Cinram International Income Fund announced its first quarter 2012 financial results.

Cinram International Income Fund announced its first quarter 2012 financial results.

Cinram trades on the TSX under the symbol CRW.UN

For more information visit: www.cinram.com

Unedited press release follows:

Cinram Reports 2012 First Quarter Results

(All figures in U.S. dollars unless otherwise indicated)

TORONTO, May 11, 2012 – Cinram International Income Fund (“Cinram” or the “Fund”) (TSX: CRW.UN) today reported its 2012 first quarter financial results.

Q1-2012 Operating Results

• Consolidated revenue of $167.6 million in the 2012 first quarter compared to $176.7 million in the first quarter of 2011.

– Revenue from the Pre-recorded Multimedia Products segment fell to $143.1 million from $151.0 million in the first quarter of 2011, primarily as a result of a reduction in units shipped for standard DVD and CD units during the first quarter of 2012 compared with the first quarter of 2011, partially offset by an increase in Blu-ray disc shipments.

– Revenue from the Video Games segment in the first quarter of 2012 was $9.6 million, down from $11.2 million in 2011, primarily as a result of reduced orders from key customers resulting from increased competition and reduced consumer demand.

– Revenue from our Other business segment, including Wireless, Retail Services and 1K grew to $14.9 million from $14.5 million in 2011.

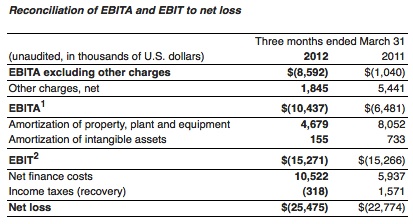

• Earnings before interest, taxes and amortization (EBITA1), excluding other charges was $(8.6) million in 2012, compared to $(1.0) million in the first quarter of 2011.

– EBITA from the Pre-recorded Multimedia Products segment decreased from $(5.7) million in 2011 to $(12.6) million in the first quarter of 2012. While gross margins were fairly consistent with prior year levels, the recent strategic review of operations and related refinancing has led to an increase in professional and consulting fees, thereby reducing EBITA.

– EBITA generated by the Video Games business segment in the first quarter of 2012 was $0.1 million, or 1% of revenue, compared with $1.5 million, or 13% of revenue, in the comparable period in 2011.

– EBITA from the Other business units grew from $3.2 million in the first quarter of 2011, or 22% of revenue, to $3.9 million in 2012, or 27% of revenue.

The Fund reported a net loss for the first quarter of 2012 of $(25.5) million or $(0.06) per unit (basic), compared with a net loss of $(22.8) million or $(0.42) per unit (basic) in 2011.

On May 1, 2012, the Fund disclosed that it received written notice from a non-core customer who has decided not to extend the fulfillment services currently provided by Cinram beyond the current term, which expires June 15, 2013. Cinram has provided distribution and related services to this customer since 2008. Revenues from this business for the year ended December 31, 2011 were reported in the Fund’s Other business segment and represented approximately 6% of the total consolidated revenues of the Fund.

Also on May 1, 2012 the Fund disclosed that its first and second lien senior lenders agreed to extend their waiver of certain financial covenants, consistent with previously granted and disclosed waivers. These waivers were extended to May 30, 2012 but can be terminated under certain circumstances by the lenders on or after May 15, 2012.

Commented Steve Brown, CEO, “First quarter results in our core business areas are in line with general industry trends, while our Digital Media Group continues to perform strongly in both revenue and margin. Our focus continues to be on our strategic alternatives process, which we anticipate will be finalized within the next few months”.

Pre-recorded Multimedia Products segment:

• First quarter pre-recorded multimedia revenue (which includes replication and distribution of Blu-ray discs, DVDs and CDs) was down 5% to $143.1 million from $151.0 million in 2011, as the increase in Blu-ray related revenue was more than offset by lower standard DVD and CD related revenue.

• Cinram replicated 106 million standard DVDs in the first quarter of 2012, compared to 120 million units in 2011.

• DVD revenue (which includes replication and distribution services) was $108.0 million in the first quarter of 2012, compared to $117.0 million in the prior year.

• Blu-ray disc replication revenue was $10.7 million in the first quarter of 2012, compared to $7.2 million in the comparable 2011 period.

• CD revenue (including replication and distribution of CDs) was down 9% to $24.4 million from $26.8 million due to lower unit shipments, consistent with industry declines for this format.

Geographic revenue:

First quarter North American revenue decreased 11% to $92.4 million from $103.8 million in 2011, principally as a result of lower standard DVD unit shipments combined with lower video game distribution revenue, offset by growth in Blu-ray revenues. North America accounted for 55% of first quarter consolidated revenue, compared with 59% in the prior year period.

European revenue was up 3% in the first quarter to $75.2 million from $72.9 million in 2011, primarily resulting from higher revenues from our German location due to an increase in the distribution of standard DVDs and related services. First quarter European revenue represented 45% of consolidated revenue, compared with 41% in the first quarter of 2011.

