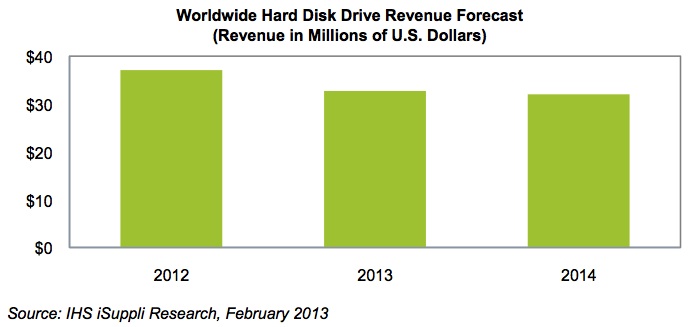

IHS announced it forecasts that global hard disk drive (HDD) market revenue will decline to $32.7 billion in 2013, down 11.8% from $37.1 billion last year.

IHS announced it forecasts that global hard disk drive (HDD) market revenue will decline to $32.7 billion in 2013, down 11.8% from $37.1 billion last year.

For more information visit: www.isuppli.com

Unedited press release follows:

Hard Disk Drive Market Revenue Set for Double-Digit Decline This Year

El Segundo, Calif. (Feb. 4, 2013) — Facing a relentless onslaught from tablets, smartphones and solid state drives (SSD), global hard disk drive (HDD) market revenue in 2013 will decline by about 12 percent this year, according to an IHS iSuppli Storage Space market brief from information and analytics provider IHS (NYSE: IHS).

Revenue is set to drop to an estimated $32.7 billion in 2013, down 11.8 percent from $37.1 billion last year. HDD revenue will be flat the following year, amounting to $32.0 billion in 2014, as shown in the figure attached.

“The HDD industry will face myriad challenges in 2013,” said Fang Zhang, analyst for storage systems at IHS. “Shipments for desktop PCs will slip this year, while notebook sales are under pressure as consumers continue to favor smartphones and tablets. The declining price of SSDs also will allow them to take away some share from conventional HDDs.”

HDD gross and operating margins likewise will decline as a result of continued price erosion. “However, HDDs will continue to be the dominant form of storage this year, especially as demand for Ultrabooks picks up and hard drives remain essential in business computing,” Zhang added.

HDD vs. SSD

HDDs overall will maintain market dominance because of their cost advantage over SSDs, particularly when higher densities are involved and dollars per gigabyte are calculated. HDD costs and pricing are significantly lower than SSDs, with already falling HDD average selling prices expected to decline further this year by 7 percent.

Moreover, HDDs will continue to be part of storage solutions even in Ultrabooks that make use of an SSD component. The solution, which cobbles hard disk drives together with a so-called cache SSD module, boasts of a superior price-value proposition compared to SSD-only counterparts.

A major growth area for HDDs will be the use of hard disk drives in the business sector spanning the enterprise space, cloud storage, big data and big-data analytics. Bearing the lowest cost of any storage medium now on the market, HDDs will remain the final destination for the majority of digital content that need to be filed away. And toward the last quarter of this year, Western Digital is expected to launch a 5-terabyte Helium HDD, catering mostly to data centers for enterprise servers and storage applications, further propelling the HDD space into overdrive.

Western Digital vs. Seagate

Western Digital is expected to continue battling archrival Seagate Technology for market leadership in both revenue and shipments, especially in the enterprise business segment. While Seagate had a 50 percent share of the enterprise market last year, the introduction by Western Digital of its new helium technology could catapult the manufacturer to the top at the end of 2013, dethroning Seagate in the process.

Optical drives vs. extinction

In the parallel market for PC optical disk drives—home to discs like CDs and DVDs—losses in both revenue and shipments are similarly expected. The declines stem from a number of reasons, including smaller chassis sizes for PCs, a shift in preference among consumers toward video streaming instead of using physical discs, and cost cutting from PC manufacturers that have lost interest in using optical drives.

In what appears to be a grim scenario, the optical disk drive industry is expected to encounter continued challenges this year, such as those presented by thinner PC designs. Optical drives could eventually be abandoned by PC makers altogether.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs more than 6,000 people in 31 countries around the world.