The Entertainment Retailers Association (ERA) announced it reckons that streaming and access services comprised a quarter of the UK entertainment market in 2013.

The Entertainment Retailers Association (ERA) announced it reckons that streaming and access services comprised a quarter of the UK entertainment market in 2013.

For more information visit: www.eraltd.org

Unedited press release follows:

Streaming and access services scoop a quarter of the entertainment market, but music and video store total hits all-time high

Booming subscription sales by services like Netflix, Lovefilm, Spotify and Deezer mean so-called “access services” rather than sales of products like discs and downloads accounted for a quarter of the entertainment market in 2013, according to new figures revealed in the Entertainment Retailers Association (ERA) Yearbook published today.

But the physical store market remains vibrant with the numbers of outlets stocking music and video reaching an all-time high, and independent retailers in particular thriving.

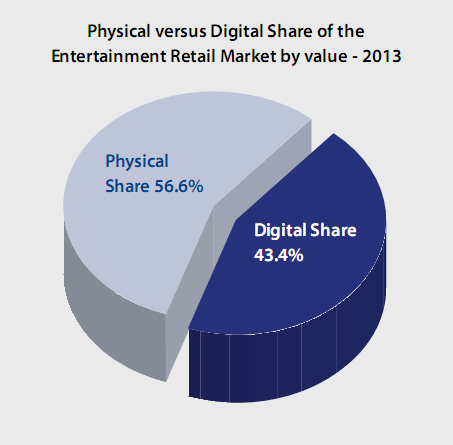

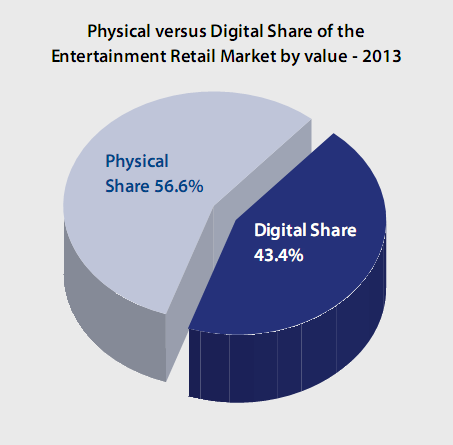

“Access models” include streaming services for video (Netflix, Lovefilm) and music (Spotify, Deezer) and in-app purchases for games (Angry Birds, Moshi Monsters). In 2013 their share of entertainment revenues grew to 26% whilst 74% of revenues were still accounted for by ownership models.

Overall internet-derived sales – including home delivery, digital download and streaming and other access services – accounted for a clear majorityof the £5.3bn entertainment market in 2013, according to ERA figures, with a 60% share of sales. The remaining 40% of revenue was generated by physical stores.

ERA Director General Kim Bayley said, “This is stark evidence of the revolution in entertainment consumption being driven by entertainment retailers. The fact that 60p in the entertainment pound is now spent online and 26p in the pound is for access to content rather than ownership is a testament to the huge investment and technological ingenuity of retailers in providing consumers with new ways to enjoy the music, video and games they love.”

Strong investment and innovation by retailers

2013 witnessed significant investment and innovation from retailers as they continued to transform the availability and accessibility of entertainment to UK consumers:

bl bloom.fm and Musicqubed launched mass market music streaming services at sub-£5 price points;

• HMV, now under new management, refocused its entire store estate on its historic music and video heartland;

• Deezer introduced its new ‘Hear This’ feature, a new personalised discovery tool, which combines expert recommendations from the service’s editors with a smart algorithm that learns about each individual’s listening habits and preferences;

• Netflix reportedly exceeded 2m subscribers in the UK;

• Google launched its All Access streaming music service to sit alongside its existing Play store;

• Spotify struck up strategic alliances with Vodafone and The Times;

• Sky confirmed the convergence of broadcast and retail models with the launch of itsNow TVstreaming service sitting alongside Sky Store and Sky Go;

• Napster launched major promotions with Sonos, Samsung and LG as well as a partnership with Sun+;

• Leading UK indieRough Trade launched its first US store in New York City;

• US gaming giant Valve announced plans to create its own console, dubbed the Steam Machine.

Said Bayley, “The transformation of the entertainment market is often misrepresented either as some kind of force of nature beyond human control or as a far-sighted initiative of record and video and games companies. It is neither.

“The entertainment revolution has been driven by new and existing retailers taking huge gambles and investing in technology and new delivery mechanisms. The striking thing, however, is that 10 years after the launch of iTunes and then the rise of mobile entertainment, physical formats still account for a clear majority of entertainment market sales.”

Physical stores versus online

In 2013 physical stores accounted for £2.12bn in sales, down 8% on 2012, while online sales – the combination of physical sales by internet-based home delivery services like Amazon and digital services – reached £3.18bn, up 13.9%.

