ForeSee announced the results of its annual U.S. holiday E-Retail Satisfaction Index.

ForeSee announced the results of its annual U.S. holiday E-Retail Satisfaction Index.

For more information visit: www.foresee.com

Unedited press release follows:

Amazon Soars; Netflix Plummets in ForeSee Holiday Study

Study Finds Customers are Less Price Sensitive in 2011, Gap and Overstock Struggle with Holiday E-Commerce

ANN ARBOR, Mich., Dec. 28, 2011 — Customer experience analytics firm ForeSee today released the results of their annual Holiday E-Retail Satisfaction Index, showing that after seven years spent jockeying for first place in the Index, Amazon and Netflix are headed in divergent directions.

Amazon climbed two points to score 88 on the study’s 100-point scale, registering the highest score from any retailer in 14 consecutive studies. Meanwhile, Netflix’s well-publicized blunders caused its customer satisfaction to plummet by seven points and 8% to 79. After years of being separated by a point or two, Amazon and Netflix, which are increasingly in direct competition as Amazon expands into streaming video and rentals, are now separated by nine points in terms of satisfaction, a gulf that may be too wide for Netflix to overcome anytime soon.

Today’s report provides the first scientific quantification of customers’ experience with Netflix since its missteps earlier this year. With its satisfaction decline, Netflix has gone from satisfaction superstar to merely average, matching the Index’s aggregate score of 79 (up one point from 78 in the 2010 holiday shopping season). Netflix saw scores drop in every single element of the website that ForeSee measures, including site content, site functionality, merchandise, and prices.

“Netflix totally misread its customer base and is paying the price, damaging its brand among both consumers and investors,” said Larry Freed, president and CEO of ForeSee. “Raising prices by 60% and splitting the baby into separate DVD and streaming services totally undermines Netflix’s cost and convenience advantages. Customer satisfaction is predictive, which means that Netflix’s financial woes may be just beginning.”

“Meanwhile, Amazon may have started as an online bookstore, but it now competes in almost every significant retail category and it is setting the bar very high for any company selling online,” continued Freed. “E-retailers have consistently upped their game since we first started measuring holiday satisfaction in 2005, but Amazon is still the 800-pound gorilla of retail, and it just keeps getting better. It’s tough for a smaller retailer to compete with this level of dedication to providing an excellent customer experience.”

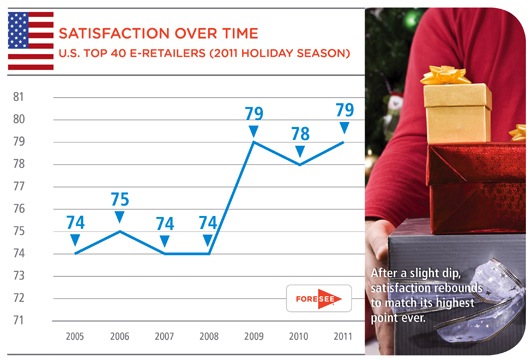

Since 2005, the average customer satisfaction score for the Index has increased from 74 to 79. A score of 80 has always been the standard for excellence; given the causal relationship between satisfaction and financial success, it is not surprising that most of the sites receiving the top 40 largest revenues according to Internet Retailer also have very high satisfaction scores. Any retailer scoring below average risks eroding loyalty, recommendations, sales, and market share to competitors who score higher, so even the Top 40 need to improve to stay at the top of the heap. If satisfaction drops significantly, a revenue drop is likely to follow.

KEY FINDINGS

The report includes individual satisfaction scores for the 40 top e-retailers (see chart below) for the past seven years, allowing for comparisons over time and between companies:

• Next to Netflix, both Gap.com (down 6% to 73) and Overstock.com (down 5% to 72) have the largest declines in satisfaction, leaving them with scores at the bottom of the Index.

• On the other end of the spectrum, the largest gains in satisfaction go to TigerDirect.com (up 8% to 79) and JC Penney (up 6% to 83), which named Ron Johnson, former head of Apple’s retail operations, as CEO this year.

