The Canadian Radio-television and Telecommunications Commission (CRTC) announced that it has published the 2013 edition of its Communications Monitoring Report, which provides an overview of the Canadian communication system.

The Canadian Radio-television and Telecommunications Commission (CRTC) announced that it has published the 2013 edition of its Communications Monitoring Report, which provides an overview of the Canadian communication system.

Fore more information visit: www.crtc.gc.ca

Unedited press release follows:

CRTC issues annual report on the state of the Canadian communication system

Ottawa-Gatineau, September 26, 2013 — Today, the Canadian Radio-television and Telecommunications Commission (CRTC) issued the 2013 edition of its Communications Monitoring Report, which provides an overview of the Canadian communication system.

“This year’s edition of the report contains a wealth of information and is intended to assist those that participate in our public proceedings,” said Jean-Pierre Blais, Chairman of the CRTC. “It is interesting to note that Canadians’ habits are evolving. More Canadians than ever are watching and listening to content on their computers, smartphones and tablets, yet the vast majority of programming is still accessed through traditional television and radio services.”

“While Canadians generally are well-served by their communication system, the Commission must remain vigilant and responsive to emerging trends and issues,” Mr. Blais added. “Canadians in rural parts of our country, and especially in the North, do not enjoy the same telecommunications services as those living in urban centres. We are working to provide those Canadians with an even greater choice.”

