IHS announced it reckons that Ultra High-Definition (Ultra HD) TVs may be better received in the marketplace than has been the case with 3D technology.

IHS announced it reckons that Ultra High-Definition (Ultra HD) TVs may be better received in the marketplace than has been the case with 3D technology.

For more information visit: www.isuppli.com

Unedited press release follows:

Can UHD Televisions Avoid the Fate of 3D Sets?

Vancouver, British Columbia (May 21, 2013) — Television industry participants gathering at the Society for Information Display (SID) 2013 Display Week event here this week are showcasing the product they hope will rejuvenate the market: the Ultra-High Definition (UHD) set.

But can UHD avoid the dismal fate of another product touted as the industry’s savior just a few years ago, the 3-D TV?

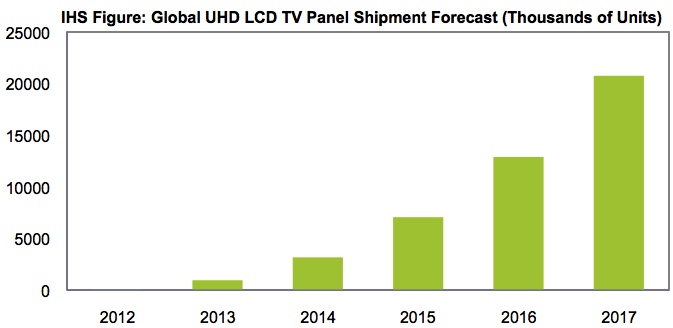

TV panel makers are betting on a high rate of growth for UHD LCD TVs during the next four years. These companies expect to ship nearly 943,000 UHD LCD panels this year, up from less than 33,000 units in 2012, according to the Display Materials & Systems Service at information and analytics provider IHS (NYSE: IHS). The next two years will see shipments ramp up even more quickly to 7.1 million units in 2015, on their way to reaching 20.8 million units by 2017, as shown in the attached figure.

The total rises much higher when including a type of lower-priced, lower-specification product called “UHD Ready,” panels, which mainly are targeted at the Chinese market. Suppliers collectively plan to ship as many as 4 million UHD Ready panels this year alone.

But with such lofty targets, is the TV market setting itself up for failure once again?

“A few years ago, 3-D TV came onto the market with tremendous hype and promise to transform how people watch television,” said Sweta Dash, senior director of display research and strategy at IHS. “This promise never came to fruition. Instead, faced with a lack of content, high pricing and inconvenient technology, 3-D never emerged from a niche status—a situation that continues today.”

Many now predict the same fate for UHD television.

“However, having learned from past mistakes, TV suppliers are gearing up to make UHD TV a success, determined not to repeat the mistakes they made with 3-D. However, the level of consumer demand for UHD is still not clear. Lower yields, higher costs, slower TV sales, lack of content and delays in production all will lead to lower shipments than many in the industry expect.”

3-D’s doom

When 3-D debuted, brands touted the technology as a fundamental shift on the scale of moving to color from black-and-white. It also provided hope for brands to differentiate their products, to gain a competitive advantage and to increase profitability.

However, the reality of 3-D TV did not meet these high expectations. The poor adoption rate of 3-D was a wakeup call for major TV brands, forcing them to shift strategy away from focusing on selling 3-D TV sets to selling 3-D TV capability as an added feature.

Brands also learned they could not charge a price premium for 3-D. This changed the adoption rate, and by the end of 2012, only about 20 percent of all LCD TVs sold had 3-D capability, according to IHS.

Learning from the past

The market for 3-D TVs faced three major obstacles when it launched: content, price and technology. Even with 3-D popular in cinema thanks to movies such as “Avatar,” there was simply not enough 3-D content for televisions. 3-D TV also doubled the price premium of regular sets, and in perhaps the most significant obstacle of all, required consumers to change their viewing behavior by wearing a pair of glasses. For all these reasons, 3-D adoption stalled.

Many believe that UHD will suffer a similar fate because like 3-D, the format lacks television content, and introductory prices are very high.

Still, there are some major differences.

First, UHD TV does not require any change in consumer behavior, as there is no need to wear glasses. UHD TV also provides greater depth to picture quality, giving a more immersive experience. And with upscaling technology, consumers can see better picture quality even when watching FHD content.

Learning from past experience, many TV brands are actively working to provide UHD content, either through upscaling or through the creation of proprietary UHD content. Already, Japan has plans to begin UHD broadcasting as soon as 2014, two years earlier than originally planned. Also, 4K cameras and camcorders are now on the market, enabling creation of 4K content. Movies in 4K are likewise starting to show up.

Working aggressively to entice consumers

The increased focus on UHD LCD TVs comes in part from delays in commercialization for organic light-emitting diode (OLED) TVs, an advanced technology that has encountered various challenges in manufacturing. As UHD is now taking over for the meantime, panel suppliers and brands are working aggressively to reduce prices, with lower-cost UHD TV sets expected later this year, mostly in sizes from 50-inch to 100-inch.

Availability of low-end UHD LCD TV panels from suppliers, especially from Taiwan, may also help trigger UHD market growth, particularly in China. Some brands are already planning to introduce a 50-inch UHD TV in China at a $2,000 price point.

But even with lower prices, UHD TV quality has to be accepted by consumers For long-term sustainable growth to occur, the quality of UHD TV must be deemed acceptable by consumers to justify the switch.

Top panel suppliers such as Samsung, LG Display, AUO and Innolux are all introducing UHD TV panels, with TV brands like Sony, Sharp, Samsung, LG Electronics, Vizio and many Chinese names planning to launch their own offerings later this year. The variety of products available, as well as the different price points and sizes for the sets, will help increase adoption rates, IHS believes.

On the technological front, oxide thin-film transistor (TFT) is considered to be a superior technology compared to conventional amorphous TFT LCD for achieving higher-resolution products. But oxide TFT faces challenges in capacity and yield issues, whereas panel suppliers have been able to offer lower-cost UHD panels produced from conventional amorphous TFT LCD.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs 6,700 people in 31 countries around the world.