Singulus Technologies announced financial results for the third quarter of 2017.

Singulus Technologies announced financial results for the third quarter of 2017.

For more information visit: www.singulus.de

Unedited press release follows:

SINGULUS TECHNOLOGIES reports financial results for the first nine months of 2017

• CIGS production machines commissioned in China at the moment

• Additional orders for production machines for HJT high performance solar cells

• Joint venture for HJT solar cells with GCL in China

• Entry into medical technology market, first order booked

• Vacuum coating machines for cosmetics industry sold

• Sales for the period under review significantly increased compared with 2016

• EBIT for nine months slightly positive

• Next down payment expected for a consisting major CNBM order by the end of the year

Kahl am Main, November 9, 2017 – In the course of the period under review the SINGULUS TECHNOLOGIES AG (SINGULUS TECHNOLOGIES) has further established itself in the solar market. Especially for the core segment CIGS (copper-indium-gallium-diselenide solar modules) SINGULUS TECHNOLOGIES projects a prolonged investment cycle. The key customer CNBM (China National Building Materials) has begun the assembly of four production sites for CIGS solar thin-film modules in China in meantime. At the fist site the production lines for CIGS solar thin-film modules have already been commissioned. The machines for the next site currently in progress were already ordered by CNBM in the previous year in the course of the ongoing major order. Here, SINGULUS TECHNOLOGIES expects the first prepayments towards the end of the year. CNBM is in negotiations with SINGULUS TECHNOLOGIES to place orders for the next two fabs which are planned and are already in progress. The timing of a possible contract placement depends on the progress of the projects and an agreement on the framework conditions.

Dr.-Ing. Stefan Rinck, CEO of SINGULUS TECHNOLOGIES AG, comments: “During the period under review we have also received large orders for CIGS production machines from other customers. This includes buffer layer coating machines of the TENUIS II type as well as vacuum coating machines of the GENERIS type.”

In the market for crystalline cell technology SINGULUS TECHNOLOGIES’ focus rests on innovative high-performance cells of the next generation, such as heterojunction solar cells (HJT), which will dominate the next expected investment cycle according to assessments by market research institutes. SINGULUS TECHNOLOGIES is currently introducing new machine concepts to the market and also targets a leading market position for the key production steps also for the production of heterojunction solar cells. In order to rapidly develop the Chinese market and to attain market leadership from the onset, SINGULUS TECHNOLOGIES has signed an agreement for the foundation of a joint venture with the two Chinese companies Golden Concord Holdings Limited (GCL) and China Intellectual Electric Power Technology Co., Ltd. (CIE). While SINGULUS TECHNOLOGIES will contribute its competence as an engineering company, CIE will provide its production process for high-performance cells and GCL, one of the world’s largest companies in the solar market, will contribute its material and marketing know-how for the distribution of the machines.

In addition, during the period under review SINGULUS TECHNOLOGIES received new orders for several SILEX II processing machines from China and the US for the use in the manufacturing of HJT solar cells. With the SILEX II, SINGULUS TECHNOLOGIES has thus achieved a leading market position in the production of these solar cells.

Portfolio expansion to medical technology

For some time SINGULUS TECHNOLOGIES has been working on the introduction of new applications of its process and engineering know-how and now starts the strategically important entry into the growth market of medical technology. In the past days SINGULUS TECHNOLOGIES signed the first contract with a volume exceeding € 10 million for the sale of processing systems for the treatment of contact lenses. The machines will be supplied in 2018 to an international company operating in the medical sector.

Dr.-Ing. Stefan Rinck remarks: “This entry into medical technology means a strategically important portfolio expansion for the future. We have been working together in development projects with this customer for some time and have now developed a new process machine for the manufacturing of contact lenses.” Dr.-Ing. Rinck continues: “We will introduce additional production machines for medical technologies. In particular, we have various production lines for vacuum coating technology in mind such as, for example, cathode sputtering machines for diverse coating and surface processing steps. We are also testing our multifunctional injection molding machines for the production of high-precision components within the medical sector.”

At the beginning of October 2017, SINGULUS TECHNOLOGIES was also able to book the first order for a vacuum coating machine of the POLYCOATER type for the use in the cosmetics sector. The customer is preparing the further expansion of its production capacity and targets additional investments. In the meantime, another machine was ordered from SINGULUS TECHNOLOGIES by this customer.

At the end of September 2017, an agreement was reached with the company MPO International (MPO), France, to also offer solutions for the metallization of three-dimensional components in the cosmetics industry. In the course of this collaboration, MPO International plans to set up a line of the DECOLINE II type in France’s Villaines la Juhel.

