IHS iSuppli announced it forecasts that global shipments of AMOLED televisions will reach 2.1 million sets in 2015, which will account for roughly 1% of the flat-panel TV market.

IHS iSuppli announced it forecasts that global shipments of AMOLED televisions will reach 2.1 million sets in 2015, which will account for roughly 1% of the flat-panel TV market.

For more information visit: www.isuppli.com

Unedited press release follows:

AMOLED TV Market Slowed by High Prices, Manufacturing Challenges

El Segundo, Calif., January 24, 2012 — Despite the excitement surrounding the introduction of active matrix organic light emitting diode (AMOLED) televisions at this month’s Consumer Electronics Show (CES), global shipments of the sets will be limited during the next few years because of high prices caused by manufacturing challenges and expensive materials.

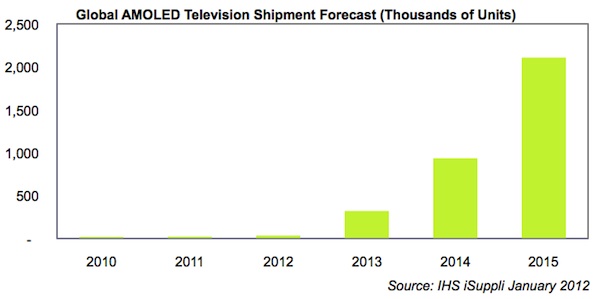

Global AMOLED TV shipments are expected to reach 2.1 million units in 2015, up from just 34,000 in 2012, according to a new IHS iSuppli Small and Medium Displays service at information and analysis provider IHS (NYSE: IHS). While this represents tremendous growth, AMOLED TV shipments still will account for only 1 percent of the global flat-panel market by 2015.

The figure attached presents the IHS iSuppli AMOLED TV shipment forecast.

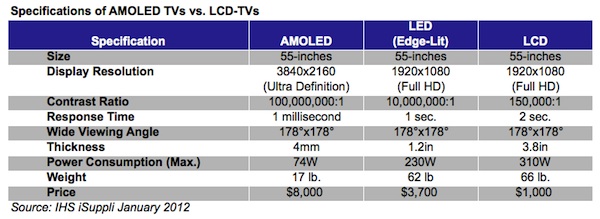

“AMOLED TV prices will remain dramatically higher than those of liquid crystal display (LCD) TVs during the next few years because of manufacturing yield issues, combined with inflated material costs due to the small pool of suppliers,” said Vinita Jakhanwal, director of small/medium and OLED displays at IHS. “A 55-inch AMOLED TV will be priced at $8,000 in 2012, more than twice the $3,700 average expense for an equivalent LCD TV. And although AMOLEDs deliver a dramatically superior viewing experience compared to LCDs, consumers are unlikely to buy large quantities of AMOLEDs until their prices fall to within a 20 percent premium of comparable LCD TVs.”

AMOLED Arrives

After years of effort and billions of dollars invested in AMOLED display technology development, South Korean firms LG Display (LGD) and Samsung Electronics at CES showcased what are currently the largest AMOLED 3-D TVs. These large, 55-inch displays represent a major departure from previous AMOLEDs, which mainly are focused on small/medium display applications like smartphones, at sizes smaller than 10 inches.

LGD’s 55-inch 3-D, ultra definition—i.e., 3840 by 1260—AMOLED TV boasts of features that exceed any other flat-panel TV now on the market. The television is only 4 millimeters thick and weighs 17 pounds. It also has a pixel speed that is 1,000 times faster and consumes only one-third of the power compared to conventional LCDs.

Samsung also showcased a 55-inch 3-D AMOLED television with similar specifications.

In comparison to these AMOLED sets, a currently available 3-D LCD-TV with a light-emitting diode (LED) backlight offers a Full HD—i.e., 1,920 by 1,080—pixel format, with the thinnest being only 1.2-inches thick and weighing more than 50 pounds. LGD and Samsung are expected to begin shipping their OLED TVs to the market by the third quarter of 2012, in time for the 2012 London Summer Olympics.

The table attached presents a comparison of AMOLED and LCD televisions specifications.

Manufacturing Challenges

Recent innovations in AMOLED backplane technology, materials and equipment and suppliers’ investments in newer-generation AMOLED fabs have made these AMOLED TVs possible. However, pricing remains much higher compared to current LCD TVs in the market.

This is because AMOLED manufacturing efficiencies and output yields are unlikely to match those of LCDs for the next three years. Furthermore, pricing for AMOLED materials will still command a premium because of the limited number of suppliers. Large-sized AMOLED panel production faces issues with scaling manufacturing to newer-generation fabs.

These factors are keeping AMOLED TV pricing high.

However, IHS iSuppli expects AMOLED display suppliers, equipment makers, material makers and TV makers to cooperate in developing more efficient and cost effective ways in order to make large-sized AMOLED panels. As a result, prices are expected to decline.

Early production of 55-inch AMOLED panels is likely to be conducted at existing eighth-generation amorphous silicon (a-Si) LCD fabs that will be converted to make the oxide silicon backplanes needed for AMOLEDs. Both LGD and Samsung plan to move mass production to eighth-generation AMOLED lines in the future. And as manufacturing matures, large-sized AMOLED panels have the potential of becoming cheaper.

LGD indicated the price for its 55-inch AMOLED TV is expected to decline to $4,000 by 2013, when comparable LCD TV prices are likely to reach a price point of less than $1,000.

Different AMOLED Approaches

While there was no visible difference between the two TVs shown by LGD and Samsung at CES, the two sets employed diverse AMOLED technology.

Samsung’s 55-inch AMOLED TV panel uses a horizontal red/green/blue (RGB) pixel structure, which requires a fine metal mask (FMM) for the patterning of AMOLED material. Currently horizontal RGB structure is challenging to implement on large substrates, as a fine pitch alignment of the FMM and the glass substrate is needed.

In comparison, Samsung’s AMOLED technology mainly uses low-temperature polysilicon (LTPS) LCD as the backplane. However, for larger fabs, the company may consider working with oxide silicon backplanes as an intermediary step before new-generation low-temperature polysilicon (LTPS) backplanes are available.

LGD’s 55-inch AMOLED television panel uses a vertical white-OLED (WOLED) pixel structure with a color filter. The use of WOLEDs eliminates the need for an RGB mask, resulting in improved efficiencies and increasing the ease of making finer pitch pixels on the panel. However, this approach needs an additional color filter. The oxide silicon backplane of LGD’s 55-inch TV likely will be manufactured at LGD’s existing eighth-generation a-Si LCD fab.

LGD indicated that such a conversion of an existing a-Si fab to make oxide silicon backplanes will require almost 50 percent less investment than a new LTPS LCD fab. This fab, according to LGD, is able to do three half-cuts of 55-inch displays from one substrate.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.