| Physical store sales versus online 2013 | ||||

| Video | Games | Music | Total | |

| Physical stores value | £1,019.5m | £719.3m | £379.2m | £2,118.0m |

| Physical stores % | 49.5% | 32.8% | 36.4% | 40.0% |

| Online value | £1,040.1m | £1,473.7m | £663.8m | £3,177.6m |

| Online % | 50.5% | 67.2% | 63.6% | 60.0% |

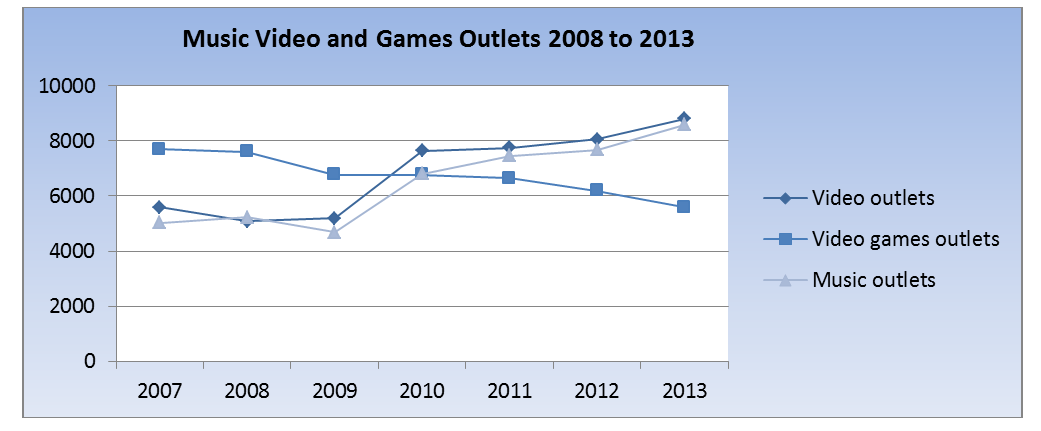

Despite this, the number of physical outlets selling both music (8,580) and video (8,803) reached an all-time-high in 2013. Only in videogames did the total number of physical outlets decline – to 5,590.

Said Kim Bayley, “It is striking how new stores are embracing entertainment even as physical sales are decreasing.”

The biggest factor in the increase in the number of music and video outlets has been the addition to the tally first, of smaller convenience format supermarkets selling a limited range and second of non-specialists such as BP, Disney and BHS.

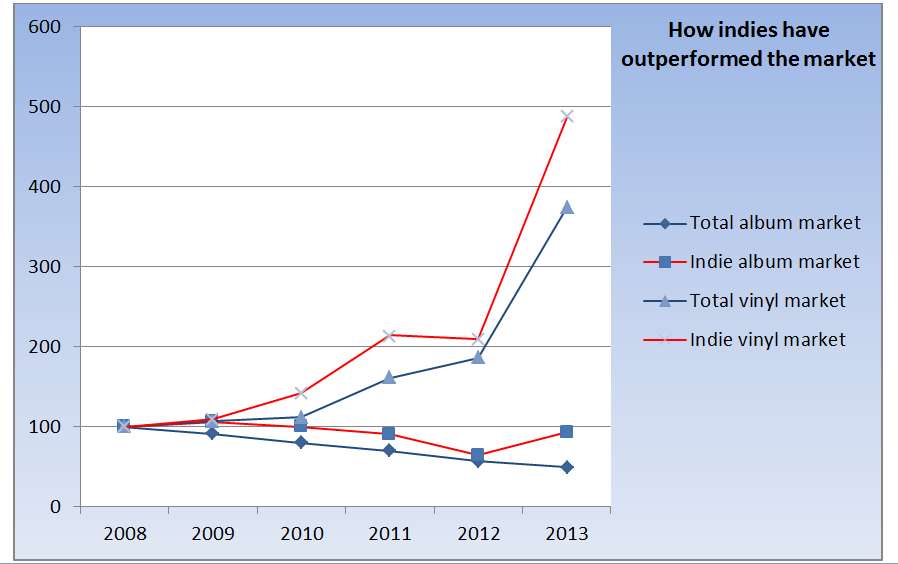

Independent stores are thriving

The ERA Yearbook confirms the continuing strong performance of independent record shops as they reap the rewards of their strong commitment to the vinyl format.

While the number of independent stores in the UK is still 12% down on 2008 at 296, independent stores have increased their share of the physical album market from 2.4% to 4.5%. Sales of vinyl albums through indie stores have increased from just 75,700 in 2008 to 368,300 in 2013.

Access versus Ownership

The fastest growing segment of the online entertainment market is accounted for by services which allow consumers to access content rather than purchasing it outright (ie products like discs or downloads). These include video subscription services such as Netflix and Lovefilm, whose total revenues grew by 120% in 2013, music streaming services like Spotify and Deezer which were up 34% year on year and a variety of games services including in-game micro-transactions, subscriptions to PC multiplayer online games, on-demand games and in-app purchases.

In total, access models grew 35.6% in 2013 to reach £1,377m, just over a quarter of the entire entertainment market.

Further quotes:

Spencer Hickman, Coordinator of Record Store Day, said, “2013 was another great year for independent record shops, suggesting that contrary to earlier fears, in the age of downloads and streaming, physical formats and vinyl in particular are still as relevant as ever.”

Mark Foster, Managing Director of Deezer UK & Ireland, said, “We are witnessing nothing less than a revolution in the way that people search for and discover entertainment. Streaming services like Deezer allow music fans to access effectively the entire catalogue of popular music whenever they want it on whichever device they want it – and all for a monthly fee less than the price of an album.”

Rudy Osorio, Head of Video at HMV, said, “We continue to be struck by the strong resilience of the physical market in the UK. Early adopters’ enthusiasm for streaming may grab the headlines, but sales of £2.1bn through store-based retailers of entertainment product show there is still a substantial mainstream market of consumers who value the convenience of disc-based formats, particularly for gifting and impulse buys.”

The ERA Yearbook is established as the definitive statistical description of the UK entertainment market comprising the music, videogames and video sectors. It combines actual point of sale data supplied by retailers accounting for approximately two-thirds of the total £5.3bn market and best-available, industry-standard estimates for the remaining third. Point of sale data for physical video sales and physical and digital music sales come courtesy of the Official Charts Company, while point of sale data for physical videogames sales comes from GfK Chart-track. Estimates for the value of the music streaming market come from record companies trade association, the BPI, grossed up from record company revenues, while estimates for the digital video and videogames markets are courtesy of consultants IHS.