IHS Inc. announced it expects that shipments of flat panel televisions in the United States will decline by 7% in the second-half of 2013.

IHS Inc. announced it expects that shipments of flat panel televisions in the United States will decline by 7% in the second-half of 2013.

For more information visit: www.ihs.com

Unedited press release follows:

Christmas Not Expected to be so Merry for the US TV Business, as Second-Half Sales Decline

El Segundo, Calif. (Oct. 22, 2013) — Shipments of flat-panel televisions in the United States are set to decline by 7 percent in the second half of 2013 as the holiday season delivers little reprieve from the long-term slowdown in domestic demand.

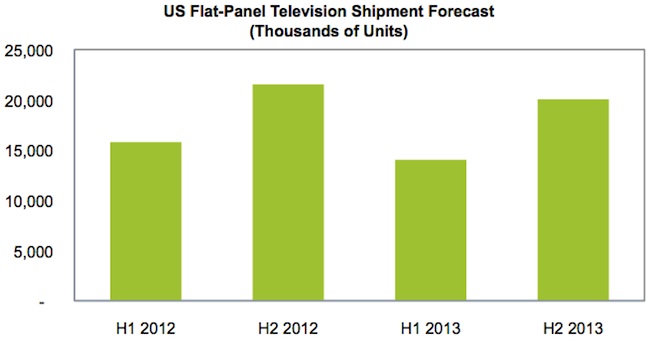

A total of 20.1 million liquid-crystal display (LCD) and plasma television sets are forecast to be shipped in the United States in the second half of 2013, down 7 percent from 21.6 million during the same period in 2012, according to the latest US Television Market Tracker report from IHS Inc. (NYSE: IHS). With the majority of TV sales occurring during the last six months of every year, the second-half decrease will set the stage for the second consecutive annual decline for the U.S. flat-panel television market.

“Driven by holiday sales, the second half of the year is always critical for determining the fate of the U.S. TV market,” said Veronica Thayer, analyst for consumer electronics and technology at IHS. “However, even with TV brands offering lower prices during this year’s Black Friday than they did in 2012, sales in the second half will decelerate sharply. The U.S. television market continues to be stymied by the long-term slowdown in replacement and secondary purchases, with most U.S. homes already owning one or more flat-screen televisions.”

U.S. flat-panel TV shipments for the full year of 2013 are expected to fall to 34.1 million, down 9 percent from 37.3 million in 2012. This follows a 6 percent loss in 2012.

The attached figure presents U.S. flat-panel television shipments by half-year in 2012 and 2013.

Black Friday fails to brighten up holiday sales

Television sales during Black Friday and other promotional days this holiday season are expected to generate about the same level of consumer activity as in 2012. However, the sales surge this year will not carry over to the rest of the holiday season, with overall Christmas demand expected to weaken compared to last year.

“When the promotions stop, TV purchasing will stop as well, because U.S. consumers are increasingly sensitive to price,” Thayer noted. “An IHS survey indicates that 43 percent of consumers now believe pricing is a major driver in their television purchasing decisions, up from 28 percent one year ago.”

On Black Friday, television brands and retailers are expected to offer price promotions on sets with larger screen sizes of 50-inches and bigger. Strong competition is anticipated to drive prices for these sets to lower levels than last year.

Televisions hit the big time

The move to larger-sized sets is gaining momentum among U.S. consumers. Shipments of 55- to 59-inch flat-panel sets this year will surpass the 45- to 49-inch-size range in 2013 for the first time.

Meanwhile, shipments of smaller sets are declining.

In 2012, 32 percent of the LCD TVs shipped in the United States were in the 30- to 34-inch range, making this the largest screen size by a significant margin. In 2013, this share is forecast to fall to 27 percent, and will continue to shrink to reach just 12 percent in 2018, due to the increase in shipments of big-screen TVs.

LED advances

U.S. consumers also are embracing light-emitting-diode (LED) backlighting, which has almost completely supplanted the older cold-cathode fluorescent lamp (CCFL) technology in LCD TVs.

In 2013, shipments of LED-backlit televisions are anticipated to amount to 28.1 million units, representing 88 percent of the LCD TV market.

CCFL shipments are projected to tail off dramatically by 2015, as LED TVs account for virtually the entire market.

“LED TVs have been a big consumer hit,” Thayer said. “This is because they have been marketed as being eco-friendly and possessing better image quality. Furthermore, the price differential between CCFL and LED backlights has dwindled, adding to the latter’s appeal.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs approximately 8,000 people in 31 countries around the world.