Cinram International Income Fund announced its second quarter 2012 financial results.

Cinram International Income Fund announced its second quarter 2012 financial results.

For more information visit: www.cinram.com

Unedited press release follows:

Cinram Reports 2012 Second Quarter and year to date results

(All figures in U.S. dollars unless otherwise indicated)

TORONTO, Aug. 10, 2012 – Cinram International Income Fund (“Cinram” or the “Fund”) today reported its 2012 second quarter and year to date financial results.

Q2-2012 Operating Results

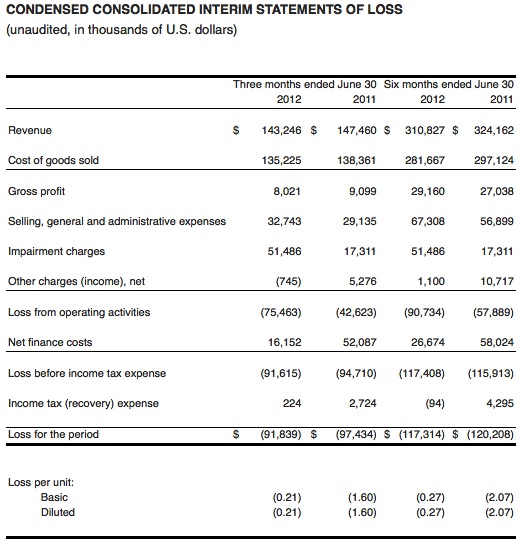

• Consolidated revenue of $143.2 million in the 2012 second quarter compared to $147.5 million in the second quarter of 2011.

– Revenue from the Pre-recorded Multimedia Products segment fell to $123.5 million from $125.8 million in the second quarter of 2011, primarily as a result of a reduction in units shipped for standard DVD and CD units during the second quarter of 2012 compared with the second quarter of 2011, partially offset by an increase in Blu-ray disc shipments.

– Revenue from the Video Game segment in the second quarter of 2012 was $5.6 million, down from $6.4 million in 2011, primarily as a result of reduced orders from key customers resulting from increased competition and reduced consumer demand.

– Revenue from our Other business segment, including Wireless, Retail Services and 1K fell to $14.2 million from $15.2 million in 2011.

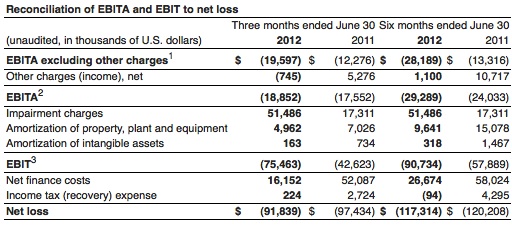

• Earnings (loss) before interest, taxes and amortization (EBITA1), excluding other charges, was $(19.6) million in 2012, compared to $(12.3) million in the second quarter of 2011.

– EBITA excluding other charges from the Pre-recorded Multimedia Products segment decreased from $(15.8) million in 2011 to $(21.8) million in the second quarter of 2012 as a result of increased professional and consulting fees associated with the ongoing strategic review of operations and related creditor protection proceedings

– EBITA excluding other charges generated by the Video Game business segment in the second quarter of 2012 was $(0.4) million, compared with $(0.5) million in the comparable period in 2011.

– EBITA excluding other charges from the Other business units decreased from $4.0 million in the second quarter of 2011, or 26% of revenue, to $2.6 million in 2012, or 18% of revenue.

