IHS announced it reckons that Americans will pay to view more movies online in 2012 than they will on physical video formats, marking the first year that legal, Internet-delivered movie consumption will outstrip that of DVDs and Blu-ray discs combined.

IHS announced it reckons that Americans will pay to view more movies online in 2012 than they will on physical video formats, marking the first year that legal, Internet-delivered movie consumption will outstrip that of DVDs and Blu-ray discs combined.

For more information visit: www.isuppli.com

Unedited press release follows:

US Audiences to Pay More for Online Movies in 2012 than for Physical Videos

El Segundo, Calif., March 22, 2012 — Americans will pay to consume more movies online in 2012 than they will on physical video formats, marking the first year that legal, Internet-delivered movies will outstrip those of DVDs and Blu-ray discs combined.

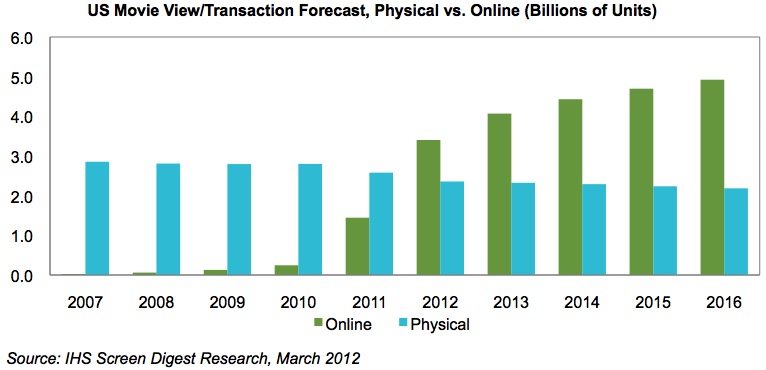

The legal, paid consumption of movies online in the United States will reach 3.4 billion views or transactions in 2012, approximately 1.0 billion units higher than the 2.4 billion for physical video for this year, according to the IHS Screen Digest Broadband Media Market Insight report from information and analytics provider IHS (NYSE: IHS). As recently as last year, physical video had claimed a commanding share of the market with 2.6 billion views or transactions, compared to 1.4 billion for online, as shown in the figure attached.

This year’s online video consumption via the open Internet represents annual growth of 135 percent from 2011. Online video transactions and videos are also set to continue increasing in the years to come, while physical video sales are expected to decline or stagnate in comparison.

“The year 2012 will be the final nail to the coffin on the old idea that consumers won’t accept premium content distribution over the Internet,” said Dan Cryan, senior principal analyst, broadband & digital media at IHS. “In fact, the growth in online consumption is part of a broader trend that has seen the total number of movies consumed from services that are traditionally considered ‘home entertainment’ grow by 40 percent between 2007 and 2011, even as the number of movies viewed on physical formats has declined.”

The physical segment consists of retail sales and rentals of VHS, DVD and Blu-ray discs (BD). The online portion is comprised of electronic sell-through (EST), Internet video on demand (iVOD) and subscription video on demand (SVOD).

Key to the surge in consumption of online video has been the rise of all-you-can-eat subscription services such as Netflix and Amazon Prime, which offer customers unlimited on-demand movies for a flat monthly or annual fee. The result is that subscriptions in 2011 accounted for 94 percent of all paid online movie consumption in the United States, compared to just 1.3 percent of units consumed that were bought on an ownership basis via electronic sell-through.

Although it is declining, physical video this year will still command more viewing time from Americans, who will spend an estimated 4.3 billion hours on DVDs and Blu-ray discs, compared to 3.2 billion hours for movies online.

And although online will account for the majority of transactions this year, it is set to attract a far lower share of revenue in 2012, at $1.7 billion, measured against $11.1 billion derived from physical formats. This is because consumers will pay an average of 51 cents for every movie consumed online, compared to $4.72 for physical video. The pattern will likely remain unchanged even by 2016, with online accounting for 17 percent of revenue, compared to 75 percent for physical video, and pay-TV video on demand taking the remaining 8 percent.

Netflix, while unquestionably the market leader, is not the only online SVOD game in town. Last year saw both Amazon and Hulu develop online streaming businesses at levels unheard of just a couple of years ago. For Amazon in particular, 2011 marked the transformation of Amazon Prime from a discounted shipping offer into a diverse entertainment proposition in its own right, allowing subscribers who paid the $79 per-year service access to a range of movies and TV shows.

The phenomenal growth of subscription movie consumption raises the prospect that as SVOD services become more widely adopted, they become an appreciable drain on the time that consumers would have used to watch movies in more lucrative ways, IHS believes. When this is combined with the possibility that consumers will always find something to watch, the still-nascent EST business could have its wings clipped before it can really take flight, even as consumption reaches previously unattainable highs.

“After more than 30 years of buying and renting movies on tapes and discs, this year marks the tipping point as U.S. consumers now are making a historic switch to Internet-based consumption, setting the stage for a worldwide migration of consumption from physical to online,” Cryan said. “We are looking at the beginning of the end of the age of movies on physical media like DVD and Blu-ray. But the transition is likely to take time: almost nine years after the launch of the iTunes Store, CDs are still a vital part of the music business.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.