IHS iSuppli announced that, according to its research, more than one-fifth of all televisions purchased by U.S. consumers in the first quarter of 2011 sported displays 50″ or larger.

IHS iSuppli announced that, according to its research, more than one-fifth of all televisions purchased by U.S. consumers in the first quarter of 2011 sported displays 50″ or larger.

For more information visit: www.isuppli.com

Unedited press release follows:

U.S. Consumer Purchasing of 50-Inch and Larger Televisions Hits Record High Percentage in Q1

El Segundo, Calif., May 13, 2011—More than one-fifth of all televisions purchased by U.S. consumers in the first quarter sported displays that were 50 inches or larger, representing an all-time-high level, according to new IHS iSuppli (NYSE: IHS) research.

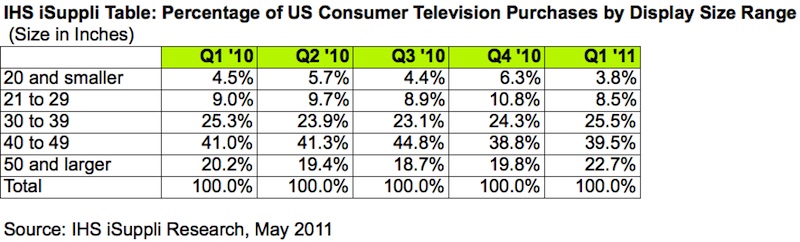

A total of 22.7 percent of American consumers bought the aforesaid television sets during the three months from January to March 2011, compared to 19.8 percent in the fourth quarter of 2010. The only other time when 50-inch-and-larger sets breached the one-fifth sales mark—or more than 20 percent—occurred a year ago during the first quarter of 2010, reaching the slightly lower level of 20.2 percent, as shown in the attached table.

“The rising popularity of 50-inch-and-larger sets among U.S. consumers stems from pure market economics,” said Riddhi Patel, director for television systems and retail services at IHS. “Televisions have become less expensive for the consumer, allowing even bigger sets previously considered beyond the reach of most consumers to become accessible. Consumer demand for ever-bigger sets has not abated, with the acquisition of larger televisions viewed as highly desirable for ordinary American households.”

TV brands also have been promoting 50-inch-and-larger televisions in the market because the sets offered bigger margins and profits.

Average pricing for 50-inch-and-larger flat-panel televisions—i.e., liquid crystal display (LCD) and plasma—in the United States amounted to $1,582 in the first quarter of 2011, down 8 percent from $1,723 in the fourth quarter of 2010.

Smaller sizes still rule

While sales of 50-inch-and-larger televisions are on the rise, smaller sets remain the most popular option for most consumers.

Reigning as the preferred size range for U.S. consumers were TV sets sized 40 to 49 inches, capturing 39.5 percent of sales in the first quarter this year, IHS iSuppli data show.

Next were TVs in the 30- to 39-inch range, at 25.5 percent, followed by the 50-inch-and- larger sets.

For the remaining two size categories, the smaller-than-20-inch range as well as the 20- to 29-inch range, fewer customers bought into those groups during the equivalent period, and total numbers decreased for both categories.

In addition to grabbing increased share, the size range represented by 50-inch-and-larger sets was also significant in that its percentage share of market grew the most between the fourth quarter last year and the first quarter in 2011. The portion of U.S. consumers who preferred that size grew 2.9 percent, compared to 1.2 percent for the 30- to 39-inch range and 0.6 percent for the most popular 40- to 49-inch range.

Japan disruption minimal

Following the Japanese earthquake and tsunami disaster, LCD TV production in Japan has reported minimal disruption. Though some TV assembly plants have been affected by semiconductor component shortages, the weak demand worldwide in recent months for general component inventories has meant that the TV markets suffered only very minimal impacts in the quake’s aftermath.

Learn more about the latest developments in the U.S. TV space with the IHS report entitled: “New 2011 Prices Reflect Demand for Larger-Sized TVs.”

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs approximately 5,100 people in more than 30 countries around the world.