IHS announced it reckons that Seagate Technology recaptured the lead in hard disk drive (HDD) shipments during the fourth quarter of 2011, ousting Western Digital, which suffered heavy losses in the Thailand floods last year.

IHS announced it reckons that Seagate Technology recaptured the lead in hard disk drive (HDD) shipments during the fourth quarter of 2011, ousting Western Digital, which suffered heavy losses in the Thailand floods last year.

For more information visit: www.isuppli.com

Unedited press release follows:

Thailand Flooding Helps Seagate Move into First Place in Hard Drive Market in Fourth Quarter

El Segundo, Calif., February 29, 2012 — Seagate Technology LLC recaptured the lead in hard disk drive (HDD) shipments during the fourth quarter of 2011, ousting Western Digital Corp., which suffered heavy losses in the devastating Thailand floods last year.

In the final quarter of 2011, Seagate shipped 46.9 million HDD units worldwide, compared to 28.5 million for archrival Western Digital, according to an IHS iSuppli Storage Space Market Brief from information and analytics provider IHS (NYSE: IHS).

Seagate suffered a relatively minimal sequential shipment decline of 8 percent compared to third-quarter figures of 50.8 million units. Western Digital, in contrast, took a massive blow as shipments fell 51 percent from 57.8 million units in the earlier quarter.

This reversal catapulted Seagate back to the top of the HDD market—a distinction it hasn’t claimed in at least two years. Offering higher-margin products, Seagate also continues its longstanding status as market revenue leader, a lock on the space that Western Digital has not been able to pry free.

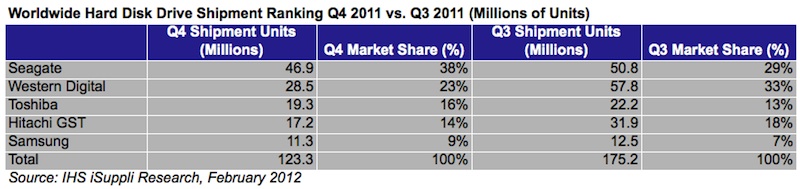

All told, HDD shipments from the industry’s five major manufacturers retreated sharply in the fourth quarter to 123.3 million units, down 30 percent from 175.2 million units the quarter before. Along with Seagate and Western Digital, major players such as Toshiba, Hitachi Global Storage Technologies and Samsung Electronics also posted shipment declines, as shown in the table below.

The new rankings mean that Seagate in the fourth quarter controlled 38 percent of overall HDD shipments, with Western Digital coming in a distant second at 23 percent. Toshiba had 16 percent, followed by Hitachi GST with 14 percent and Samsung with 9 percent.

“Seagate owes its return to market leadership to a fortuitous accident in geography: Its HDD manufacturing plant in Thailand is located on high ground,” observed Fang Zhang, analyst for storage systems at IHS. “As a result, the company was less impacted by the October floods—the most destructive in the last 50 years for the Southeast Asian country. On the other hand, Western Digital’s HDD manufacturing facilities were engulfed by rampaging storm waters, which effectively slashed its fourth-quarter output to half of the manufacturer’s preflood volume.”

Moving forward, the two HDD titans will continue to battle for the No. 1 spot. Both companies also are engaging in mergers—Seagate with Samsung and Western Digital with Hitachi GST—which would have the general effect of intensifying rivalry between the two.

Gross margins and ASPs rise in Q4

Both Seagate and Western Digital saw their gross margins rise to record highs in the fourth quarter, due to across-the-board price increases in the wake of flood-related HDD shortages.

Seagate, which had a long-term goal to reach gross margins in the 22 to 26 percent range, actually achieved the 32 level in the fourth quarter, thanks to higher average selling prices (ASP) of HDDs. Seagate’s ASP surged from $55 in the third quarter to $68 in the fourth—a strong 24 percent upswing.

Western Digital also attained a company record with gross margins at 32.5 percent during the same period, after its ASP soared to $69, up from $46. Given the expected HDD shortages for the first half of this year and Western Digital’s long road to recovery, Seagate’s gross margin is expected to remain at the 30 percent level throughout 2012.

In general, however, pricing will start to decline at the end of the first quarter this year for some HDD products, with component shortages finally easing and production increases kicking in from plants that had escaped flooding.

Even so, pricing is not expected to return to preflood levels anytime soon, especially because there will be fewer manufacturers left after both Seagate and Western Digital complete their individual buyouts of Samsung and Hitachi GST, respectively. Also, higher pricing can be expected with the relocation of HDD production following the flood, increased component costs from manufacturers impacted by the disaster, and lofty costs in general associated with the continuing development of high-technology drives.

One other factor could impact market values for the rest of the year. If the new, super-thin Ultrabooks promoted by Intel Corp. take off—and there is every indication they will—HDD prices could remain elevated throughout 2012, IHS believes.

Learn more about this topic in the IHS iSuppli report entitled: “Seagate Regains Lead in HDD Market.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analytics and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.