IFPI announced that it has released the 2016 edition of its Global Music Report.

IFPI announced that it has released the 2016 edition of its Global Music Report.

The Global Music Report 2016 can be downloaded from IFPI’s website.

For more information visit: www.ifpi.org

Edited press release follows:

12th April 2016

Global music revenues increase 3.2% as digital revenues overtake physical for the first time

• Digital sales contribute 45 per cent of industry revenues; overtake physical’s 39 per cent share

• Streaming revenues up 45.2 per cent, helping to drive 3.2 per cent global growth

• Music consumption is exploding globally, but the “value gap” is the biggest brake on sustainable revenue growth for artists and record labels

The global music market achieved a key milestone in 2015 when digital became the primary revenue stream for recorded music, overtaking sales of physical formats for the first time.

Digital revenues now account for 45 per cent of total revenues, compared to 39 per cent for physical sales.

IFPI’s Global Music Report 2016 also reported a 10.2 per cent rise in digital revenues to US$ 6.7 billion, with a 45.2 per cent increase in streaming revenue more than offsetting the decline in downloads and physical formats.

Total industry revenues grew 3.2 per cent to US$ 15.0 billion, leading to the industry’s first significant year-on-year growth in nearly two decades. Digital revenues now account for more than half the recorded music market in 19 markets.

However, there is a fundamental weakness underlying this recovery. Music is being consumed at record levels, but this explosion in consumption is not returning a fair remuneration to artists and record labels. This is because of a market distortion resulting in a “value gap” which is depriving artists and labels of a fair return for their work.

IFPI Chief Executive Frances Moore said: “After two decades of almost uninterrupted decline, 2015 witnessed key milestones for recorded music: measurable revenue growth globally; consumption of music exploding everywhere; and digital revenues overtaking income from physical formats for the first time. They reflect an industry that has adapted to the digital age and emerged stronger and smarter. “This should be great news for music creators, investors and consumers. But there is good reason why the celebrations are muted: it is simply that the revenues, vital in funding future investment, are not being fairly returned to rights holders. The message is clear and it comes from a united music community: the value gap is the biggest constraint to revenue growth for artists, record labels and all music rights holders. Change is needed – and it is to policy makers that the music sector looks to effect change”.

REPORT HIGHLIGHTS

The Global Music Report 2016 outlines the state of the recorded music market worldwide and highlights innovation and investment within the industry as it advances into the digital era.

Streaming remains the industry’s fastest-growing revenue source. Revenues increased 45.2 per cent to US$ 2.9 billion and, over the five year period up to 2015, have grown more than four-fold.

Helped by the spread of smartphones, increased availability of high-quality subscription services and connected fans migrating onto licensed music services, streaming has grown to represent 19 per cent of global industry revenues, up from 14 per cent in 2014. Streaming now accounts for 43 per cent of digital revenues and is close to overtaking downloads (45 per cent) to become the industry’s primary digital revenue stream.

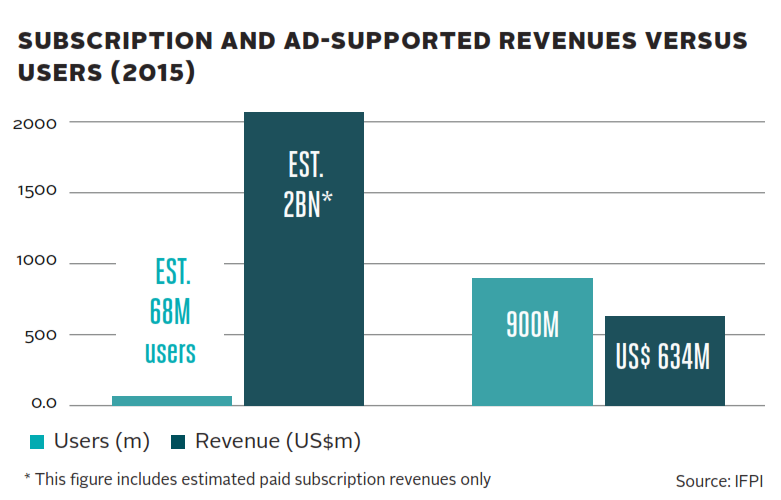

Premium subscription services have seen a dramatic expansion in recent years with an estimated 68 million people now paying a music subscription. This figure is up from 41 million in 2014 and just eight million when data was first compiled in 2010.

Downloads remain a significant offering, accounting for just 20 per cent of industry revenues. Income was down 10.5 per cent to US$ 3.0 billion – a higher rate of decline than in 2014 (- 8.2 per cent). Full album downloads are still a major part of the music fans’ experience and were worth US$1.4 billion. This is higher than the level of sales in 2010 (US$983 million) and 2011 (US$1.3 billion).

Performance rights revenue grew. Revenue generated through the use of recorded music by broadcasters and public venues increased 4.4 per cent to US$2.1 billion and remains one of the most consistent growing revenue sources. This revenue stream now accounts for 14 per cent of the industry’s overall global revenue, up from 10 per cent in 2011.

Revenues from physical formats declined, albeit at a slower rate than in previous years, falling by 4.5 per cent compared to 8.5 per cent in 2014 and 10.6 per cent in 2013. The sector still accounts for 39 per cent of overall global income and remains the format of choice for consumers in a number of major markets worldwide including Japan (75 per cent), Germany (60 per cent), and France (42 per cent).

FIXING THE VALUE GAP: ON THE LEGISLATIVE AGENDA

The “value gap” arises because some major digital services are able to circumvent the normal rules that apply to music licensing. User upload services claim they do not need to negotiate licences for the music available on their platforms, or conclude licences at artificially low rates, claiming protection from so-called “safe harbour” rules that were introduced in the early days of the internet and established in both US and European legislation.

Today the safe harbour rules are being misapplied. They were intended to protect truly passive online intermediaries from copyright liability. They were not designed to exempt companies that actively engage in the distribution of music online from playing by the same rules as other online music services. The effect is a distorted market, unfair competition and artists and labels deprived of a fair return for their work.

Rights holders from across the music community and wider creative sector are committed to changing this legislative anomaly. They say there is no case for digital platforms that have built major businesses on the back of music and other creative content, to be allowed to seek “safe harbour” refuge while they profit from making music available on the internet.

The user upload platforms benefiting from the misapplication of “safe harbours” have an estimated user base of more than 900 million. Yet the entire advertising-supported revenues sector they are part of, generates revenues of US$634 million, accounting for only four per cent of global music revenues.

An important step forward was made in December 2015, when the European Commission published its Communication Towards a modern, more European copyright framework. While acknowledging that music and other creative content and online services are both important for economic growth and jobs in Europe, the paper clearly identifies the “value gap” is a problem. The Commission plans to make its first proposals on how to deal with the “value gap” public in 2016.

Notes An additional section of the report called ‘Data & Analysis’ with further detailed figures at global, regional and national level will be available to from Thursday 14th April. The full report containing this premium data section will be available free to IFPI members or can be purchased via IFPI’s webshop from that date.