Balance sheet and liquidity:

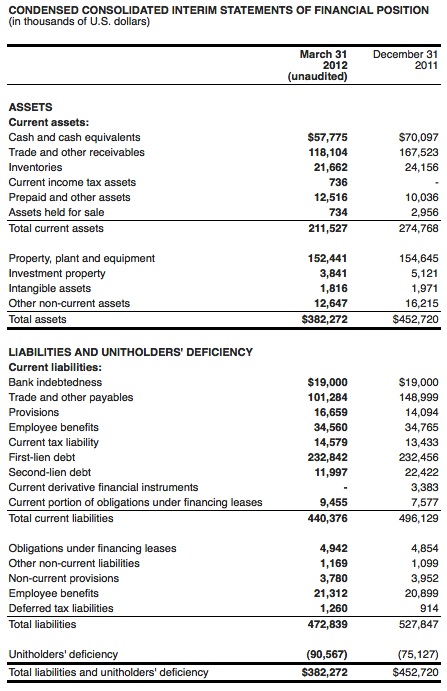

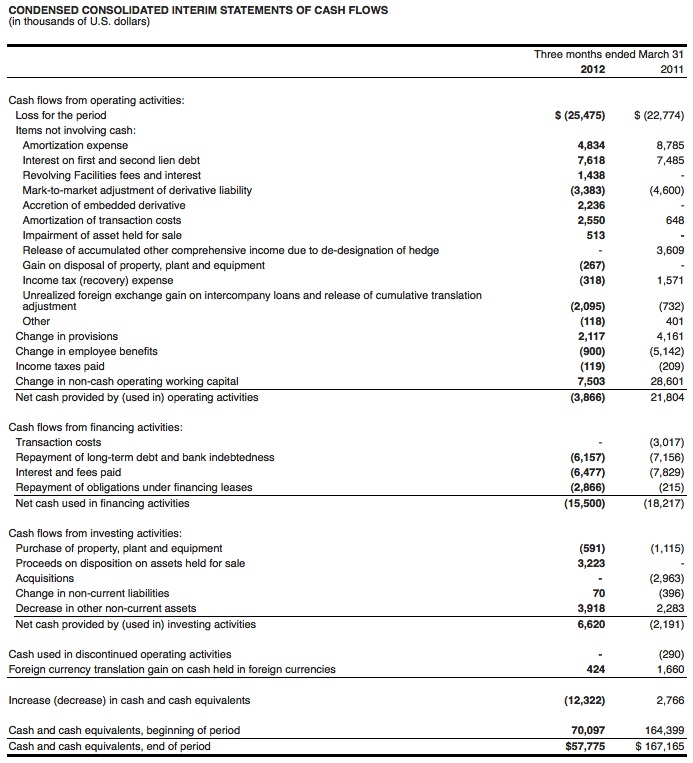

As of March 31, 2012, our net debt position (first and second lien debt including bank indebtedness less cash and cash equivalents) was $206.1 million, compared to $203.8 million at December 31, 2011.

Unit data

For the three-month period ended March 31, 2012, the basic weighted average number of units and exchangeable limited partnership units outstanding was 425.4 million, compared with 54.0 million in the prior year. The increase is related to the issuance of 373.2 million units of the Fund on January 3, 2012, as a result of the second lien debt being exchanged for equity.

1 EBITA is defined in this report as earnings (loss) from continuing operations before impairment charges, net finance costs (including interest expense, foreign exchange translation gains/losses, investment income, amortization of unamortized transaction costs, investment banker fees and changes in fair value of derivatives and warrants), income taxes, and amortization and is a standard measure that is commonly reported and widely used in the Fund’s industry to assist in understanding and comparing operating results. EBITA is not a defined term under IFRS. Accordingly, this measure should not be considered as a substitute or alternative for net earnings or cash flow from operations, in each case as determined in accordance with IFRS. A reconciliation of EBITA to net loss from continuing operations under IFRS is found in the table above.

2 EBIT is defined in this report as earnings (loss) from continuing operations before net finance costs (including interest expense, foreign exchange translation gains/losses, investment income, amortization of unamortized transaction costs, investment banker fees, and change in fair value of derivatives and warrants) and income taxes, and is a standard measure that is commonly reported and widely used in the Fund’s industry to assist in understanding and comparing operating results. EBIT is not a defined term under IFRS. Accordingly, this measure should not be considered as a substitute or alternative for net earnings or cash flows from operations, in each case as determined in accordance with IFRS. A reconciliation of EBIT to net loss from continuing operations under IFRS is found in the table above.

About Cinram

Cinram International Inc., an indirect, wholly-owned subsidiary of the Fund, is one of the world’s largest providers of pre-recorded multimedia products and related logistics services. With facilities in North America and Europe, Cinram International Inc. manufactures and distributes pre-recorded DVDs, Blu-ray discs, CDs, and CD-ROMs for motion picture studios, music labels, publishers and computer software companies around the world. Cinram also provides distribution and logistics services to the telecommunications industry in North America through its wireless subsidiary. The Fund’s units are listed on the Toronto Stock Exchange under the symbol CRW.UN. The Cinram group of companies also incorporates 1K Studios, a digital media firm based in Los Angeles specializing in building enhanced consumer experiences for movies, TV shows, music, books and games. For more information, visit www.cinram.com.