![]() Dolby Laboratories announced its first quarter 2012 financial results.

Dolby Laboratories announced its first quarter 2012 financial results.

Dolby trades on the NYSE under the symbol DLB.

For more information visit: www.dolby.com

Unedited press release follows:

Dolby Laboratories Reports First Quarter Fiscal 2012 Results

SAN FRANCISCO–Dolby Laboratories, Inc. (NYSE:DLB) today announced the Company’s financial results for its first quarter of fiscal 2012.

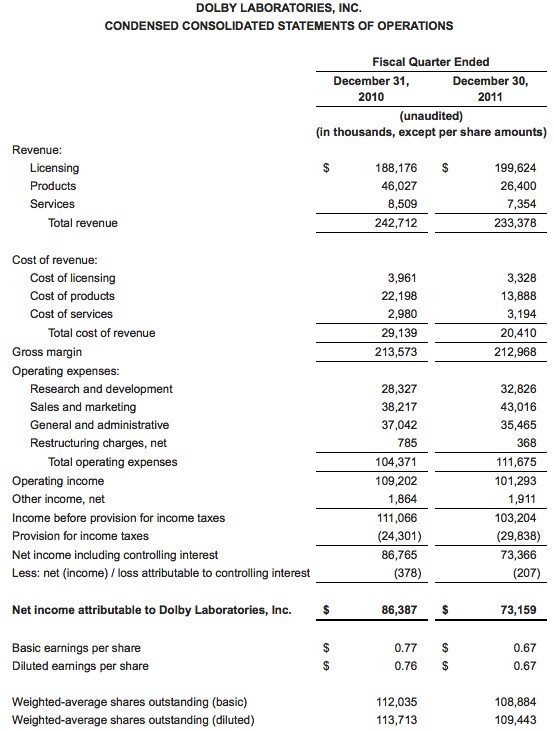

For the first quarter, Dolby reported total revenue of $233.4 million, compared to $242.7 million for the first quarter of fiscal 2011.

First quarter GAAP net income was $73.2 million, or $0.67 per diluted share, compared to $86.4 million, or $0.76 per diluted share, for the first quarter of fiscal 2011. On a non-GAAP basis, first quarter net income was $83.1 million, or $0.76 per diluted share, compared to $85.0 million, or $0.75 per diluted share, for the first quarter of fiscal 2011. Dolby’s non-GAAP measures exclude expenses related to stock-based compensation, the amortization of intangibles from business combinations, restructuring charges, and the related tax impact of these items. In addition, the non-GAAP measures exclude a one-time benefit resulting from the release of a deferred tax liability in the first quarter of fiscal 2011.

“In the first quarter, we grew licensing revenue year over year on the strength of our broadcast and mobile markets,” said Kevin Yeaman, President and Chief Executive Officer, Dolby Laboratories. “We continue to enhance the entertainment experience in online content with the addition of services such as HBO Go®, which recently announced the adoption of Dolby® Digital Plus.”

Financial Targets

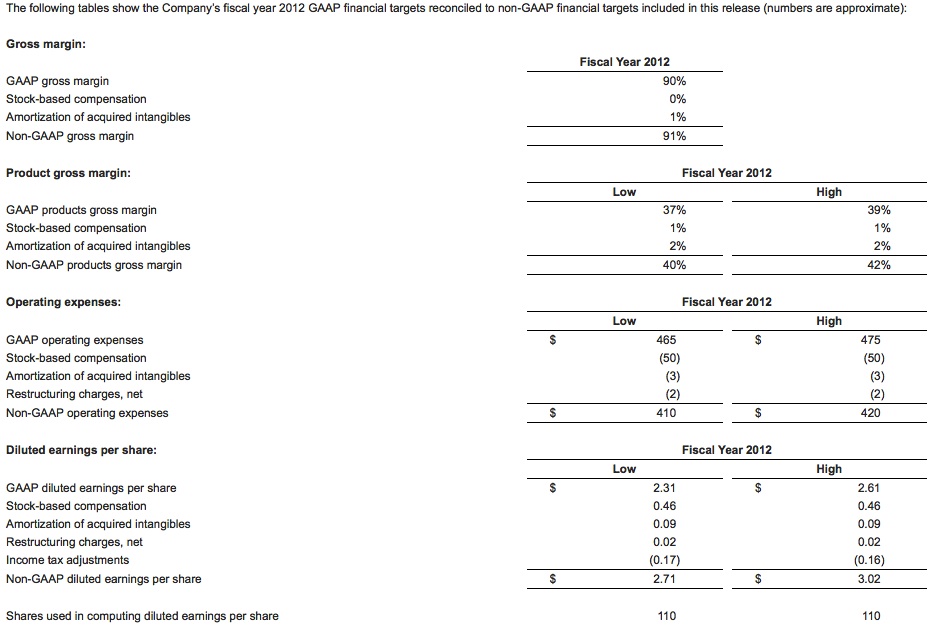

For fiscal 2012, Dolby continues to target revenue of $910 million to $970 million.

GAAP

For fiscal 2012, Dolby continues to target total gross margin of approximately 90 percent, operating expenses of $465 million to $475 million, and other income of approximately $5 million. In addition, Dolby continues to target a tax rate of approximately 29 percent to 30 percent for fiscal 2012. While stock-based compensation expense may vary based on factors such as stock price or volatility, Dolby continues to target stock-based compensation expense for fiscal 2012 of approximately $51 million. In addition, Dolby continues to target charges related to the amortization of acquired intangibles for fiscal 2012 of approximately $10 million and restructuring charges of approximately $2 million.