• Price matters less: American consumers were less price sensitive during the 2011 holiday shopping season than they were last year

• Nearly 20 years of research coming from both academia and the private sector indicates that increasing customer satisfaction is one of the most powerful things a retailer can do in any channel to increase sales, loyalty, and positive word-of-mouth recommendations. The report quantifies the impact of satisfaction on these desirable customer behaviors.

“Customer satisfaction is a leading indicator of consumer spending, and the bump in the Index is good news for online retailers,” said Freed. “Unemployment is down, consumer confidence is up, and holiday retail sales are up from last year. Improved customer satisfaction suggests the good news may continue into the new year.”

|

Internet Retailer Rank* |

Website |

Holiday 2005 |

Holiday 2006 |

Holiday 2007 |

Holiday 2008 |

Holiday 2009 |

Holiday 2010 |

Holiday 2011 |

Point Change Since Last Year |

Point Change Since First Measured |

| Average, Top 40 E-Retailers |

74 |

75 |

74 |

74 |

79 |

78 |

79 |

1 |

5 |

|

|

1 |

Amazon.com |

82 |

84 |

82 |

84 |

87 |

86 |

88 |

2 |

6 |

|

3 |

Avon.com |

75 |

76 |

79 |

77 |

81 |

83 |

83 |

0 |

8 |

|

31 |

JCP.com (JC Penney) |

71 |

76 |

75 |

76 |

81 |

78 |

83 |

5 |

12 |

|

17 |

QVC.com |

80 |

80 |

80 |

79 |

83 |

84 |

83 |

-1 |

3 |

|

12 |

Store.Apple.com |

76 |

79 |

79 |

78 |

82 |

82 |

83 |

1 |

7 |

|

36 |

VistaPrint.com |

NM |

NM |

NM |

NM |

NM |

80 |

83 |

3 |

3 |

|

11 |

Newegg.com |

79 |

78 |

77 |

78 |

81 |

82 |

82 |

0 |

3 |

|

26 |

BN.com (Barnes and Noble) |

77 |

77 |

78 |

78 |

NM |

NM |

81 |

NA |

4 |

|

20 |

LLBean.com |

80 |

80 |

80 |

78 |

80 |

83 |

81 |

-2 |

1 |

|

40 |

VictoriasSecret.com |

NM |

NM |

NM |

76 |

80 |

79 |

81 |

2 |

5 |

|

34 |

Dell.com |

74 |

77 |

74 |

74 |

79 |

76 |

80 |

4 |

6 |

|

NA |

eBay.com |

NM |

NM |

NM |

NM |

NM |

80 |

80 |

0 |

0 |

|

4 |

HPShopping.com |

74 |

78 |

75 |

76 |

78 |

78 |

80 |

2 |

6 |

|

19 |

SportsmansGuide.com |

NM |

NM |

NM |

NM |

NM |

NM |

80 |

NA |

NA |

|

24 |

Williams-Sonoma.com |

NM |

77 |

75 |

74 |

79 |

80 |

80 |

0 |

3 |

|

13 |

Cabelas.com |

NM |

NM |

NM |

NM |

82 |

77 |

79 |

2 |

-3 |

|

22 |

Costco.com |

69 |

69 |

72 |

72 |

79 |

79 |

79 |

0 |

10 |

|

15 |

Kohls.com |

NM |

NM |

NM |

NM |

NM |

NM |

79 |

NA |

NA |

|

32 |

Netflix.com |

84 |

86 |

86 |

84 |

86 |

86 |

79 |

-7 |

-5 |

|

6 |

TigerDirect.com |

77 |

76 |

77 |

77 |

80 |

73 |

79 |

6 |

2 |

|

39 |

Walmart.com |

73 |

73 |

74 |

78 |

79 |

80 |

79 |

-2 |

5 |

|

38 |

BestBuy.com |

72 |

73 |

74 |

73 |

77 |

77 |

78 |

2 |

7 |

|

9 |

HomeDepot.com |

NM |

NM |

NM |

69 |

NM |

75 |

78 |

4 |

9 |

|

30 |

Macys.com |

NM |

71 |

71 |

70 |

79 |

75 |

78 |

3 |

7 |

|

16 |

NeimanMarcus.com |

72 |

73 |

72 |

69 |

73 |

NM |

78 |

NA |

6 |

|

2 |

Staples.com |

71 |

73 |

73 |

77 |

77 |

78 |

