Harris Interactive announced one of its recent surveys suggests that most Americans are not yet ready to cut the cable TV cord but many would be willing under the right circumstances.

Harris Interactive announced one of its recent surveys suggests that most Americans are not yet ready to cut the cable TV cord but many would be willing under the right circumstances.

For more information visit: www.harrisinteractive.com

Unedited press release follows:

The Evolution of Watching Television

Most Americans have seen TV shows online; fewer are ready to cut the cable cord today, but many could soon

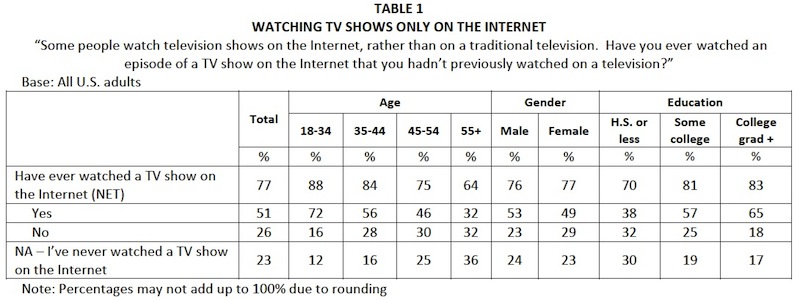

New York, N.Y. – June 14, 2011 – The Internet has crept into every corner of our lives, and it looks like television is no exception. Over three-quarters of Americans (77%) have watched a TV show on the Internet rather than on a traditional television. Just three in ten U.S. adults (30%) say , however, they are not interested in giving up their cable television in favor of watching TV shows on the Internet, yet over half of those with cable would stop paying for cable, if certain stipulations were met (56%).

These are some of the findings of a recent Adweek/Harris Poll survey of 2,309 U.S. adults surveyed online between May 24 and 26, 2011 by Harris Interactive.

The future of TV, and how Americans experience it, is changing. In many ways these changes are visible with the use of DVR systems, the increasing number of shows available online, and the expansion of services offered by companies like Netflix.

Other findings in this poll include:

• Half of U.S. adults say they have watched a show on the Internet that they never previously saw on a traditional television (51%);

• Younger adults are more likely to have watched a TV show on the Internet than are those older-88% of those 18-34 years have, compared to 84% of those 35-44 years, 75% of those 45-54 years and 64% of those 55 years and older;

• Men and women are equally likely to have watched a TV show on the Internet-just over three quarters say they have done so (76% and 77%, respectively);

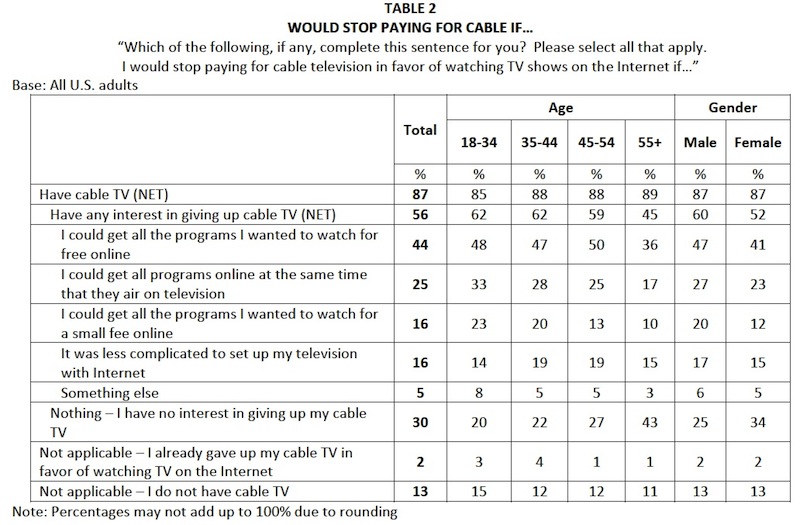

• Almost nine in ten Americans currently have cable TV (87%) and a majority would stop paying for it in favor of watching TV shows on the Internet if certain conditions were met (56%):

• Two in five say they would stop paying for cable TV in favor of watching TV shows on the Internet if they could get all of the programs that they wanted to watch for free online (44%);

• A quarter of adults say that they would need to get all the shows they wanted to watch online at the same time that they air on TV (25%);

• 16% would do so if they could get all the programs they wanted to watch for a small fee online and the same number say they would do so if it was less complicated to set their TV up with Internet .