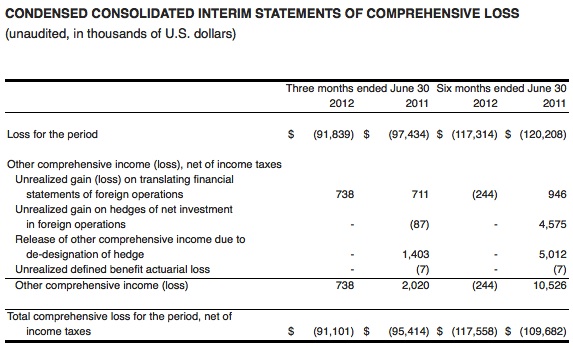

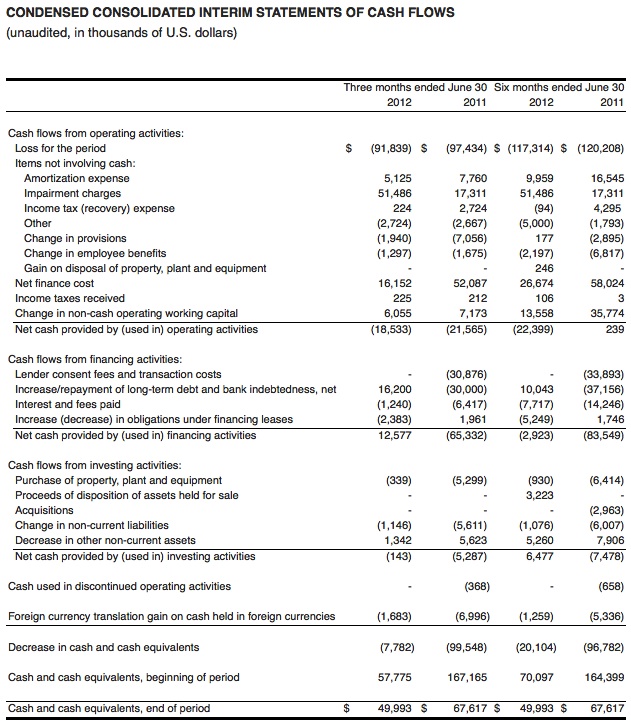

The Fund reported a net loss for the second quarter of 2012 of $(91.8) million or $(0.21) per unit (basic), compared with a net loss of $(97.4) million or $(1.60) per unit (basic) in 2011.

For the first six months of 2012, revenue was $310.8 million, a 4% decrease from $324.2 million in the prior year comparable period, primarily as a result of lower standard DVD and CD revenue, partially offset by an increase in Blu-ray related revenue. EBITA excluding other charges declined to $(28.2) million, compared with $(13.3) million in the comparable prior year period, as a result of higher professional and consulting fees as indicated above.

On June 25, 2012, the Fund and certain North American entities (the “CCAA Entities”) initiated Companies’ Creditors Arrangement Act (“CCAA”) proceedings, and subsequently the U.S. based CCAA Entities filed voluntary petitions under chapter 15 of Title 11 of the United States Code (the “Chapter 15 Proceedings”) in order to enable them to pursue reorganization efforts under the protection of CCAA and the United States Code. The Fund and the other CCAA Entities remain in possession of their assets and are continuing to operate the business as “debtors in possession” under the jurisdiction of the Canadian Court and in accordance with the applicable provisions of the CCAA. In general, the Fund and the other CCAA Entities are authorized to continue to operate as an ongoing business, but may not engage in transactions outside the ordinary course of business without the approval of the Canadian Court or the monitor appointed by the Canadian Court, as applicable.

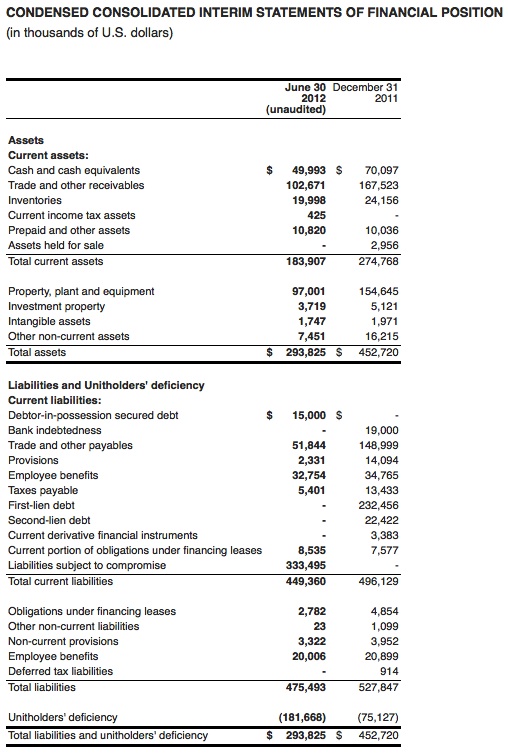

The commencement of the CCAA Proceedings and Chapter 15 Proceedings constitutes an event of default under substantially all pre-petition debt obligations, and those debt obligations became automatically and immediately due and payable by their terms, although any action to enforce such payment obligation is stayed as a result of the commencement of the CCAA Proceedings and the Chapter 15 Proceedings. Due to the commencement of the CCAA Proceedings and the Chapter 15 Proceedings, pre-petition liabilities of $333.5 million are included in “Liabilities subject to compromise” in the condensed consolidated statement of financial position as of June 30, 2012.

