Technicolor SA announced financial and production results for its second quarter 2016.

Technicolor SA announced financial and production results for its second quarter 2016.

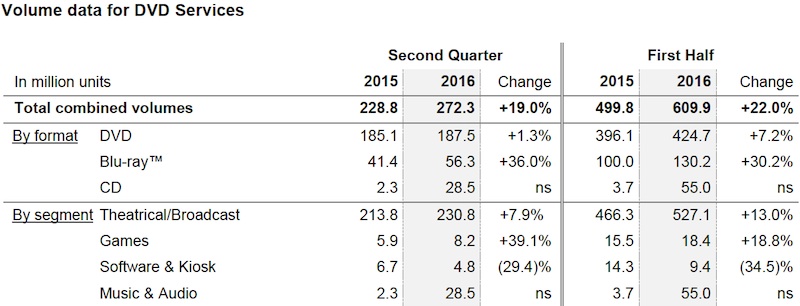

On the optical disc replication front, Technicolor reported that “DVD Services revenues amounted to €223 million in the second quarter of 2016, up 22.7% at constant currency compared to the second quarter of 2015, primarily driven by a year-over-year increase in total combined disc volumes of c.19%. During the period, DVD volumes were up c.1%, while Blu-ray disc volumes increased by c.36% compared to the second quarter of 2015. Games volumes were up c.39% year-on-year, while CD volumes were also substantially higher, due to last year’s customer additions.

Additionally, “key theatrical titles produced in the second quarter included Zootopia (Disney), Batman vs. Superman: Dawn of Justice (Warner), Deadpool (Fox) and The Divergent Series: Allegiant (Lionsgate), while key games titles included Doom (Bethesda Softworks) and Overwatch (Activision).

For more information visit: www.technicolor.com

Unedited press release follows:

First Half 2016 Results

Strong operational performance and integration of acquisitions ahead 2016 objectives confirmed and accelerated deleveraging

Paris (France), 27 July 2016 – Technicolor (Euronext Paris: TCH; OTCQX: TCLRY) announces today its results for the first half of 2016.

Frederic Rose, Chief Executive Officer of Technicolor, stated:

“The integration of our 2015 acquisitions is progressing very well and our second half will see material operating margin improvement in Entertainment Services and further improvement of the operating margin in Connected Home.”

Key points

• Revenue growth driven by the larger scale of the Group’s Operating businesses (Connected Home and Entertainment Services) and strong organic growth in Connected Home and Production Services;

• Adjusted EBITDA of the Operating businesses at €177 million, up by €95 million year-over-year at constant currency;

• Strong free cash flow generation resulting from the good performance achieved by the Operating businesses;

• Adjusted EBITDA margin of Connected Home at 7.7%, up by 3.4 points year-on-year as the integration process is ahead of plan;

• The strong increase in Production Services Adjusted EBITDA more than offset a negative contribution in DVD Services of the North American assets of Cinram, which are expected to perform at Group’s standards in the second half of 2016;

• The strong performance of Licensing activities partially offset the sharp decline in MPEG LA revenues;

• The Company will prepay €100 million of senior debt this week as a result of its good free cash flow generation in the first half of 2016.

2016 objectives confirmed

Technicolor confirms its 2016 objectives of a free cash flow in excess of €240 million, and an Adjusted EBITDA in the range of €600 million to €630 million.

The Adjusted EBITDA objective consisting of:

• An Adjusted EBITDA in excess of €475 million for the Operating businesses versus €266 million in 2015, reflecting:

– For Connected Home: revenues in the second half of 2016 at a similar level to that of the first half of 2016, with continued focus on operating improvement;

– For Entertainment Services: an Adjusted EBITDA margin expected to grow materially in the second half of 2016, driven by continued revenue growth and synergies in Production Services, and favorable seasonality and payback from cost initiatives executed in the first half of 2016 for DVD Services;

• An Adjusted EBITDA for the Technology segment in excess of €200 million versus €396 million in 2015 , based on the contribution of new licensing agreements. This notwithstanding a much lower contribution than expected from MPEG LA;

• Corporate and Other Adjusted EBITDA for an amount of around €(80) million.

Leverage ratio inferior to 1.4x at end December 2016 compared to a ratio of 1.74x at end December 2015.

Summary of consolidated results for the first half of 2016 (unaudited)

Key financial indicators

Group revenues from continuing operations totaled €2,420 million in the first half of 2016, up by more than 50% at constant currency compared to the first half of 2015, resulting from the strong performance of the Operating businesses, namely Connected Home and Entertainment Services. This performance reflected the contribution of the acquisitions and customer wins in DVD Services completed in 2015, as well as solid organic growth in Connected Home and double-digit organic growth in Production Services. In Licensing, the sharp decline of the MPEG LA contribution, which was higher than anticipated, was partially offset by a 58% revenue growth across other Licensing activities.

Adjusted EBITDA from continuing operations amounted to €265 million in the first half of 2016, up 8.4% at constant currency compared to the first half of 2015. The Operating businesses generated €177 million of Adjusted EBITDA, up by €95 million year-on-year at constant currency, and represented 67% of the Group’s Adjusted EBITDA. The strong increase in Adjusted EBITDA for the Connected Home segment, driven by its change of scale and associated synergies, fully offset the €79 million decline recorded by the Technology segment. In the Entertainment Services segment, the significant growth in Adjusted EBITDA of Production Services was in part offset by an adverse performance in DVD Services as the North American assets of Cinram, acquired end 2015, were not breakeven in the first half. Technicolor launched significant cost cutting measures to bring these assets to its profitability standards in the second half of 2016 and recorded some improvement at the end of the first half. In Production Services, Adjusted EBITDA grew as fast as revenues, with margin starting to benefit from synergies in the second quarter of 2016.

