DisplaySearch announced it forecasts that Active Matrix OLED (AMOLED) manufacturing capacity will nearly triple in 2012.

DisplaySearch announced it forecasts that Active Matrix OLED (AMOLED) manufacturing capacity will nearly triple in 2012.

For more information visit: www.displaysearch.com

Unedited press release follows:

AMOLED Manufacturing Capacity Forecast to Nearly Triple in 2012

Ramp-Up of the First Gen 5.5 AMOLED Fab to Dramatically Increase Availability of AMOLED Panels

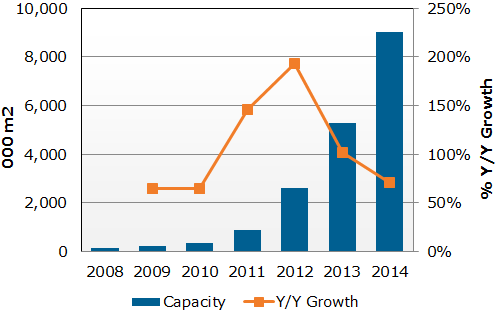

Santa Clara, California, August 23, 2011—The long-anticipated growth in size and volume of AMOLED display manufacturing is finally becoming a reality, with Samsung Mobile Display’s (SMD) ramp-up of the first Gen 5.5 AMOLED fab. The company began installing equipment in its A2 factory in December 2010 and is now expected to reach maximum capacity of 80,000 substrates per month by the end of Q1’12. As analyzed in the DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report, this development is forecast to drive growth in AMOLED capacity from 890,000 m2 in 2011 to 2.6 million m2 in 2012; capacity is expected to then double again in 2013.

Figure 1: AMOLED Manufacturing Capacity

Source: DisplaySearch Q2’11 Quarterly FPD Supply/Demand and Capital Spending Report

“SMD currently accounts for nearly 100% of commercial AMOLED shipments, and its A2 Gen 5.5 fab and planned future factories will account for much of the expected capacity growth. Other existing and potential AMOLED manufacturers are watching SMD’s progress and aggressive expansion plans, hoping that they will be able to leverage advances in equipment technology and take advantage of growing interest in AMOLED displays for smart phones and other applications,” explained Charles Annis, DisplaySearch Vice President of Manufacturing Research. “AUO, LG Display, Chimei Innolux and IRICO are also forecast to build either pilot or mass production AMOLED lines in the next two years, while other companies are currently considering entering the market.”

LCD panel makers have suffered negative net profit margins for four consecutive quarters, and with excess a-Si LCD capacity for TV production, FPD equipment spending is now forecast to fall by more than 40% in 2012. On the other hand, supply of AMOLED displays has been very tight in 2011. As SMD ramps A2, many more AMOLED displays will hit the market, and demand is expected to grow in turn. AMOLED displays are a bright spot in the FPD manufacturing industry, offering hope for FPD supply chain companies.

“In addition to the opportunities that capacity expansion can provide, many companies are racing to develop material and equipment technologies to support AMOLED manufacturing. Successful development of oxide semiconductors, high resolution lithography, laser-induced thermal imaging (LITI), vertical, scanning evaporation, thin film encapsulation and flexible substrates—just to name a few—could mean big payoffs for some supply chain companies as production of AMOLEDs ramps up,” Annis added.

Most of the new AMOLED capacity coming on-line is optimized for small/medium display production. But high-quality and—theoretically—low-cost AMOLED TV remains the ultimate target for FPD makers. Both SMD and LG Display are moving ahead with Gen 8 AMOLED TV pilot production plans for 2012. How successful they will be and what additional capacity expansions AMOLED TV might drive are still unclear, but these are key trends to follow in the FPD manufacturing industry.

Discussion of these topics and much more can be found in the DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report. The report is a comprehensive guide to the most important metrics used to evaluate supply, demand and capital spending for all major FPD technologies and applications. The report features in depth analysis and critical data in user-friendly Excel pivot tables and detailed interpretation of market and technical trends in PowerPoint. For more information about the improved DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.