![]() Kantar Worldpanel announced it reckons the UK physical entertainment market is growing for the first time since August 2014.

Kantar Worldpanel announced it reckons the UK physical entertainment market is growing for the first time since August 2014.

For more information visit: www.kantarworldpanel.com

Unedited press release follows:

Physical entertainment back in growth as games level up

30 October 2017 — The latest data on the physical entertainment market from Kantar Worldpanel has revealed that the sector is back in growth for the first time since August 2014: up 2.2% year on year. Driven by a stellar performance from the games market – which grew sales by 26.0%, offsetting declines of 5.4% and 4.8% in music and video respectively – this is the strongest overall growth physical entertainment has seen in over three years.

Olivia Moore, analyst at Kantar Worldpanel, explains: “It’s been a great quarter for games – a real bright spot in the physical market’s struggle against the rise of digital. Helped by the release of much-anticipated title Destiny, mint games – as opposed to second hand – have led the charge.

“The market will now be looking to build on its success in the run up to Christmas, and consoles will have a vital part to play. Early signs are promising, with 850,000 consumers looking to pick up either the Nintendo Switch or Xbox One X in the run up to the festive season. Argos and Amazon benefited most from the gaming revival, continuing to nip at the heels of market leader GAME.”

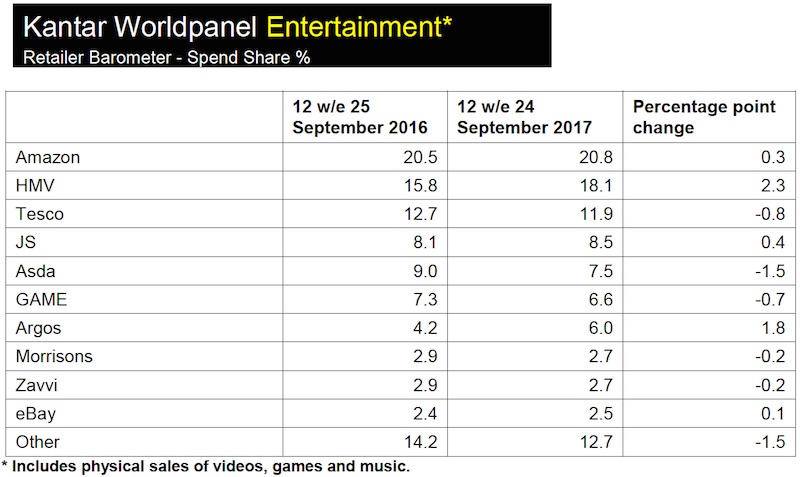

Amazon remains the largest retailer for physical entertainment, growing share by 0.3 percentage points year on year to hold 20.8% of the market. Meanwhile HMV made the biggest gains: increasing market share by 2.3 percentage points to stand at 18.1%. Olivia Moore explains: “Already the top seller of music, the past quarter has seen HMV leapfrog Amazon to become number one for sales of physical video too. The retailer increased its share of the video market with the help of a strong performance in new film releases – up 6.0 percentage points to stand at 22.5% – while Amazon’s share remained flat at 20.2%.”

Beauty and the Beast, Guardians of the Galaxy Vol. 2 and Logan were the top video performers of the quarter, while NOW 97 dominated in music. Olivia Moore continues: “Blu-ray continues to outperform DVD as consumers become more willing to spend more for higher quality content, although its share of the market remains smaller. Blu-ray saw 15,000 new shoppers during the latest quarter, with film fans also purchasing the format more frequently on average.

“In further good news for the video category, digital purchasing nudged the total transactional market – as opposed to streaming or subscription – into 4% growth, offsetting continuing declines in physical transactional sales. This is the best performance we’ve seen for several years. Driven by popular new releases, transactional digital welcomed 600,000 new shoppers in the past 12 weeks, suggesting

the sector is making some headway in its battle against declining disc sales and the rise of subscription services.”

Please note: From the 12 w/e 24 September 2017, data on eBay will be detailed in Kantar Worldpanel’s quarterly entertainment barometer. eBay figures were previously included in ‘other’, so data for all other individual retailers is not affected.

Kantar Worldpanel entertainment barometer data has been reworked as of October 2016. This is part of an ongoing process to ensure we maintain the best and most accurate read of the physical entertainment market. The change has had a slight impact on retailer shares but has not affected reported performance. The period-on-period growth trends of the outlets remain unaffected as historic data has been reworked for consistency. For reworked 12 w/e historical data please contact Camargue.

About Kantar Worldpanel’s Entertainment Retail Barometer

The Kantar Worldpanel Entertainment Retail Barometer is based on Kantar Worldpanel data for the 12 weeks to 24 September 2017. The barometer includes physical sales of videos, games and music. Vinyl sales are not included. Kantar Worldpanel Entertainment is the leading provider of continuous consumer panel research, measuring the film, music and game purchasing trends of 15,000 demographically representative individuals in Great Britain.

All data is based on the value of items being bought by these consumers. Kantar will only support data that is published in the context in which we have presented it and our own interpretation of these findings: other interpretations may not be accurate and we cannot be held responsible for them. Kantar Worldpanel Entertainment* Retailer Barometer – Spend Share %

About Kantar Worldpanel

Kantar Worldpanel is the global expert in shoppers’ behaviour.

Through continuous monitoring, advanced analytics and tailored solutions, Kantar Worldpanel inspires successful decisions by brand owners, retailers, market analysts and government organisations globally.

With over 60 years’ experience, a team of 3,500, and services covering 60 countries directly or through partners, Kantar Worldpanel turns purchase behaviour into competitive advantage in markets as diverse as FMCG, impulse products, fashion, baby, telecommunications and entertainment, among many others.

For further information, please visit us at www.kantarworldpanel.com. Twitter: Google+: LinkedIn: RSS: Newsletter

About Kantar

Kantar is the data investment management arm of WPP and one of the world’s largest insight, information and consultancy groups. By uniting the diverse talents of its 12 specialist companies, the group is the pre-eminent provider of compelling data and inspirational insights for the global business community. Its 30,000 employees work across 100 countries and across the whole spectrum of research and consultancy disciplines, enabling the group to offer clients business insights at every point of the consumer cycle. The group’s services are employed by over half of the Fortune Top 500 companies.

For further information, please visit us at www.kantar.com. Twitter: Facebook: Google +: LinkedIn