Non-GAAP

For fiscal 2012, Dolby continues to target total gross margin of approximately 91 percent, operating expenses of $410 million to $420 million, and other income of approximately $5 million. In addition, Dolby continues to target a tax rate of approximately 29 percent to 30 percent for fiscal 2012. Dolby’s non-GAAP targets exclude expenses related to stock-based compensation, the amortization of intangibles from business combinations, restructuring charges, and the related tax impact of these items. In addition, the non-GAAP measures exclude a one-time benefit resulting from the release of a deferred tax liability in the first quarter of fiscal 2011.

Diluted Earnings per Share

Dolby continues to target diluted shares outstanding of approximately 110 million. These targets lead to a fiscal 2012 diluted earnings per share target range of $2.31 to $2.61 on a GAAP basis and $2.71 to $3.02 on a non-GAAP basis.

The Company’s Conference Call Information

Members of Dolby Laboratories’ management will lead a conference call open to all interested parties to discuss the Company’s first quarter fiscal 2012 financial results at 2:00 p.m. PT (5:00 p.m. ET) on Tuesday, January 31, 2012.

Access to the teleconference will be available over the Internet from http://investor.dolby.com/medialist.cfm or by dialing 1-888-437-9274 from within the United States or 1-719-325-2297 from outside the country.

A replay of the call will be available from 5:00 p.m. PT on Tuesday, January 31, 2012, until 9:00 p.m. PT on Tuesday, February 7, 2012. Callers can dial 1-877-870-5176 from within the United States or 1-858-384-5517 from outside the country, and then enter the confirmation code 5824012. An archived version of the teleconference will also be available on the Dolby Laboratories website, www.dolby.com.

Non-GAAP Financial Information

To supplement Dolby’s financial statements presented on a GAAP basis, Dolby provides non-GAAP financial measures of gross margin, operating expense, tax rate, and diluted earnings per share. These measures are adjusted to exclude the charges and expenses discussed above. Dolby presents such non-GAAP financial measures in reporting its financial results to provide investors with an additional tool to evaluate Dolby’s operating results in a manner that focuses on what Dolby’s management believes to be its ongoing business operations. Dolby’s management believes it is useful for itself and investors to review, as applicable, both GAAP information that includes the impact of stock-based compensation expense, amortization of intangible assets acquired through business combinations, restructuring charges, the related tax impact of all of these items on the provision for income taxes, and a one-time benefit resulting from the release of a deferred tax liability in the first quarter of fiscal 2011, and the non-GAAP measures that exclude such information in order to assess the performance of Dolby’s business for planning and forecasting in subsequent periods. Dolby’s management does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Whenever Dolby uses such a non-GAAP financial measure, it provides a reconciliation of the non-GAAP financial measure to the most closely applicable GAAP financial measure. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as detailed above. Investors are also encouraged to review Dolby’s GAAP financial statements as reported in its SEC filings. A reconciliation between GAAP and non-GAAP financial measures is provided at the end of this press release and on Dolby’s investor relations website at http://investor.dolby.com/medialist.cfm.

Forward-Looking Statements

Certain statements in this press release, including statements relating to Dolby’s expectations regarding revenue, gross margin, operating expense, other income, tax rate, stock-based compensation, amortization of intangibles, restructuring charges, and diluted earnings per share for fiscal 2012, and its statements regarding the strength of its broadcast and mobile markets, its opportunities with respect to online content, and the benefits that may be derived from them are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: risks that Dolby technologies may not be included in future PC operating systems; risks associated with trends in the markets in which Dolby operates, including the personal computer, DVD, and Blu-ray Disc™, broadcast, consumer electronics, gaming, mobile, and automobile markets; pricing pressures; risks that shifts from disc-based media to online media content could result in fewer devices with Dolby technologies; risks associated with the effects of macroeconomic conditions; the timing of Dolby’s receipt of royalty reports and/or payments from its licensees; Dolby’s accuracy of calculation of royalties due to its licensors; Dolby’s ability to develop, maintain, and strengthen relationships with industry participants; Dolby’s ability to develop and deliver innovative technologies in response to new and growing markets in the entertainment industry; competitive risks; risks associated with conducting business in China and other countries that have historically limited recognition and enforcement of intellectual property and contractual rights; risks associated with the health of the motion picture industry generally; the development and growth of the market for digital cinema and digital 3D and Dolby’s ability to successfully penetrate this market; Dolby’s ability to expand its business generally, and to expand its business beyond sound technologies to other technologies related to digital entertainment delivery, by acquiring and successfully integrating businesses or technologies; and other risks detailed in Dolby’s Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in its most recent annual report on Form 10-K. Dolby disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise.

About Dolby Laboratories

Dolby Laboratories (NYSE:DLB) is the global leader in technologies that are essential elements in the best entertainment experiences. Founded in 1965 and best known for high-quality audio and surround sound, Dolby creates innovations that enrich entertainment at the movies, at home, or on the go. For more information about Dolby Laboratories or Dolby technologies, please visit www.dolby.com.