IHS announced it reckons that Samsung shipped more LCD TVs in the first quarter of 2012 than its competitors, continuing to outmuscle the likes of LG, Sony, Toshiba and Sharp.

IHS announced it reckons that Samsung shipped more LCD TVs in the first quarter of 2012 than its competitors, continuing to outmuscle the likes of LG, Sony, Toshiba and Sharp.

For more information visit: www.isuppli.com

Unedited press release follows:

Samsung Maintains Global LCD TV Leadership Amid Dismal Market Conditions in Q1

El Segundo, Calif. (July 20, 2012) — Samsung Electronics Co. Ltd. in the first quarter retained its dominant position in the global liquid crystal display television (LCD TV) business, holding its own despite weak market conditions, according to an IHS iSuppli Worldwide Television Q2 2012 Market Tracker from information and analysis analytics provider IHS (NYSE: IHS).

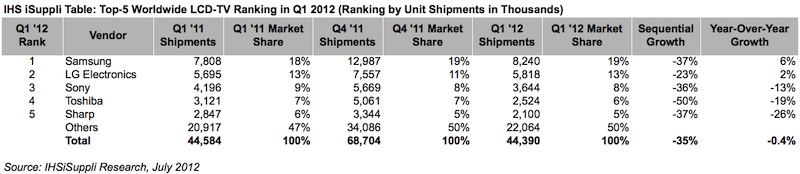

The South Korean electronics giant in the first quarter shipped 8.2 million LCD TVs globally, as presented in the figure attached. While this was down 37 percent from 12.9 million in the fourth quarter of 2011, Samsung’s decline was in line with the performance of the overall market, which dropped 35 percent during the same period. This allowed Samsung to continue to hold a 19 percent share of global LCD shipments.

“Through good times and bad for the LCD TV market, Samsung is able to hold onto its lead in shipments because of the company’s global reach, competitive pricing and the internal control of its supply chain,” said Tom Morrod, senior analyst and head of TV technology at IHS. “Samsung has shown the capability to adjust to even the weakest of market conditions as it benefits from consumer spending on virtually any format of TV while maintaining profitable operations, which has been a major challenge for many other manufacturers.”

Samsung also was able to maintain a positive operating margin of 5.0 percent in its overall television business during the period. The company was one of only two companies within the Top 5 to achieve this feat, illustrating the weakness in 2012 of the overall LCD TV business.

The LCD TV market’s travails

Global LCD TV shipments typically decline in the first quarter following the peak holiday sales season in the fourth quarter. However, the 35 percent sequential contraction in the first quarter was unusually sharp, above the 20 to 25 percent decrease more typically seen in previous years.

The precipitous drop this year was due to a number of factors, including weak global consumer demand, oversupply going into the end of 2011 and repositioning by a few major brands of loss-making TV divisions.

The decline was nearly as sharp for worldwide LCD TV revenue, which fell by 32 percent from the fourth quarter to the first. Heavy discounting in the face of tentative consumer spending led to the major drop between the 2011 holiday season and the first quarter of 2012.

In another troubling sign for the LCD TV market in 2012, shipments in the first quarter were flat compared to same period one year earlier, inching down a marginal 0.4 percent.

Despite these setbacks, LCD display technology continues to advance its conquest of the television market. LCD TVs in the first quarter accounted for 87 percent of global television revenue, a record high up from 86 percent in the fourth quarter of 2011.

Life’s good for LG

While it remained relegated to second place—trailing Samsung by 6 percentage points—LG Electronics posted the best performance among the world’s top 5 LCD TV makers. The South Korean firm limited its sequential shipment decline in the first quarter to just 25 percent, allowing LG to claim 15 percent of global shipments, up from 13 percent in the third quarter.

Along with Samsung, LG made profits on its TV division of 4.4 percent. Both brands have been able and willing to expand production in areas of operation where they make money while other brands try to rein in money-losing divisions, helping LG in this case to take share away from the competition in many markets.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.