IHS announced it reckons that, following a 30% drop during the first three months of 2012, worldwide shipments of flat-panel televisions returned to growth in the second quarter.

IHS announced it reckons that, following a 30% drop during the first three months of 2012, worldwide shipments of flat-panel televisions returned to growth in the second quarter.

For more information visit: www.ihs.com

Unedited press release follows:

Global Flat-Panel TV Shipments Return to Growth in Q2; Samsung Stays on Top of LCD Market

El Segundo, Calif. (Aug. 13, 2012) — Following a sharp 30 percent drop during the first three months of 2012, worldwide shipments of flat-panel televisions returned to growth in the second quarter, according to a preliminary estimate from the new Worldwide Monthly TV Tracker issued by Displaybank which was recently acquired by IHS (NYSE: IHS).

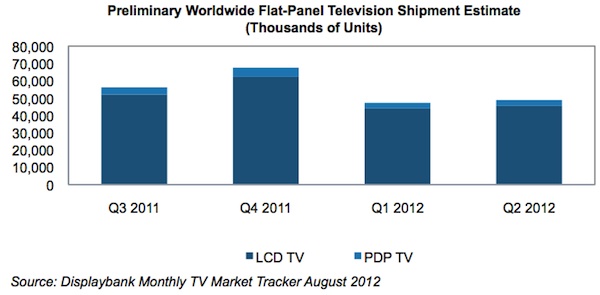

Worldwide shipments of flat-panel televisions, a category consisting of liquid crystal display (LCD) and plasma sets, rose to 48.9 million units in the second quarter, up 3.6 percent from 47.2 million from the first quarter. The figure attached presents the preliminary IHS estimate of quarterly flat-panel television shipments, based on data from the Worldwide Monthly TV Tracker. Final second-quarter results will be issued later this month.

“After an unusually weak start to 2012, global television shipments showed some signs of life in the second quarter,” said Tom Morrod, senior analyst and head of TV technology at IHS. “While television shipments typically decline in the first quarter following the peak Christmas selling season, the drop this year was unusually sharp because of tentative consumer spending. The return to growth in the second quarter follows normal seasonal patterns for television shipment growth, and likely signals further growth ahead in the third quarter.”

The second quarter started off on a strong note, with shipments in April rising by 4 percent from March to reach the highest levels of the year up to that point, according to data from the Displaybank Worldwide Monthly TV Tracker. While shipments declined slightly in May and June, the increase in April was sufficient to drive growth for the entire second quarter.

Worldwide LCD TV shipments increased 3.4 percent in the second quarter, following a 29.3 percent drop in the first quarter. While worldwide plasma shipments are generally declining, they enjoyed a 6.6 percent bump in the second quarter, compared to a 39.5 percent plunge in the first quarter.

Samsung remains on top in LCD TVs; TCL posts strongest growth among Top 5

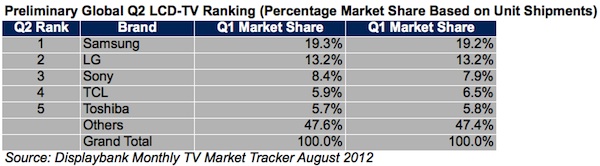

In the LCD segment, which accounts for the overwhelming majority of flat-panel display shipments, Samsung Electronics Co. Ltd. remained the leading brand in the second quarter, according to the preliminary estimate. Samsung was responsible for 19.2 percent of unit shipments, down just slightly from 19.3 percent in the first quarter. LG Electronics held its second-place ranking with a 13.2 percent share of shipments, unchanged from the first quarter.

The table attached presents a preliminary ranking of the world’s Top 5 LCD-TV brands based on data from the Worldwide Monthly TV Tracker. IHS will issue a final market-share ranking in full detail later this month.

“Samsung continues to be dominant because of its shrewd marketing, global distribution and efficient production,” Morrod observed. “Both Samsung and fellow South Korean brand LG are able to undercut their Japanese rivals on pricing, allowing them to retain their leadership. And with the Japanese market contracting dramatically, the companies based in the country have struggled to find new volume sales opportunities elsewhere.”

The strongest performance among the Top 5 was posted by No. 4-ranked TCL Corp. of China, which increased its share of shipments to 6.5 percent, up from 5.9 percent in the first quarter.

“TCL is prospering both because of overseas sales—which were up by about 150,000 units in the second quarter—and due to domestic Chinese sales,” Morrod said. “The company is taking advantage of capitalizing on rising sales in China in addition to upping its stature abroad.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.