Canadians are accessing more content on different platforms

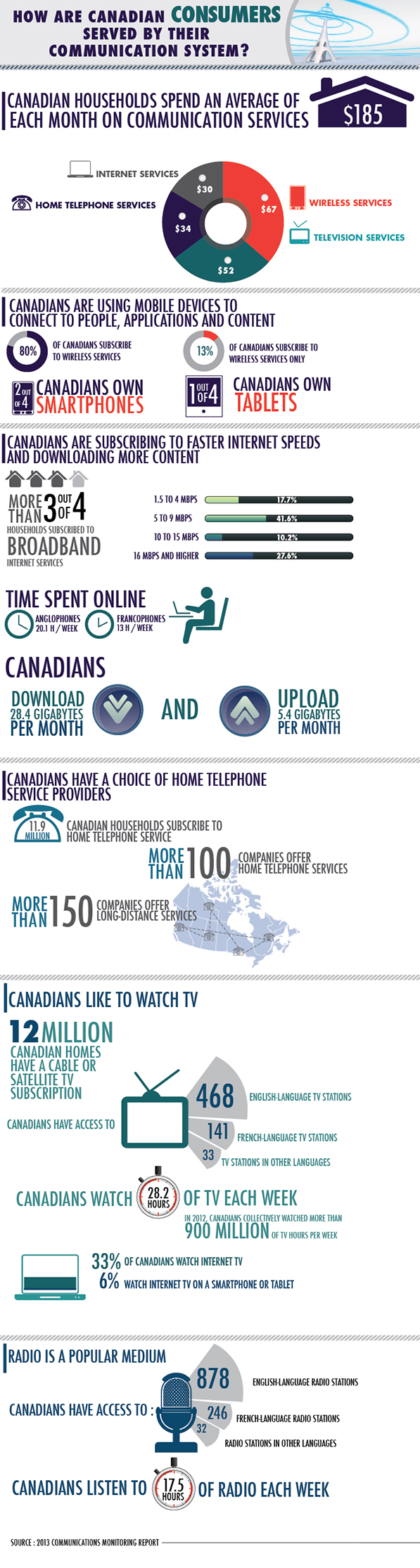

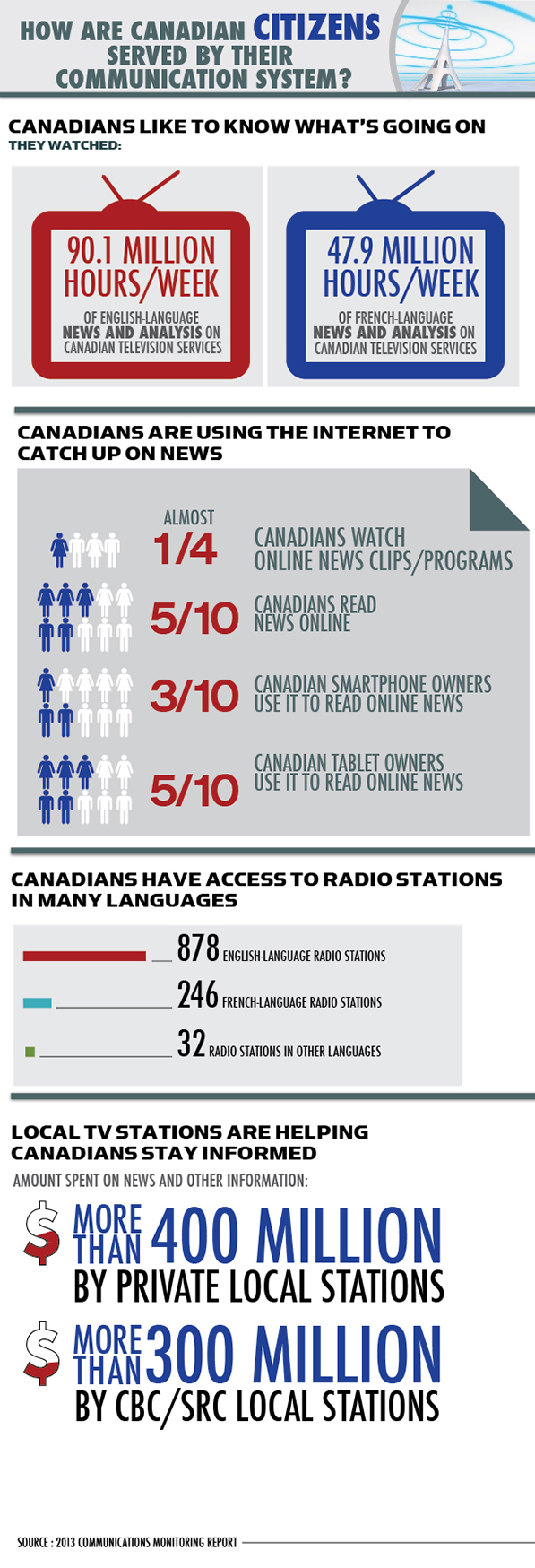

In 2012, Canadians spent almost the same amount of time listening to the radio and watching television as they did the previous year. They listened to an average of 17.5 hours of radio each week, compared to 17.7 hours in 2011. Canadians also watched an average of 28.2 hours of television per week, down slightly from 28.5 hours. Collectively, they watched 931.3 million hours of television per week, 48.9% of which were Canadian programs.

At the same time, more than two out of four Canadians owned a smartphone and more than one out of four owned a tablet. Canadians used these devices, as well as computers and laptops, to access programming on digital platforms.

Thirty-three percent of Canadians watched Internet television; typical users watched 3 hours of Internet television per week, an increase from 2.8 hours in 2011. Six percent of Canadians watched programming on a tablet or smartphone, while 4% report watching television programming exclusively online.

In addition, 20% of Canadians streamed the signal of an AM or FM station over the Internet, 14% streamed audio content on a smartphone, 13% streamed a personalized Internet music service and 8% streamed audio on a tablet.

Overall, anglophones spent 20.1 hours per week online, while francophones spent 13 hours per week online.

In 2012, the broadcasting industry contributed $3.4 billion to the creation and promotion of Canadian programming, an increase of $263 million from the previous year.

Canadians are adopting smartphones and faster Internet services

Canadian families spent an average of $185 each month on communications services in 2012, compared to $181 the previous year. In particular, Canadians consumed more wireless data and subscribed to Internet services featuring higher broadband speeds.

Wireless services

Over 99% of Canadian households subscribed to either a wireless or home telephone service.

In 2012, there were 27.9 million Canadian wireless subscribers, an increase of 1.8% in one year, with an average of two wireless subscriptions per household. During the previous four years, the number of new subscribers had grown by an annual rate of 6% to 9%. Canadian families spent an average of $67 per month on wireless services, up from $61 the previous year.

While the three largest wireless companies accounted for 92% of all revenues, the smaller wireless companies increased their market share from 4% in 2011 to 5% in 2012. The reach of faster wireless networks, known as Long Term Evolution or LTE networks, continued to spread across the country. The number of Canadians that could access these networks jumped from 45% to 72%.

