DisplaySearch announced that the continuing transition to LED backlights is motivating LCD TV panel manufacturers to develop their supply chains in order to reduce the cost of LED-backlit panels.

DisplaySearch announced that the continuing transition to LED backlights is motivating LCD TV panel manufacturers to develop their supply chains in order to reduce the cost of LED-backlit panels.

According to the statement, DisplaySearch’s latest Quarterly LED Backlight Panel Shipment and Forecast Report reveals that 9.5 million (18.5%) of the LCD TV panels that shipped in Q2’10 had LED backlights, which was 110% growth Q/Q.

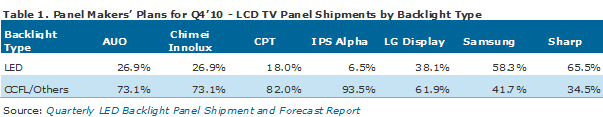

LCD TV panel makers are targeting aggressive growth for LED panel shipments, with plans to reach 40% LED penetration in Q4’10, and to exceed 50% in Q2’11. Penetration is highest among leading LCD TV panel makers, including Samsung, LG Display, AUO, Sharp and Chimei Innolux. Notably, Samsung and Sharp aim to ship more LED LCD TVs than CCFL panels in Q4’10. Among these players, Sharp is the only one focusing on direct-type LED backlights, as opposed to the more common edge-lit structure.

“LCD TV panel prices fell quickly in Q3’10 due to oversupply and inventory adjustments downstream. However, LED panel prices are falling even faster than CCFL.” noted David Hsieh, Large-Area LCD Research Team Leader and Vice President of the Greater China Market for DisplaySearch. Hsieh added, “Panel makers are expecting to grow their shipments through the end of the year as LED panel prices and end-market retailer prices of LED LCD TVs fall rapidly.”

After the tight supply in Q2’10, the LED backlight supply chain ramped up to meet panel makers’ production schedules. Furthermore, panel makers are investing vast resources to develop lower cost LED backlights with enhanced performance. Some of the technology development efforts include “single-sided two light bars” edge-lit LED backlights, the use of alternative optical films for higher brightness and lower cost, as well as enlargement of LED chip packages for better luminous efficiency. These technologies will pave the way for another wave of LED penetration.

In Q2’10, the leading size of LED TV panel shipments was 40”, with a 23% share among all LED LCD TV panels shipped. This was followed by 32” with 21% share, 46” with 15%, and 42” with 11%. Shipments of 37” LED panels grew the fastest—642% from Q1’10 to Q2’10. In terms of LED panel manufacturing, Samsung and Sharp each shipped 2.8 million LED LCD TV panels in Q2’10, with 29% market share each. LG Display followed slightly behind with 2.4 million units and a 25% share, while AUO shipped 1.2 million units with 13% share. As a result, the leading four companies accounted for 96% of the total shipment of LCD TV panels with LED backlights.

DisplaySearch also found that many system integrators or brands that have their own LCD module assemblies are also buying LCD cells from panel makers such as Chimei Innolux and AUO, and then assembling the LED backlight with their own design. The backlight, module, and system integration business models of leading manufacturers are helping to drive rapid LED penetration.

The Quarterly LED Backlight Panel Shipment and Forecast Report also examined LED panel shipment and penetration in desktop monitor and notebook PC panels. LED penetration for desktop monitor panels shipped in Q2’10 was 13.1%, and panel makers have set targets to exceed 30% by the end of the year. LG Display, AUO, and Chimei Innolux are leading in LED monitor panel shipments. In terms of notebook PCs, LED penetration soared to 92% in Q2’10.

For more information visit: www.displaysearch.com