IHS iSuppli announced that, according to its latest research, 22.5% of all television sets purchased in the U.S. in the fourth quarter of 2010 employed Light Emitting Diode (LED) backlights.

IHS iSuppli announced that, according to its latest research, 22.5% of all television sets purchased in the U.S. in the fourth quarter of 2010 employed Light Emitting Diode (LED) backlights.

For more information visit: www.isuppli.com

Unedited press release follows:

One-in-Five US Televisions Used LED Backlights in Q4 2010

El Segundo, Calif., April 7, 2011—Deepening their penetration of the U.S. television market, flat-panel liquid crystal display (LCD) TVs featuring light-emitting diode (LED) technology accounted for a little more than one-fifth of all U.S. TV sets purchased in the final quarter of 2010, according to new IHS iSuppli research.

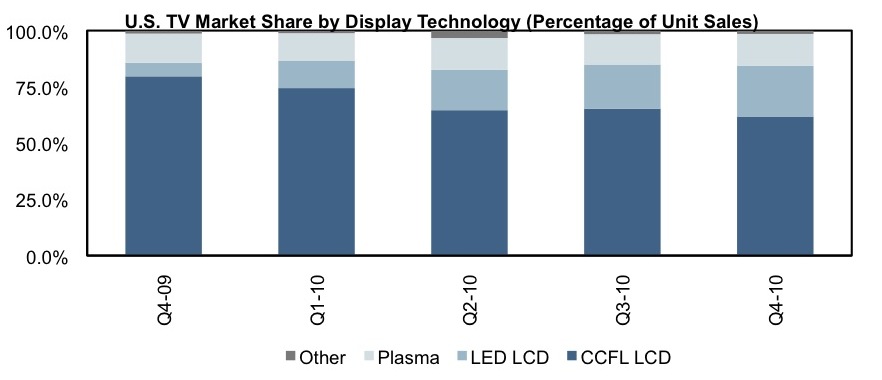

“LED-backlit LCD TVs made up 22.5 percent of TVs bought in the U.S. market in the fourth quarter last year, up almost 3 points from 19.6 percent in the third quarter,” said Riddhi Patel, director for television systems and retail services at IHS.

“In comparison, a full three-fifths of consumer purchases were for LCD TVs featuring the older technology of cold cathode fluorescent lamp (CCFL),” Patel added. “LED models are brighter, more power efficient and have thinner profiles, but they are also much more expensive than their CCFL counterparts, which explains the market disparity between the two flat-panel LCD technologies.”

The increased share of LED TV models solidifies the steady gains the technology has made since the second quarter of 2009 when it first appeared, Patel noted. In the fourth quarter of 2009, LED models only had 6 percent share, nearly four times less than what the latest totals indicate.

Plasma TV purchases remained flat despite aggressive end-market pricing, with sales growth hindered by the declining prices of LCD TVs in general as well as by consumer perceptions that plasma sports lower-grade specifications.

The attached figure shows the U.S. market share of various TV technologies from the fourth quarter of 2009 to a year later in 2010.

Changes in TV buying behavior traced to lower prices

A decline in U.S. TV prices during the fourth quarter also resulted in various changes in purchasing behavior among Americans during the period, IHS iSuppli research indicates.

For instance, aggressive pricing and the easy availability of deals meant that 4 percent fewer consumers, down to 45 percent, spent less time researching the TV market before purchasing a set. Among those that counted themselves as having made an impulse buying decision, the number jumped from 18 percent in the third quarter to 20 percent in the fourth quarter.

The price drop that resulted from a combination of holiday sales and inventory oversupply in the fourth quarter also opened up the TV market to a larger demographic of consumers, increasing technological awareness among them.

For instance, the percentage of those who identified themselves as “following technology trends closely but only buying when the price is right” jumped 2.6 points to 41.59 percent—suggesting that their resistance to buying decreased in the face of lower TV prices.

Similarly, among those who said they “tolerated buying technology only out of necessity,” the numbers rose—a tacit concession to the power of attractive pricing, given that the pool of consumers who thought that new TVs had become a necessity actually increased during the period.

Buyers of all stripes continued to think picture quality was the most important criterion in buying LCD TVs, followed by price and screen size. Brand name was less crucial, and the importance of a set being Internet enabled dropped in the fourth quarter in favor of TVs that might not have the feature but were on sale.

Learn more about the U.S. TV market with the IHS report entitled: Changes in TV Preference as Q4 2010 Prices Dip.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.