NPD DisplaySearch announced it forecasts that shipments of tablet PCs will grow from 72.7 million units in 2011 to 383.3 million units by 2017.

NPD DisplaySearch announced it forecasts that shipments of tablet PCs will grow from 72.7 million units in 2011 to 383.3 million units by 2017.

For more information visit: www.displaysearch.com

Unedited press release follows:

Emerging Markets and High Performance Drive Rapid Growth in Tablet Demand

Asia Pacific and China Gaining Importance; Display Resolution Increasing

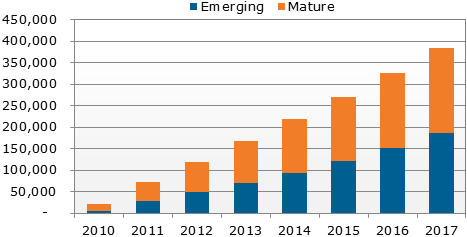

Santa Clara, Calif., January 30, 2012 — Shipments of tablet PCs are expected to grow from 72.7 million units in 2011 to 383.3 million units by 2017, according to the latest NPD DisplaySearch Tablet Quarterly report. Driving the demand is the continued solid growth in mature markets complemented by increasingly strong growth in emerging markets. Emerging markets are expected to account for up to 46% of worldwide shipments by 2017, an increase from the 36% share in 2011.

“The emerging market opportunity for tablets has been flying under the radar mainly because the device brands aren’t household names and there are concerns regarding the sustainability of the market,” said Richard Shim, NPD DisplaySearch Senior Analyst. “However, we are beginning to see investments by some of the better known brands in developing regions, and we expect this to not only continue but to flourish as competition improves.”

The introduction of tablets from new brands, such as Aakash in India, and established brands, such as Dell in China, is boosting competition and adoption. Penetration rates of tablet PCs in China and Asia Pacific are leading the emerging market regions, but Brazil, India, Russia and other countries are becoming bigger forces on the worldwide scene as prices come down and distribution channels expand. Additionally as counties such as Turkey move to overhaul its entire education systems through efforts such as their FATIH project, Tablet PCs are also taking on a bigger role outside of the home as well.

“Growth in the emerging markets will be accompanied by competition at lower price points,” says Jim McGregor, NPD In-Stat Chief Technology Strategist. “This will result in significant opportunities for processors that can optimize power and performance while achieving device price points that are often under $100.”

Figure 1: Worldwide Tablet PC Emerging vs. Mature Market Shipment Forecast Breakout

Source: NPD DisplaySearch Q4’11 Tablet Quarterly

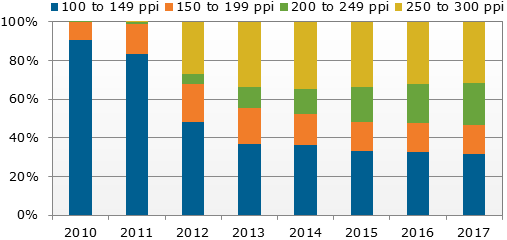

In addition to broader market opportunities driving growth, evolution of the tablet platform will also increase growth. That evolution is expected to initially take the form of higher pixel densities and, in the later years of the forecast, higher performance to enable richer multimedia experiences. In the coming quarters, resolutions and pixel densities will increase in panels, resulting in market segmentation of premium and value categories. Pixel densities of 200-300 ppi are forecast to rise in 30% of units in 2012 to 47.5% by 2017.

Figure 2: Worldwide Annual Tablet PC Pixel-Per-Inch Forecast

Source: NPD DisplaySearch Q4’11 Tablet Quarterly

The NPD DisplaySearch Tablet Quarterly report tracks quarterly changes in tablet PC products and strategies, and also offers forecasts based on the impact of those changes on the market. It covers the changing landscape of screen sizes, features that are expected to be included and excluded in future tablets, and operating systems, including highlights such as these:

• Survey results of U.S. commercial tablet owners indicate 39% of respondents said having a Windows OS option as part of their next tablet purchase was important to very important.

• Touch technology penetration is dominated by projected capacitive with over 80% share in 2011, which is expected to continue and grow to nearly 95% share in 2017. Competing touch technologies, including resistive, combo, and on-cell, will have limited opportunities in tablet PCs.

• Many display manufacturers are transitioning tablet panel production to larger plants, Gen 6 and Gen 8, which will lead to greater capacity for tablet displays and lower prices.

For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, NPD DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on NPD DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.