On July 12, 2012, the Canadian Court approved the sale of substantially all of Cinram’s assets and businesses in North America and Europe (the “Sale Transaction”) to newly formed subsidiaries of Najafi Companies (“Najafi”). The Sale Transaction was also approved by the U.S. Court on July 25, 2012.

Under the Sale Transaction, Najafi will purchase for cash consideration of $82.5 million, subject to certain adjustments and before expenses, substantially all of the assets used in Cinram’s core businesses for the manufacture of pre-recorded multimedia products and the provision of related logistics services, digital media solutions and outsourced vendor management inventory services in North America, and substantially all of the European business. Certain assets and businesses of the Fund were excluded from the Sale Transaction, including investment properties, certain land and building, the Fund’s wireless division, as well as certain other non-operating subsidiaries of the Fund.

The Sale Transaction is expected to close during 2012, subject to satisfaction of closing conditions, some of which are beyond the sole control of the Fund. Accordingly, there is no certainty that the Sale Transaction will be completed as outlined above.

1 EBITA excluding other charges is defined in this release as earnings (loss) before impairment charges,

net finance costs (including interest expense, foreign exchange translation gains/losses, investment income,

amortization of unamortized transaction costs, investment banker fees and changes in fair value of

derivatives and warrants), income taxes, amortization and other charges and is a standard measure that

is commonly reported and widely used in the Fund’s industry to assist in understanding and comparing

operating results. EBITA excluding other charges is not a defined term under IFRS. Accordingly, this

measure should not be considered as a substitute or alternative for net earnings or cash flow from

operations, in each case as determined in accordance with IFRS. A reconciliation of EBITA excluding

other charges to net loss from continuing operations under IFRS is found in the table above.

2 EBITA is defined in this release as earnings (loss) from continuing operations before impairment charges,

net finance costs (including interest expense, foreign exchange translation gains/losses, investment income,

amortization of unamortized transaction costs, investment banker fees and changes in fair value of

derivatives and warrants), income taxes, and amortization and is a standard measure that is commonly

reported and widely used in the Fund’s industry to assist in understanding and comparing operating

results. EBITA is not a defined term under IFRS. Accordingly, this measure should not be considered as

a substitute or alternative for net earnings or cash flow from operations, in each case as determined in

accordance with IFRS. A reconciliation of EBITA to net loss from continuing operations under IFRS is

found in the table above.

3 EBIT is defined in this release as earnings (loss) from continuing operations before net finance costs

(including interest expense, foreign exchange translation gains/losses, investment income, amortization

of unamortized transaction costs, investment banker fees, and change in fair value of derivatives and

warrants) and income taxes, and is a standard measure that is commonly reported and widely used in the

Fund’s industry to assist in understanding and comparing operating results. EBIT is not a defined term

under IFRS. Accordingly, this measure should not be considered as a substitute or alternative for net

earnings or cash flows from operations, in each case as determined in accordance with IFRS. A

reconciliation of EBIT to net loss from continuing operations under IFRS is found in the table above.

About Cinram

Cinram International Inc., an indirect, wholly-owned subsidiary of the Fund, is one of the world’s largest providers of pre-recorded multimedia products and related logistics services. With facilities in North America and Europe, Cinram International Inc. manufactures and distributes pre-recorded DVDs, Blu-ray discs, CDs, and CD-ROMs for motion picture studios, music labels, publishers and computer software companies around the world. Cinram also provides distribution and logistics services to the telecommunications industry in North America through its wireless subsidiary. The Fund’s units are listed on the Toronto Stock Exchange under the symbol CRW.UN. The Cinram group of companies also incorporates 1K Studios, a digital media firm based in Los Angeles specializing in building enhanced consumer experiences for movies, TV shows, music, books and games. For more information, visit www.cinram.com.