (CCFL), for instance, saw a $102 decrease from their previous perch in January and an even steeper drop of $301 when year-ago levels are taken into consideration.

Among LCD TVs featuring the more advanced technology of LED backlighting, price declines were smaller, averaging less than 1 percent in February, likely a testament to the growing popularity of the ultra-thin sets among consumers. Most of the price decrease here centered on LED-backlit sets smaller than 50 inches, with the largest drop on average of $28 falling on the 30- to 39-inch models.

The only segment in the TV space where pricing went up in February was in 3-D LCD TVs, increasing by $16 on average to $2,990. And in a sign of the industry’s commitment to continue supporting 3-D technology, the total number of available 3-D TV models jumped to 68, compared to 54 in January and 19 in March 2010.

Excluding 3-D TVs, the general decline in LCD televisions was mirrored in the plasma TV area, with prices falling to $1,525 on average in February, down 3 percent from the earlier month. Much like their counterparts in the LCD space, plasma sets are experiencing deep price cuts and discounting to make room for the new 2011 lineup.

The contraction in TV pricing for LCD and plasma models notwithstanding, the market is set to gain strength after the first quarter in line with normal seasonal patterns, IHS believes, and retailers are expected to then raise average prices across all channels after all the old models have been cleared away.

Learn more about the latest developments in the U.S. TV space with the IHS iSuppli U.S. TV and Price Specifications Tracker service, as well as Patel’s recent report, entitled: Companies Drop Features to End Price War.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.