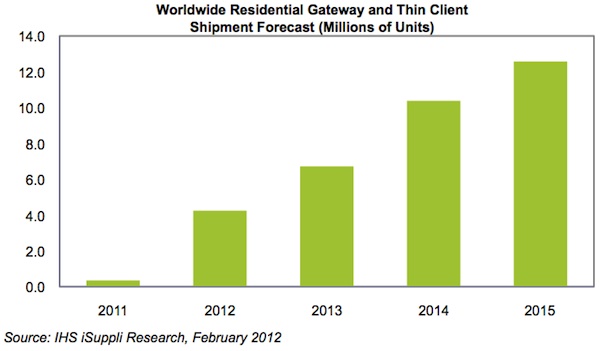

IHS announced it forecasts that the size of the residential gateway market will increase from 4.2 million units in 2012 to 12.6 million by 2015.

IHS announced it forecasts that the size of the residential gateway market will increase from 4.2 million units in 2012 to 12.6 million by 2015.

For more information visit: www.isuppli.com

Unedited press release follows:

Residential Gateway Market Projected to Triple from 2012 to 2015

El Segundo, Calif., February 27, 2012 — Residential gateways are expected to become the new hub of the so-called digital living room when they take over from set-top boxes, with the vigorous gateway market projected to triple from 2012 to 2015, according to an IHS iSuppli Consumer Platforms topical report from information and analytics provider IHS (NYSE: IHS).

Shipments of residential gateways and thin client boxes that act as receivers are miniscule at present, but their numbers will grow dramatically as cable and wireless operators begin to roll out services offering broader connectivity and seamless access. Worldwide gateway and thin client shipments are projected to reach 4.2 million units in 2012, up from just 345,000 last year and a mere 1,000 in 2010. Shipments then are expected to continue to climb quickly during the next two years—rising to 6.7 million units in 2013, to 10.4 million in 2014 and to 12.6 million by 2015, as shown in the figure attached.

“While the set-top box has been the heart of the home media environment, acting as the home’s primary media interface to the outside world and also connecting to the network and the TV, the residential gateway will be the next step up as it is able to link together an even wider range of devices,” said Jordan Selburn, senior principal analyst for consumer platforms at IHS. “Through the residential gateway, a set-top box acting as a central server can be connected to any number of thin client boxes—and eventually to other media devices being used in the home, like smartphones or tablets—in order to deliver content. As such, gateways can become the nucleus of the digital living room, where consumers have seamless access to material from a wide range of sources.”

Factors to Help the Gateway Market Take Off

Although gateway devices will center on the North American region during the next few years and limit the size of the overall residential gateway space in the near term, the market will continue to expand as emerging regions begin to adopt the model. If the current set-top box market is any indication, countries like Brazil, Russia, India and China could propel the gateway space during the latter part of the decade and beyond, IHS predicts. In North America, many of the leading operators are moving to the server/client model, with the “Whole Home DVR” service offered by DirecTV, Comcast and others as the first step.

The residential gateway model also has a pull and push component driving it forward, further ensuring that the market will grow rapidly. Among service providers, gateways can save money by allowing them to move to a server/client configuration that is less expensive than putting a hard drive into each set-top box. Operators also can charge for the increased connectivity provided by gateways, boosting provider revenues in the process. On the part of consumers, gateways with real-time, high-definition video transcoding capabilities will become a must-have feature in the connected world, allowing media to be correctly rendered in the tablets and smartphones that users already possess.

The key component within the residential gateway box—the media processor—is now ready for prime time, IHS believes. Tasked with converting media into the right format and resolution for a given rendering device, the media processor requires substantial computation power, and until recently was out of reach for even leading-edge media processors without a separate co-processing chip.

All that has changed, however, with companies like Intel Corp., Broadcom Corp. and STMicroelectronics launching products aimed at the gateway and client markets. Intel was the first to release a chip—the CE4200—for handling real-time transcoding, and quickly began to forge relationships with major set-top box manufacturers. For its part, Broadcom has the BCM7425 and other similar chips in volume production, while STMicroelectronics has its “Orly” chip scheduled for production in mid-2012.

Residential gateways are not expected to settle on one single networking standard but incorporate a mix that will be dependent on region and operator. Wired or wireless, Cat 5, coax or powerline—all will vie to be the backbone of the connected home.

Learn more about this topic with the IHS iSuppli report entitled: “Residential Gateways: A Giant Leap for Set-Top Boxes.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analytics and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.