IHS iSuppli announced that, according to its latest teardown analysis, Nintendo’s 3D handheld game system carries a bill of materials (BOM) of $100.71.

IHS iSuppli announced that, according to its latest teardown analysis, Nintendo’s 3D handheld game system carries a bill of materials (BOM) of $100.71.

For more information visit: www.isuppli.com

Unedited press release follows:

Nintendo 3DS Carries $100.71 Bill of Materials, IHS iSuppli Physical Teardown Reveals

El Segundo, Calif., March 28, 2011—Nintendo’s groundbreaking 3DS handheld gaming system carries a bill of materials (BOM) of $100.71, according to a preliminary physical dissection of the product conducted by the IHS iSuppli Teardown Analysis Service.

When the $2.54 manufacturing cost of the 3DS is added in, the total cost to produce the portable gaming system rises to $103.25. This compares to a retail cost of $249.99 in the United States.

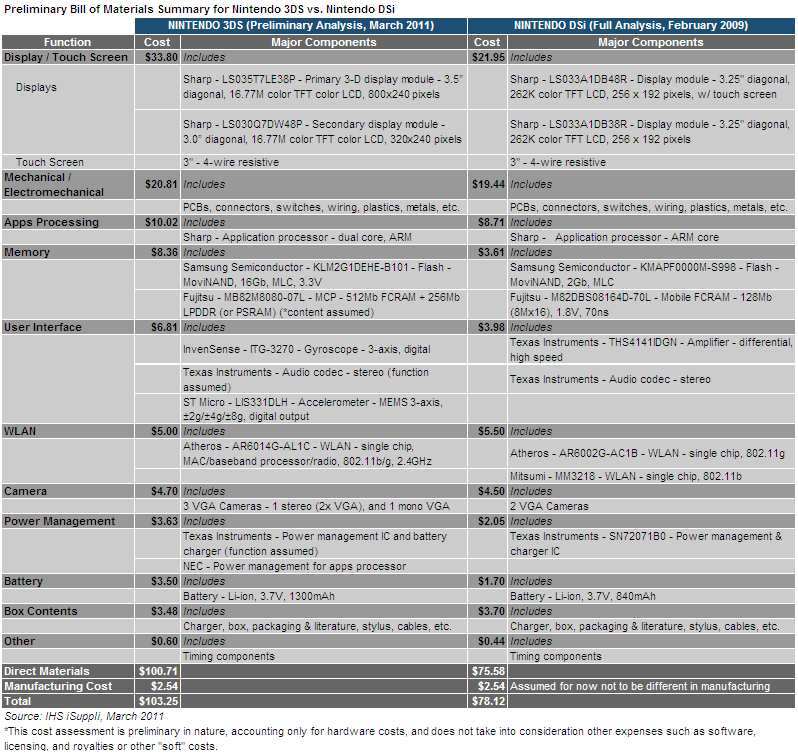

The $100.71 BOM represents a 33 percent increase from $75.58 in materials for the previous member of Nintendo’s handheld gaming line, the Nintendo DSi, based on pricing from the time of its introduction a little more than two years ago. If the current Nintendo 3DS BOM was compared with current market pricing for the Nintendo DSi, the difference would be even greater.

The attached table presents the preliminary results of the IHS teardown of the 3DS compared to the DSi. The 3DS cost assessment presented in this release is preliminary in nature, accounting only for hardware expenditures, and does not take into consideration other expenses such as software, licensing and royalties.

Although the 3DS just went on sale in United States yesterday, IHS last week was able to procure one of the devices in Japan, where it has been available for about one month, and commenced a teardown.

Made in Japan

As with most products made by Japanese companies, the 3DS largely uses components from suppliers based in Japan. Because of this, the 3DS has much greater exposure than most electronic products to the supply chain risk presented by the recent earthquake and tsunami. Although IHS cannot identify any specific supply problems for 3DS components, the same logistical and power challenges plaguing most Japanese industries could impact production and distribution of this game system.

The 3DS display in depth

“The 3DS’s most distinguishing feature is its 3-D top screen, which uses a clever feat of engineering to achieve the illusion of depth,” said Andrew Rassweiler, senior director, teardown services for IHS. “When the display module is removed from the 3DS enclosure, it looks like a slightly thicker conventional thin film transistor liquid crystal display (TFT LCD). However, upon opening up the device, we observed that on one side of the glass is a conventional color TFT element, while the other side was a monochrome LCD element. The monochrome LCD parallax barrier in the back acts as a gate that allows light to either pass through certain areas of the screen or not. Switching this gate in the right patterns at high frequency helps create the illusion of 3-D depth.”

