IHS announced it reckons that shipments of large-sized LCD panels rose in September due to retailers stocking up for Black Friday sales.

IHS announced it reckons that shipments of large-sized LCD panels rose in September due to retailers stocking up for Black Friday sales.

For more information visit: www.isuppli.com

Unedited press release follows:

Black Friday Arrives in September for Large-Sized LCD Panel Suppliers

El Segundo, Calif. (Nov. 28, 2012) — Two months before stores had their best sales event of the year on Black Friday, global display suppliers got their chance to cash in on the bonanza, as shipments of large-sized LCD panels rose in September due to retailers preparing for the big day.

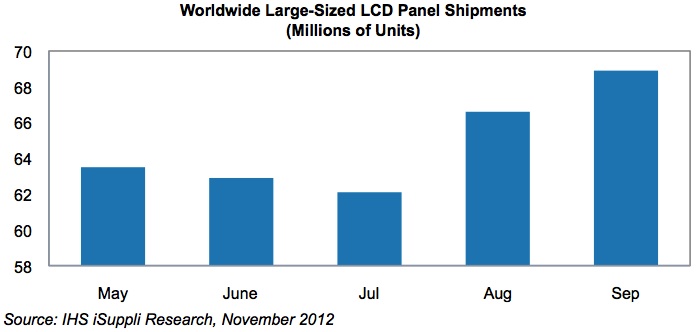

Worldwide shipments of panels larger than 9.x inches in the diagonal dimension climbed to 68.9 million units in September, up 3.4 percent from 66.6 million in August, according to an IHS iSuppli LCD Health Watch Report from information and analytics provider IHS (NYSE: IHS). The September growth came on top of a 7.4 percent expansion in August following two months of decline in June and July, as presented in the figure attached.

“U.S. retailers anticipated strong TV sales for Black Friday and Christmas propelled by aggressive pricing, which helped to fuel two straight months of shipment growth for liquid crystal display (LCD) TV panels during August and September,” said Sweta Dash, senior director for display research and strategy at IHS. “Strong growth in the LCD TV panel segment made up for the declining monitor and notebook sectors, which suffered from weak consumer demand impacted by the slow economy and competition from tablets.”

Televisions get smart

A major market driver for the television market is the interactive Smart TV featuring built-in Internet connectivity, which is proving popular in the United States. Illustrative of the strength of the TV panel segment, shipments of LCD panels to the sector rose 5.5 percent in September, compared to a contraction of 2.3 percent for notebook panels and a smaller 0.3 percent dip for monitor panels.

The strength of the TV panel segment was especially evident in September. TV vendors built up their inventory in anticipation of Black Friday sales after Thanksgiving, traditionally the biggest time of the year for television purchases among American consumers looking for deeply discounted sets.

In particular, panels sized 60-inches and larger had enjoyed a 92 percent surge in shipments during August after declining in July, with growth momentum continuing in September. Very aggressive pricing and strong competition is expected during the holidays for this size segment.

A bright Black Friday?

Overall, TV merchants and brands alike had hoped to see big sales during the holidays close out a difficult year, characterized by a sluggish U.S. economy and persistent high unemployment. While TV panel shipments grew because of rising demand, the opposite was true of the large-sized LCD panel market for notebooks and monitors, both of which struggled in September.

In the notebook panel segment, shipments are down because of continuing weak demand. Notebooks have been suffering from competition posed by tablets like the iPad, and the new thin notebooks known as Ultrabooks have underperformed in light of price points deemed too high. Moreover, the verdict is still out on whether the newly launched Windows 8 operating system will make enough of an impact to propel notebooks toward growth for the remainder of the year. Some brands pushed pricing for lower-end Ultrabooks down to the $500 or $600 range during Black Friday, in an effort to make notebooks more competitive with tablets.

In the monitor panel segment, shipments have also been lackluster. Monitor sales have declined because of cutbacks in government and educational spending in the United States and Europe, accompanied by softer demand in the consumer sector—again because of inroads made by tablets.

The two biggest suppliers of large-sized LCD panels in September were LG Display of South Korea, with a market share of 28.7 percent, flat from August; and Samsung Electronics, also of South Korea, with 20.0 percent, up 1.1 percent.

In third place was Chimei Innolux of Taiwan with 18.7 percent share; followed in fourth place by AU Optronics, also of Taiwan, with 15.9 percent; and in fifth place by BOE Display Technology of China, with 4.9 percent.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to long-term, sustainable growth and employs more than 6,000 people in more than 30 countries around the world.