Home telephone services

Fewer Canadians had a traditional telephone in their homes, as the number of residential subscribers decreased by 2.1% to 11.9 million in 2012. Over the past five years, Canadians have made greater use of other technologies to communicate, resulting in the loss of more than 1 million telephone lines. During the same period, subscriptions to wireless services increased by 5.8 million.

In 2012, Canadian families spent an average of $35 on home telephone service, which was less than the $37 they spent the previous year.

Internet services

In 2012, Canadians subscribed to faster Internet services and spent more time online. By the end of the year, 79% of the 13.9 million households in Canada had an Internet subscription. The percentage of households that had download speeds of at least 5 megabits per second rose from 54% in 2011 to 62% in 2012. Canadian families spent an average of $31 per month on Internet services, which was slightly more than the $30 they spent the previous year.

Television services

In 2012, the number of households that subscribed to basic television service increased by 1% to 12 million. Over 68 percent of Canadians television subscribers obtained this service from a cable company, 24% from a satellite company and 8% from companies that deliver television programming over telephone lines (known as an Internet Protocol television service). Canadian families spent an average of $52 per month on television services, which was a few cents less than what they spent a year earlier.

Communication revenues surpass $60 billion

Overall revenues for the communication sector surpassed $60 billion for the first time in 2012, growing 2.3% to $60.7 billion. Revenues generated by broadcasting services increased by 1.4% to $16.8 billion, while those generated by telecommunications services climbed 2.7% to $43.9 billion.

Communications Monitoring Report

Infographic: How are Canadian citizens served by their communication system?

Infographic: How are Canadians served by creators in the communication system?

Infographic: How are Canadians consumers served by their communication system?

The CRTC

The CRTC is an independent public authority that regulates and supervises broadcasting and telecommunications in Canada.

These documents are available in alternative format upon request.

Additional information on the 2013 Communications Monitoring Report

The Communications Monitoring Report contains information on the broadcasting sector for the year ended August 31, 2012 and on the telecommunications sector for the year ended December 31, 2012. Highlights from the report are included below.

Broadcasting highlights

Radio

• In 2012, 1,156 radio services were offered to Canadians. This includes 878 English-language services, 246 French-language services and 36 services in other languages.

• The average time spent listening to radio services went from 17.7 hours per week in 2011 to 17.5 hours in 2012. Private radio stations captured 77.1% of the weekly radio tuning share, while the Canadian Broadcasting Corporation and other stations had tuning shares of 13.4% and 9.5%, respectively.

• In 2012, commercial radio stations contributed $54 million to the creation of Canadian content and the support of Canadian artists, a 2% increase from 2011.

• The revenues of private commercial broadcasters increased by 0.4% from $1.61 billion in 2011 to $1.62 billion in 2012.

• In 2012, 13% of Canadians subscribed to satellite radio.

Television

• In 2012, 743 television services were offered to Canadians. This includes 468 English-language services, 141 French-language services and 133 services in other languages.

• Canadians watched an average of 28.2 hours of television per week, which was close to the 2011 average of 28.5 hours.

• Overall revenues for private television services grew by 1.9% from $6.4 billion in 2011 to $6.5 billion in 2012.

• In 2012, private conventional television stations invested $662 million in Canadian programming, including $76.9 million on drama and comedy series, documentaries and award shows.

• During the same period, investments in Canadian programming by specialty and pay television services totaled $1.4 billion, including $299.5 million on drama and comedy series, documentaries and award shows.

• The Canadian Broadcasting Corporation/Société Radio/Canada (CBC/SRC) invested $734 million in Canadian programming, including $202.7 million on drama and comedy series, documentaries and award shows.

• The revenues of private conventional television stations decreased by 5% from $2.14 billion in 2011 to $2.04 billion in 2012.

• Specialty, pay and pay-per-view television and video-on-demand services saw their revenues increase by 5.9% from $3.8 billion in 2011 to $4 billion in 2012.

• The CBC/SRC’s conventional television stations reported $508 million in advertising and other revenues, a 1.6% increase from $500 million in 2010.

Broadcasting distribution

• In 2012, 12 million Canadians subscribed to television services, an increase of 1% over the previous year. Of this total, 64.2% subscribed to cable services, 23.6% to satellite services and 8.4% to services that deliver television programming over telephone lines (also known as Internet Protocol television or IPTV).

