The NPD Group announced it reckons that Netflix and other subscription Video-on-Demand (SVOD) services continue to grow in popularity at the expense of premium TV channels.

The NPD Group announced it reckons that Netflix and other subscription Video-on-Demand (SVOD) services continue to grow in popularity at the expense of premium TV channels.

For more information visit: www.npd.com

Unedited press release follows:

Cord Shaving? SVOD Subscribers Increase, as Premium TV Subscribers Decline, According to The NPD Group

SVOD makes up 67 percent of all digital video transactions, and it continues to grow faster than all other types of digital-video acquisition.

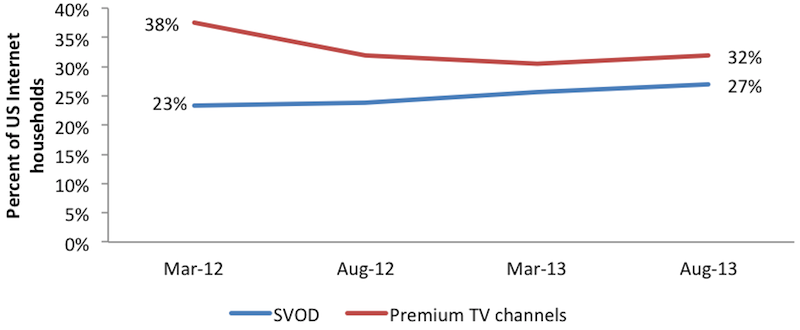

With questions about the new viewer behavior trend in premium TV: video “cord cutting” and “cord shaving” abounding, a new report from The NPD Group, a global information company, reveals that subscriptions to HBO, Showtime, and other premium TV channels have declined over the past two years, as Netflix and other subscription video-on-demand (SVOD) services have gained in popularity. There was a 6 percentage point overall decline in U.S. households subscribing to premium TV channels over the past two years, while households subscribing to SVOD grew 4 points.

According to NPD’s “The State of SVOD” report, 32 percent of U.S. households were subscribed to premium-TV channels in August of 2013, compared to 27 percent of U.S. households that subscribed to SVOD services. Netflix remains the clear leader in SVOD; however, Hulu Plus and Amazon Prime are reaping the biggest growth benefits in the category, as consumers tack on secondary SVOD services.

“As SVOD services have gained momentum, it’s clear that some consumers are trimming their premium-TV subscriptions,” said Russ Crupnick, senior vice president of industry analysis for The NPD Group. “As SVOD increasingly strives to become a channel itself, viewers might consider it to be an adequate substitution for other premium channels, or perhaps they are switching to economize on their time and money spent.”

Overall digital-video transactions rose 3 share points since 2012, reaching 70 percent of all home-video transactions in 2013. (NPD counts home-video transactions as purchases and individual paid rentals, not including free on-demand movies and TV shows included with a pay TV subscription.) In 2013 SVOD made up 71 percent of all digital-video transactions, and it continued to grow faster than all other digital acquisition types.

Data note: Information in this press release was derived from NPD’s report titled, “The State of SVOD,” which is based on data from NPD’s “VideoWatch Digital” consumer tracker (450,000 transactions) and “Video Omnibus Study” (7,500 respondents). Note: NPD counts home-video transactions as purchases and individual paid rentals, not including free on-demand movies and TV shows included with a pay TV subscription. Data is weighted to reflect the U.S. population aged 13 and older.

About The NPD Group, Inc.

The NPD Group provides global information and advisory services to drive better business decisions. By combining unique data assets with unmatched industry expertise, we help our clients track their markets, understand consumers, and drive profitable growth. Practice areas include automotive, beauty, consumer electronics, entertainment, fashion, food / foodservice, home, luxury, mobile, office supplies, sports, technology, toys, and video games. For more information, visit npd.com and npdgroupblog.com. Follow us on Twitter: @npdgroup.