IHS iSuppli announced it expects the global electronics contract manufacturing business to decline slightly in 2012.

IHS iSuppli announced it expects the global electronics contract manufacturing business to decline slightly in 2012.

For more information visit: www.isuppli.com

Unedited press release follows:

Uncertain Economic Conditions Spur Decline in Electronics Contract Manufacturing in 2012

El Segundo, Calif., January 26, 2012 — Following a year of expansion in 2011, the global electronics contract manufacturing business is expected to decline slightly in 2012, as continuing economic uncertainty in Europe and the United States constricts growth, according to an IHS iSuppli EMS & ODM Market Brief report from information and analysis provider IHS (NYSE: IHS).

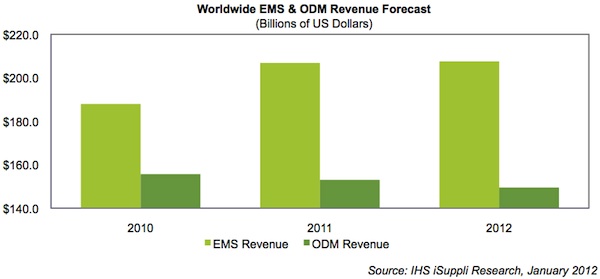

Total contract manufacturing revenue this year is expected to decline to $357 billion, down by slightly less than 1 percent from $360 billion in 2011. This compares to 4.7 percent growth in 2011.

Both the electronic manufacturing services (EMS) and original development manufacturing (ODM) segments of the industry are not projected to perform well for this year. Revenue in the EMS sector for 2012 will be practically flat at $207.5 billion, up by a negligible 0.3 percent from $206.8 billion in 2011. The ODM sector will be in even worse straits, shrinking 2.3 percent to $150.0 billion, down from $153.0 billion, as shown in the figure attached.

The anticipated performance for the overall contract manufacturing industry this year represents a big step down from its results in 2011, particularly during the first half of the year, when growth was solid.

Last year, EMS boasted 10.1 percent growth on top of a 34.7 percent increase in revenue during 2009. However, the ODM market already was struggling in 2011, with a 1.7 percent decline.

European contagion

“The paramount factor affecting the electronics contract manufacturing business in 2011 is the sovereign debt crisis in Europe,” said Thomas Dinges, senior principal analyst for EMS and ODM at IHS. “Europe remains a key market for products built all over the globe. If Europe goes into recession because of its financial problems, and the recession then spreads to the United States—already hobbled by high unemployment and assorted economic travails—there will be very little that the global contract manufacturing industry can do, other than hope that the pipeline of new business remains strong and that the price increases enacted this past year serve as a buffer to prop up margins somewhat.”

To be sure, a recession is not certain to occur this year. Still, the forecasts paint a picture of reduced growth for both Europe and the United States in 2012.

China offers up hope; other issues also weigh in

A bright spot can be discerned, however, coming from the industry’s single biggest growth engine: China. Overall expectations point to another round of high single-digit growth this year in that country, which already accounts for more than half of the contract manufacturing industry’s aggregate revenues.

China also has grown to be the world’s largest consumption market of smartphones and PCs—some of the end products it helps produce—so China’s pace of growth in those markets will determine how quickly those areas expand.

China, though, is no longer the nexus of cheap labor, instead sitting atop a list of countries characterized by low manufacturing wages. China in 2011 had wages averaging $2.19 for each worker per hour, which is rising at nearly 15 percent per year.

Despite this, IHS does not believe another region in the world is likely to emerge as a new low-cost manufacturing location. In most cases, the infrastructure—including power, water and transportation—of locations under consideration is simply not adequate or robust enough to support large-scale manufacturing, especially when compared to what the industry now deploys in two of its largest manufacturing locations in China or Mexico.

The bottom line

The worldwide contract manufacturing industry also will contend with other significant issues in 2012. For instance, the soundness of companies and their balance sheets will continue to be scrutinized after the bankruptcy filing in October 2011 of major player Elcoteq from Finland. In addition, there likely will be continued pressure on suppliers to ensure among customers that they are in compliance with all local labor laws given the recent announcement by Apple to allow outside monitors into its supplier facilities.

On a positive note, the continuing popularity among consumers of devices like smartphones and tablets means contract manufacturing in these areas can be expected to help compensate for slow growth elsewhere in the industry. A shift toward fewer product offerings in the notebook industry also will have positive impacts, leading to improved inventory velocity throughout the besieged PC notebook supply chain. Moreover, lower component pricing this year should help improve industry margins for the near term.

Learn more about this topic with the IHS iSuppli report entitled: “EMS and ODM Market: 12 Critical Questions in 2012.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.