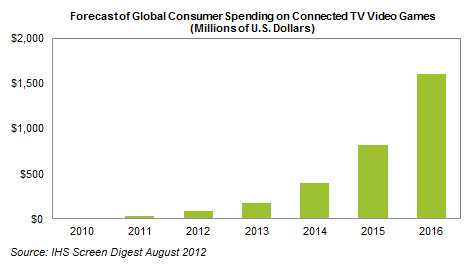

IHS announced it forecasts that global consumer spending on connected TV video gaming will grow to $1.6 billion in 2016, up from $88.0 million in 2012.

IHS announced it forecasts that global consumer spending on connected TV video gaming will grow to $1.6 billion in 2016, up from $88.0 million in 2012.

For more information visit: www.ihs.com

Unedited press release follows:

Stars Begin to Align for Games on Connected TVs—Spending to Reach $1.6 Billion in 2016

El Segundo, Calif. (Aug. 9, 2012) — Worldwide consumer spending on video games on connected TVs is forecast to grow rapidly to $1.6 billion in 2016, up from $88.0 million in 2012, driven by a combination of the exploding adoption of Internet-enabled TV devices, the rising availability of free-to-access games and the dismantling of market hurdles involving hardware capability, user interface and middleware fragmentation.

IHS predicts that in 2016 more than 800 million actively connected TV devices will have exposure to monetized games content, up from 100 million in 2012, according to an IHS Screen Digest Games Intelligence Service Insight Report from information and analytics provider IHS (NYSE: IHS). These connected devices include Internet-Enabled Televisions (IETVs), Blu-ray players and over-the-top (OTT)-capable set-top boxes (STBs). Growth also will be fueled by the steady dismantling of established market development barriers and the adoption of freemium content monetized through microtransactions.

“The stars of the connected TV games market are beginning to align,” said Piers Harding-Rolls, senior principal analyst and head of games research at IHS. “The sheer volume of addressable connected devices means this sector will be hard to ignore for content owners. There remain hurdles to overcome, of course, not least of which is user monetization. However, IHS expects an acceleration in spending during the next five years as these hurdles are dismantled by leading industry players. Connected TV devices are now poised to join a competitive mix of games distribution channels in the home alongside dedicated consoles, tablets and smartphones.”

The figure attached presents the IHS Screen Digest forecast of global consumer spending on video games on connected TV devices.

Hurdles to market development fall

The market for video games on TV traditionally has been dominated by dedicated consoles. Other distribution channels serving interactive TV games have failed to find any significant competitive traction. However, this state of affairs is changing.

On the hardware front, the latest connected TV devices are now much more capable games machines compared to legacy pay-TV STBs. Like smartphones and tablets, which are making significant advances in chipset power, graphics capability and storage, connected TV devices are following suit with similar components.

Furthermore, remote control technology has advanced significantly in recent months and years, with consumer electronics manufacturers deploying more flexible solutions to cater to the cross-section of content that is available through their connected devices. These solutions include built in gesture control and remote apps on smartphones and tablets to enable touch-screen inputs.

Putting the pieces together

One major hindrance to the scalability of the legacy interactive TV games market was pay-TV STB middleware fragmentation. However, the industry is starting to offer solutions to this fragmentation issue. These include smart TV platform collaboration among consumer electronics manufacturers LG, Sharp and Philips, connected device support for platform-agnostic deployment and run-time environments such as Adobe’s AIR and third-party publishing networks that help content owners get their games to market through companies such as PlayJam.

Lastly there is the important issue of user monetization and the rollout of effective billing and payment relationships and mechanisms. Progress is being made in this area, but more needs to be done to deliver comprehensive solutions for what is a global opportunity.

Companies on the hunt

The value chain for games content direct to the connected TV is already very active.

Of the major CE companies, it is the Korean companies, Samsung and LG, that have most aggressively pursued the idea of over-the-top content and services like video games to their IETVs. This includes a substantial amount of games content direct from developers, publishers, internal development teams and third-party content aggregators.

Aside from original equipment manufacturers (OEMs), Internet Protocol Television (IPTV) operators such as China Telecom and Shanghai Telecom have also been receptive to games content in a bid to differentiate their services.

There are also a handful of third-party games stores, networks and publishers active across connected TV devices. These include Canada-based Transgaming, and UK companies Accedo Broadband and PlayJam. Of these, PlayJam has the most extensive set of OEM distribution relationships. The company offers an end-to-end service specifically for games developers, which includes deployment tools, a marketing and distribution network, and access to its range of APIs that cover billing, community features and analytics.

“There are already a large number of companies bringing games content to connected TV devices,” Harding-Rolls stated. “Based on the quick evolution of previous digital games markets and the time it takes to develop the necessary relationships to get content published across devices, gaining first-mover advantage is likely to be key to the connected TV games sector. Additionally, those third-party companies that offer solutions to major market hurdles such as market fragmentation and consumer billing are well-positioned to benefit in the short to medium term.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.