78 |

0 |

7 |

|

28 |

Nordstrom.com |

NM |

74 |

74 |

74 |

79 |

78 |

77 |

0 |

NA |

|

27 |

HSN.com |

75 |

75 |

76 |

69 |

76 |

79 |

76 |

-3 |

1 |

|

21 |

Target.com |

70 |

74 |

72 |

75 |

78 |

77 |

76 |

-1 |

6 |

|

41 |

Blockbuster.com |

NM |

NM |

NM |

72 |

77 |

76 |

75 |

0 |

4 |

|

7 |

OfficeDepot.com |

72 |

73 |

71 |

72 |

77 |

76 |

75 |

-1 |

3 |

|

5 |

OfficeMax.com |

NM |

NM |

68 |

70 |

75 |

75 |

75 |

0 |

7 |

|

8 |

Sears.com |

68 |

73 |

70 |

70 |

75 |

74 |

75 |

1 |

7 |

|

37 |

ToysRUs.com |

69 |

71 |

72 |

NM |

75 |

77 |

75 |

-2 |

6 |

|

14 |

Buy.com |

72 |

72 |

70 |

70 |

76 |

77 |

74 |

-3 |

2 |

|

33 |

Store.Sony.com |

69 |

73 |

70 |

70 |

77 |

76 |

74 |

-2 |

5 |

|

23 |

Gap.com |

73 |

74 |

NM |

69 |

76 |

78 |

73 |

-5 |

0 |

|

25 |

Overstock.com |

71 |

71 |

70 |

69 |

76 |

76 |

72 |

-4 |

1 |

| * 2011 Rank in Internet Retailer’s Top 500 Guide, a ranking of the Top 500 online retailers in the U.S. by sales volume. Internet Retailer does not include eBay in its Top 500 guide because eBay is a marketplace rather than an individual retailer. ForeSee opted to include eBay although they are not officially on Internet Retailer’s list because of the large volume of retail transactions they represent. The composition of the list varies from year to year based on Internet Retailer’s list. | ||||||||||

| The following Top 40 retailer sites had sample sizes that were too small to report a statistically meaningful score: AmwayGlobal.com, CDW.com, and Grainger.com. Blockbuster.com, number 41 on Internet Retailer’s list, was measured in lieu of number 35, Buy.Norton.com, for the Top 40 study because there were not enough responses to provide a score for Buy.Norton.com in the spring Top 100 study. | ||||||||||

About the ForeSee Results E-Retail Satisfaction Index (U.S. Holiday Edition)

The seventh annual holiday online satisfaction report is based more than 8,500 responses from visitors to the top 40 e-retail websites according to sales revenue as reported by Internet Retailer’s Top 500 Guide. Survey responses were collected via FGI Research’s Smart Panel. ForeSee Results used the methodology of the American Customer Satisfaction Index (ACSI) to calculate the scores. The ACSI is the national standard for customer satisfaction, and this measure has been shown to have a direct link with stock prices and other measures of financial performance.

About ForeSee

As a pioneer in customer experience analytics, ForeSee continuously measures satisfaction across customer touch points and delivers critical insights on where to prioritize improvements for maximum impact. Because ForeSee’s superior technology and proven methodology connect the customer experience to the bottom line, executives and managers are able to drive future success by confidently optimizing the efforts that will achieve business and brand objectives. The result is better business for companies and a better experience for consumers. Visit www.foresee.com for customer experience solutions and original research.