IHS iSuppli announced that, according to its latest research, premium television brands face a growing challenge from lower-end value labels.

IHS iSuppli announced that, according to its latest research, premium television brands face a growing challenge from lower-end value labels.

For more information visit: www.isuppli.com

Unedited press release follows:

Low-End Brands Drive Down Prices of High-End LCD TVs

El Segundo, Calif., August 12, 2011—Premium television brands are confronting a growing challenge from lower-end value labels that are offering low-priced liquid crystal display (LCD) TVs with features previously seen only in costlier, advanced-technology sets, according to the latest IHS iSuppli U.S. TV Price & Specifications Market Tracker, from information and analysis provider IHS (NYSE: IHS).

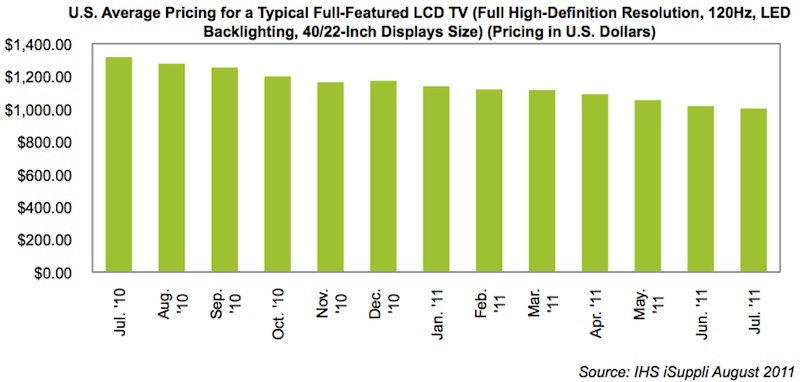

U.S. average pricing for a typical high-end LCD TV amounted to $1,002.58 in July, down 23.9 percent from $1,317.89 during the same month in 2010, as shown in the figure attached.

“Long the chief attraction for high-end brands like Sony and Samsung, features such as 1080p high-definition resolution, 120Hz refresh rates and light-emitting diode (LED) backlighting technology now are cropping up in value brands entering the market, especially in the 40- to 42-inch space,” said Lisa Hatamiya, displays researcher for IHS. “But unlike their pricey counterparts, the new upstarts boast dramatically lower pricing.”

For example, value brands like Apex and Element offer 40-inch 1080p/120Hz LED sets for $550 at Target and Wal-Mart stores across the United States. In comparison, premium brands with the same features are priced at about $1,100—double the price offered by the discount brands.

Feeling the pressure, premium brands are striving to keep up. California-based VIZIO—once considered a value brand itself but now part of the elite cadre of premium TV names—in June dropped the price of its 40- to 42-inch high-resolution LED model by $49. At an average price of $836 and a low of $628, it is the lowest-priced premium TV with those features on the market.

Overall, however, the value TV brands have not yet started to make 3-D or Internet connectivity a mainstream offering in their lines, two other benefits claimed by the premium market. But as value TV brands improve their quality and availability of advanced features, premium brands will need to continually enhance their products, focusing on key advantages while keeping price in mind, IHS believes.

Learn more about the latest developments in the U.S. TV space with the IHS iSuppli report entitled: “Value Brands Bring Down Prices in Feature-Rich Market.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.