Adjusted EBIT from continuing operations reached €154 million in the first half of 2016, relatively stable at constant currency compared to the first half of 2015. During the first half of 2016, Technicolor performed the purchase price allocations (“PPA”) of the acquisitions made in the second half of 2015 and recorded a €18 million of amortization in the first half of 2016. Excluding this impact, Adjusted EBIT was up 7.5% year-on-year. Technicolor estimates the amortization of the purchase price allocations at around €40 million in 2016.

EBIT from continuing operations totaled €95 million in the first half of 2016, down 27.8% compared to the first half of 2015. This decrease was mostly due to €20 million of non-current items, out of which €8 million of research and development write-offs and €8 million of integration costs related to the acquisition of Cisco Connected Devices, that both impacted the Connected Home segment. In addition, restructuring costs were €8 million higher year-on-year, resulting principally from cost initiatives executed in the first half in the Technology segment, including the shutdown of the Hannover facility.

The Group’s financial result amounted to €(73) million in the first half of 2016 compared to €(44) million in the first half of 2015, reflecting:

• Interest costs were €45 million in the first half of 2016, reflecting an increase in borrowing costs of €12 million, mainly due to the issuance of new Term Loan Debt to finance the acquisitions of The Mill and Cisco Connected Devices in September and November 2015;

• Other financial charges amounted to €29 million in the first half of 2016 compared to €17 million in the first half of 2015. This increase resulted primarily from the 22% appreciation of the Brazilian real that led to a non-cash revaluation of Technicolor’s US dollar assets in Brazil.

Income tax increased slightly as a result of the Group’s Operating businesses getting stronger, in particular outside France.

As of the end of June 2016, Technicolor has settled with all plaintiffs in the Cathode-Ray Tube (“CRT”) litigation case in the US, except Sharp and a second group of plaintiffs with smaller claims. Technicolor recognized a non-current expense amounting to €50 million in the first half of 2016 corresponding to the amount of these settlements and to an accrual for the remaining claims. The cash impact will be €46 million in 2016, up by €10 million compared to the amount of €36 million previously announced in February 2016.

Net income was a loss of €52 million in the first half of 2016 compared to a profit of €48 million in the first half of 2015.

Statement of financial position and cash position

|

First Half |

Change YoY |

||

| In € million |

2015 |

2016 |

Reported |

| Operating cash flow from continuing operations |

208 |

224 |

+7.3% |

| Group free cash flow |

117 |

98 |

(16.2)% |

| Nominal gross debt |

1,330 |

(40) |

|

| Cash position |

3854 |

434 |

+49 |

| Net financial debt at nominal value (non IFRS) |

9854 |

896 |

(89) |

| IFRS adjustment |

(77)4 |

(67) |

+10 |

| Net financial debt (IFRS) |

9084 |

829 |

(79) |

Operating cash flow from continuing operations, which is defined as Adjusted EBITDA less net capital expenditures, restructuring cash out and working capital & other assets and liabilities variation to facilitate reconciliation with the IFRS statement of cash flow, amounted to €224 million in the first half of 2016, up by €16 million compared to first half of 2015, including:

• Capital expenditures amounted to €74 million, up by €31 million year-on-year, due to higher capitalized R&D in the Connected Home segment following the acquisition of Cisco Connected Devices and capacity expansion in the Production Services division, as Technicolor added new capacity in India, Canada, London (UK) and Paris (France) to support the execution of its strong order backlog;

• Cash outflow for restructuring totaled €33 million in the first half of 2016, up by €5 million year-on-year, resulting from higher restructuring costs in the Technology segment and in the DVD Services division;

• The variation of working capital & other assets and liabilities was positive €66 million in the first half of 2016, as the Connected Home segment succeeded in absorbing the Cisco Connected Devices acquisition through rigorous inventory management.

Group free cash flow amounted to €98 million in the first half of 2016, including:

• Financial charges were €47 million, up by €6 million year-on-year, due to the issuance of a new Term loan in the second half of 2015 to finance the acquisitions of Cisco Connected Devices and The Mill;

• Tax cash outflow was €40 million, up by €7 million year-on-year, due to stronger Operating businesses;

• Other cash charges reached €21 million, mainly reflecting pensions for €12 million and Connected Home integration cash outflow for €6 million.

Nominal gross debt totaled €1,330 million at end June 2016, down €40 million versus end December 2015, after a Term Loan debt repayment of €34 million and other debt reimbursement for €6 million.

The Group’s cash position amounted to €434 million at end June 2016, up by €49 million compared to end December 2015, due primarily to the solid free cash flow generation.

Net debt at nominal value amounted to €896 million at end June 2016, down by €89 million compared to end December 2015.

Financial calendar

Q3 2016 revenues 21 October 2016

Warning: Forward Looking Statements

This press release contains certain statements that constitute “forward-looking statements”, including but not limited to statements that are predictions of or indicate future events, trends, plans or objectives, based on certain assumptions or which do not directly relate to historical or current facts. Such forward-looking statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from the future results expressed, forecasted or implied by such forward-looking statements. For a more complete list and description of such risks and uncertainties, refer to Technicolor’s filings with the French Autorité des marchés financiers.

About Technicolor

Technicolor, a worldwide technology leader in the media and entertainment sector, is at the forefront of digital innovation. Our world class research and innovation laboratories enable us to lead the market in delivering advanced video services to content creators and distributors. We also benefit from an extensive intellectual property portfolio focused on imaging and sound technologies. Our commitment: supporting the delivery of exciting new experiences for consumers in theaters, homes and on-the-go. For more information visit: www.technicolor.com.