This 3-D display is from Sharp Corp. and measures 3.5-inches in size with a total 800 by 240 pixel format—or a pixel format of 400 by 240 per eye. It uses an integrated LCD-based parallax barrier panel sandwiched to the back of the color LCD, which rapidly alternates between left and right images.

At $33.80, the main 3-D as well as the secondary display—also from Sharp—together with the touch screen, represent the most expensive group of component costs in the 3DS, accounting for roughly 34 percent of the total cost of materials. The 3DS display also has the biggest cost differential of any major subsystem of the new gaming system compared to the DSi, coming in at $11.85 more than the DSi display.

Apps processor looks Sharp

Another significant subsystem in the 3DS is the applications processing chip. At approximately $10, the apps processor accounts for roughly 10 percent of the 3DS’s total BOM, and is 15 percent more expensive than the equivalent DSi semiconductor around its time of release. At the present time, the old Sharp processor likely would cost less than $7 per unit.

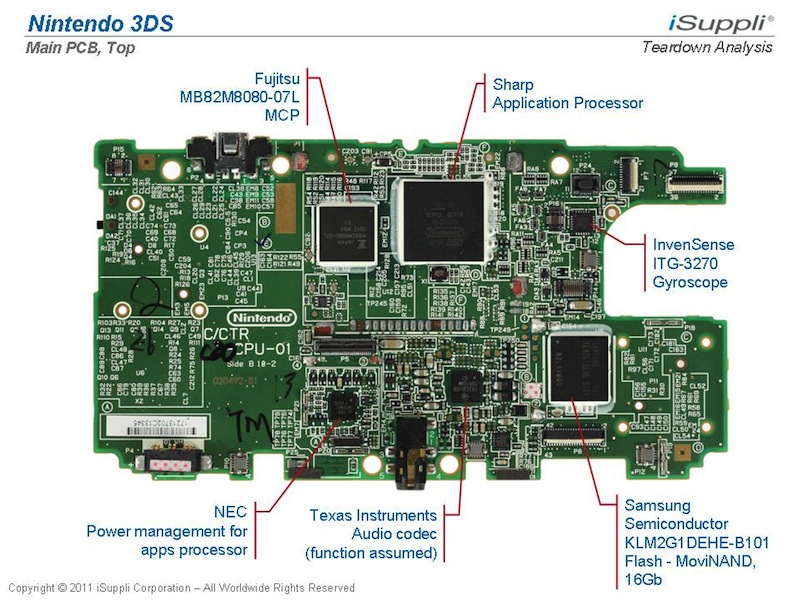

As in the DSi, IHS believes the apps processor in the 3DS is manufactured by Sharp—and is labeled as being produced in Japan. The Sharp assumption comes from the similarity in markings on the silicon die inside the chip, resembling those from the Nintendo DSi. Similar pattern matching on die markings is commonly used to determine chip provenance. It is also likely this apps processor was custom designed for Nintendo by another chip intellectual property and design company. An analysis of this apps processor suggests it delivers significantly higher performance than the apps processor in the DSi.

Memories of Nintendo

The 3DS’s memory subsystem comes in at 8.36, or 8.3 percent of the total BOM. The cost is more than double that found in the Nintendo DSi at the time of its release.

The main reason for the increased cost is that the NAND flash memory content of the 3DS has increased by eight times to 16Gbits (2GBytes), up from 2Gbits (256Mbytes) in the DSi. The NAND flash memory found in the 3DS torn down by IHS is from Samsung Electronics Co. Ltd., and is an embedded multimedia card (eMMC) device, which enables easier implementation and shorter design cycles than conventional flash. Such memory is usually available from multiple sources.

More interestingly—and potentially problematic—is the multi-chip memory IC from Fujitsu employed in the 3DS that includes 512Mbits of fast cycle random access memory (FCRAM), which appears to be a proprietary technology of Japan’s Fujitsu.

“As a rule, most electronic system designers employ memory products that are available from multiple sources in order to reduce supply risk and to guarantee the best pricing,” Rassweiler noted. “However, Nintendo’s decision to buy the device from sole-source Fujitsu adds supply chain risk, and limits Nintendo’s capability to drive costs down on a major component.’