• Canadians had access to nearly 250 cable and satellite television providers.

• In 2012, broadcasting distribution companies directed $394 million to funds that support the production of Canadian programming, including programming for community channels. This total was 1.6% higher than the $388 million allocated for this purpose in 2011.

• Revenues generated from the distribution of television programming grew by 1.1% from $8.6 billion in 2011 to $8.7 billion in 2012.

• The five largest cable and satellite companies accounted for 88% of all revenues derived from the distribution of television programming.

• Eight percent of Canadians report neither subscribing to cable or satellite services nor watching over-the-air television stations.

Digital media

• Anglophones spent 20.1 hours online per week in 2012, up from 18.2 hours in 2011. At 13 hours per week, francophones spent roughly the same amount of time online in 2012 as the previous year.

• Typical users watched over 3 hours of Internet television per week, an increase from 2.8 hours in 2011. Thirty-three percent of Canadians watched online television programming, and 4% report only watching this type of programming.

• Six percent of Canadians watched television programming on a tablet or smartphone.

• The percentage of Canadians that subscribed to Netflix grew from 10% in 2011 to 17% in 2012.

• Canadians are listening to audio content on a number of platforms: 20% streamed the signal of an AM or FM station over the Internet, 14% streamed audio on a tablet, 13% streamed a personalized Internet music service and 8% streamed audio on a smartphone.

• In 2012, Canadians downloaded an average of 28.4 gigabytes (GB) and uploaded 5.4 GB per month using their Internet services.

Telecommunications highlights

Revenues and expenditures

• Telecommunications revenues increased by 2.7% from $42.7 billion in 2011 to $43.9 billion in 2012.

• Competitors of traditional telephone companies (such as resellers and cable companies) accounted for $20.9 billion, or 48%, of total revenues.

• In 2012, telecommunications companies allocated $9.6 billion for capital expenditures, which are used to maintain, improve or expand networks. This amount represented a slight increase from the $9.5 billion spent in 2011.

Wireless services

• The number of wireless subscribers rose by 1.8% from 27.4 million in 2011 to 27.9 million in 2012. In addition, 81% of subscribers were on a post-paid wireless plan and 52% had a mobile broadband plan.

• The number of Canadians that own a smartphone increased from 38% in 2011 to 51% in 2012.

• In 2011, wireless services accounted for 46% of all telecommunications revenues, as they improved from $19.1 billion in 2011 to $20.4 billion in 2012, an increase of 6.5%.

• Wireless companies earned $1.6 billion in roaming revenues, including $799 million from voice usage and $784.6 million from data usage.

• Wireless companies that began offering services to Canadians following the 2008 spectrum auction increased their market share from 4% in 2011 to 5% in 2012.

• The three largest wireless service providers accounted for 90% of all revenues in this segment of the communications market.

• Advanced wireless networks, which support smartphones and other devices that connect to the Internet, were available to 99% of the Canadian population.

• The percentage of Canadians that could access fourth-generation (LTE or long-term evolution) wireless networks jumped from 45% to 72% in one year.

Internet services

• The number of residential Internet subscribers grew by 3% from 10.7 million in 2011 to 11 million in 2012.

• Seventy-five percent of households had broadband Internet service that offered download speeds of at least 1.5 megabits per second (Mbps), up from 72% a year earlier.

• The percentage of households that had download speeds of at least 5 Mbps jumped from 54% to 62%.

• In 2012, revenues generated from the provision of Internet services increased by 5.9% from $7.2 billion to $7.6 billion. Internet services accounted for 17% of all telecommunications revenues.

• Independent service providers increased their share of the residential market from 7% in 2011 to 8% in 2012.

• The five largest Internet service providers accounted for 76% of all revenues in this segment of the communication market.

• There were more than 500 Internet service providers operating in Canada.

Local and long-distance telephone services

• The number of local residential telephone lines fell from 12.2 million to 11.9 million in 2012. This was accompanied by a slight decline in revenues for residential telephone service, which went from $4.6 billion to $4.4 billion.

• In 2012, local and long-distance services accounted for 26% of all telecommunications revenues.

• Cable companies that provide home telephone service had captured approximately 35.8% of the market.

• Canadians were served by more than 100 local telephone service providers and more than 150 long-distance service providers.