• Looking by age, majorities of those aged 18-34, 35-44 and 45-54 with cable would be interested in giving up their cable TV if certain conditions were met (between 59% and 62%) yet less than half of those 55 and older say the same (45%); and,

• Men are more interested in stopping their cable TV paid subscription than women are (60% vs. 52%).

So What?

While most Americans have experienced TV shows online, many are not quite ready to cut the cable cord. But, if various conditions were met, majorities would be willing to say good-bye to those monthly cable bills. These listed provisions may foreshadow the future of American television watching as the networks and online companies work to give their consumers what they want, while finding new and creative ways to maintain revenue. It looks like it is all in the hands of the cable companies now.

Methodology

This Adweek/Harris Poll was conducted online within the United States between May 24 and 26, 2011 among 2,309 adults (aged 18 and over). Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population. Where appropriate, this data were also weighted to reflect the composition of the adult online population. Propensity score weighting was also used to adjust for respondents’ propensity to be online.

All sample surveys and polls, whether or not they use probability sampling, are subject to multiple sources of error which are most often not possible to quantify or estimate, including sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments. Therefore, Harris Interactive avoids the words “margin of error” as they are misleading. All that can be calculated are different possible sampling errors with different probabilities for pure, unweighted, random samples with 100% response rates. These are only theoretical because no published polls come close to this ideal.

Respondents for this survey were selected from among those who have agreed to participate in Harris Interactive surveys. The data have been weighted to reflect the composition of the adult population. Because the sample is based on those who agreed to participate in the Harris Interactive panel, no estimates of theoretical sampling error can be calculated.

These statements conform to the principles of disclosure of the National Council on Public Polls.

The results of this Harris Poll may not be used in advertising, marketing or promotion without the prior written permission of Harris Interactive.

The Harris Poll ® #72, June 14, 2011

By Samantha Braverman, Sr. Project Researcher, Harris Interactive

About Harris Interactive

Harris Interactive is one of the world’s leading custom market research firms, leveraging research, technology, and business acumen to transform relevant insight into actionable foresight. Known widely for the Harris Poll and for pioneering innovative research methodologies, Harris offers expertise in a wide range of industries including healthcare, technology, public affairs, energy, telecommunications, financial services, insurance, media, retail, restaurant, and consumer package goods. Serving clients in over 215 countries and territories through our North American, European, and Asian offices and a network of independent market research firms, Harris specializes in delivering research solutions that help us – and our clients – stay ahead of what’s next. For more information, please visit www.harrisinteractive.com.

About Adweek

Adweek relaunched in April 2011 as a single news source covering the intersection of advertising, media, marketing and technology. The new Adweek unites all of these disciplines through the magazine’s bold opinion pieces, enhanced data mining, trends, and behind-the-scenes coverage, as well as a freshly designed Adweek.com with breaking news all day, added video content, new columns and editorial franchises, social media integration and an editorial archive. With celebrated columnist, book author, and commentator Michael Wolff at the helm as Editorial Director, Adweek will bring its journalistic prowess and integrity to subjects formerly covered by Adweek, Brandweek and Mediaweek. Adweek will continue to provide experiential opportunities for the industry through conferences, events, honors, and awards.

Adweek is owned by Prometheus Global Media, a diversified company with leading assets in the media and entertainment arenas, including: Music (Billboard and its related conferences and events, including The Billboard Latin Music Awards), Entertainment (The Hollywood Reporter, Backstage, ShowEast, Cineasia, and CineEurope); and Advertising & Marketing (Adweek, Adweek Conferences and The CLIO Awards).