Consolidated key figures for the 3rd quarter and the first nine months 2017

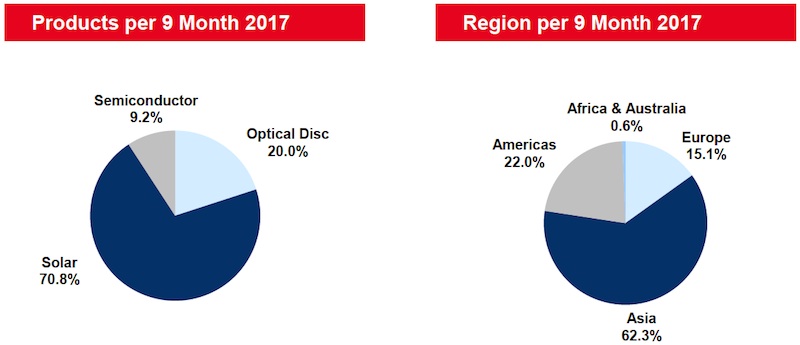

During the first nine months of the current business year SINGULUS TECHNOLOGIES recorded sales of € 63.6 million, which was thus significantly above the level of the prior-year period amounting to € 36.7 million. Sales in the third quarter came to € 15.3 million, which is also higher than the prior-year level (previous year: € 12.1 million). On an operating basis (EBIT) SINGULUS TECHNOLOGIES realized a slightly positive result of € 0.4 million for the first nine months of the current business year (previous year: € -14.8 million)

At the end of the first nine months of the business year 2017 the order intake came to € 53.4 million, below the prior-year level of € 144.1 million. In the quarter under review the order intake came to € 27.3 million (previous year: € 12.6 million). The order backlog amounted to € 99.7 million as of September 30, 2017 (previous year: € 134.0 million). The levels of order intake and order backlog for the business year 2016 reflect the major order from the Chinese state-owned enterprise China National Building Materials (CNBM) with a volume of around € 110 million.

In the course of the first nine months of the business year 2017, the gross profit margin improved substantially compared with the previous year, amongst others due to a higher utilization rate. The financial result came to € -1.4 million (previous year excluding restructuring gain: € -2.8 million). As of September 30, 2017, the available liquid funds amounted to € 19.1 million (previous year: € 18.5 million). The headcount within the SINGULUS TECHNOLOGIES Group declined slightly to 313 people as of September 30, 2017 (December 31, 2016: 318 employees).

Outlook for the business year 2017

For the current year, sales in a range from € 90 to 100 million are projected. In comparison with the previous year (€ 68.8 million), an increase in sales of around 30 % to 45 % is thus expected for the current business year. The realization of sales also impacts the key earnings figures for the current business year. Due to an improved cost structure as well as a higher gross profit margin, SINGULUS TECHNOLOGIES was able to further lower the level of breaking even. While in the previous year a loss (EBIT) in the amount of € -17.7 million was reported, with the newly published sales range, an operating result (EBIT) in a range from € +2 million to € -3 million is expected. Accordingly, the company could still achieve to break even in 2017.

The company will publish a forecast for the business year 2018 with the report of the annual financial results for 2017.

| Consolidated key figures 3rd quarter 2016/17 | |||

| 2016 | 2017 | ||

| Sales (gross) | in million € | 12.1 | 15.3 |

| Order intake | in million € | 12.6 | 27.3 |

| EBIT | in million € | -5.5 | -2.1 |

| EBITDA | in million € | -4.8 | -1.7 |

| Earnings before taxes | in million € | -5.7 | -2.7 |

| Net profit/loss | in million € | -5.8 | -2.8 |

| Research & development expenditures | in million € | 3.2 | 2.4 |

| Consolidated key figures nine months 2016/17 | |||

| 2016 | 2017 | ||

| Sales (gross) | in million € | 36.7 | 63.6 |

| Order intake | in million € | 144.1 | 53.4 |

| Order backlog (Dec. 30.09) | in million € | 134.0 | 99.7 |

| EBIT | in million € | -14.8 | 0.4 |

| EBITDA | in million € | -13.0 | 1.8 |

| Earnings before taxes | in million € | 23.6 | -1.0 |

| Net profit/loss | in million € | 23.4 | -1.1 |

| Operating cash flow | in million € | 11.6 | -18.2 |

| Shareholders’ equity (Sept. 30) | in million € | 11.8 | 11.9 |

| Balance sheet total (Sept. 30) | in million € | 91.2 | 74.4 |

| Research & development expenses | in million € | 8.0 | 6.5 |

| Employees (Sept. 30) | 327 | 313 | |

| Weighted average shares outstanding, basic | 2,323,916 | 8,087,752 | |

| Earnings per share, basic | € | 10.07 | -0.14 |