User interface adds MEMS

At $6.81, or 6.8 percent of the total BOM, the user interface subsystem of the 3DS is significantly more expensive that of the DSi, with a 71.1 percent premium. The 3DS subsystem adds a microelectromechanical system (MEMS) gyroscope from InvenSense, as well as an accelerometer manufactured by STMicroelectronics, which allows the game system to operate using motion-sensitive control. These devices, plus a more expensive audio codec, were the main sources of additional costs in this functional section of the 3DS.

The wireless local area network (WLAN) subsystem of the 3DS carries a cost $5.00, accounting for 5 percent of the BOM. The WLAN module features a single-chip solution: the Atheros AR6014G-AL1C 802.11b/g device. This represents major design progress for Nintendo, which used a dual-chip approach for the DSi, years after most other designs had adopted more efficient singe-chip solutions.

Three cameras deliver 3-D photography

A major attraction of the 3DS is its use of a camera subsystem that allows users to take 3-D photographs. This stereo vision system employs two parallel VGA cameras in a module, plus a third VGA camera. VGA camera modules are some of the least expensive of their kind now made, so Nintendo was able, with some price erosion over the years, to add a third module, while keeping the costs very similar to the two cameras implemented in the Nintendo DSi.

The camera subsystem costs $4.70, or 4.7 percent of the BOM, and up a scant $0.20 from the DSi.

Battery subsystem takes a page from Apple’s book

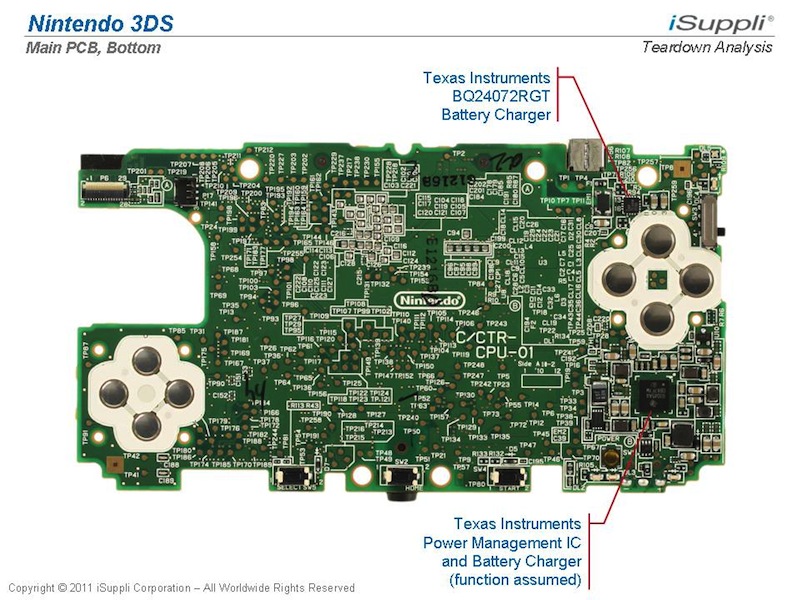

The battery subsystem of the 3DS costs $3.50, more than twice as expensive as that of the DSi, at $1.70. It accounts for 3.5 percent of the BOM. The battery’s cost premium is because of its increased capacity.

“Because the 3DS has bigger, more sophisticated displays and a higher-performance apps processor than the DSi—as well as new added features such as a gyroscope and accelerometer—it makes sense the battery would have higher capacity,” Rassweiler said.

The original DSi battery was a mere 840 milliampere-hour (mAh) model, while the device in the 3DS is labeled a 1300mAh device. However, the underlying battery cell, which IHS believes comes from Samsung SDI, appears to be rated even higher at 1470mAh. Between the beefier battery and a more robust set of chips to manage power in the 3DS, it appears Nintendo has taken a multi-faceted approach to improving battery life for consumers.

“It’s worth noting that Apple always spends a significant amount of money on power management circuitry and high-quality custom battery packs in order to differentiate its products in the key area of battery lifetime. With the 3DS, it appears that Nintendo has taken a page from Apple’s lesson book,” Rassweiler also noted.

For more information on IHS iSuppli’s Nintendo 3DS teardown, please visit: Nintendo 3DS Hardware Analysis

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.