IHS iSuppli announced that, according it its latest research, Seagate will control 40% of the hard drive market when its deal to acquire Samsung’s disk business closes later this year.

IHS iSuppli announced that, according it its latest research, Seagate will control 40% of the hard drive market when its deal to acquire Samsung’s disk business closes later this year.

For more information visit: www.isuppli.com

Unedited press release follows:

Seagate to Control 40 Percent of Hard Drive Market With Samsung Acquisition

El Segundo, Calif., May 3, 2011— Seagate Technology LLC’s recent buyout of Samsung Electronics Co. Ltd.’s hard disk drive (HDD) business will considerably boost the newly merged entity’s overall standing, with combined shipments accounting for two-fifths of an HDD market worth 652.4 million units in 2010, according to IHS iSuppli research.

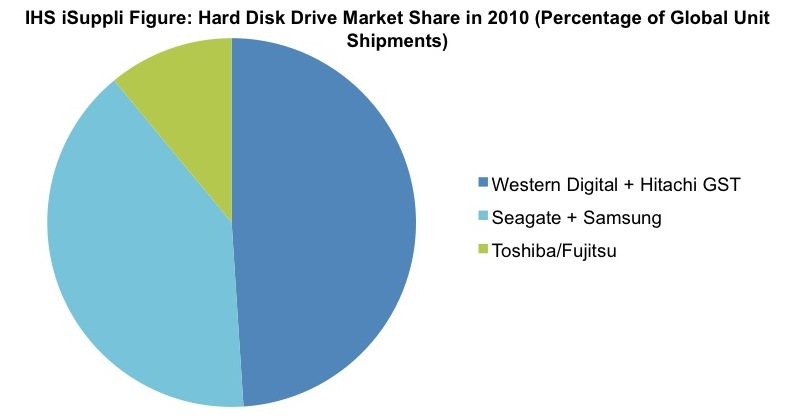

Based on final year-end figures from 2010, HDD shipments tallied from both Seagate and Samsung equated to 261.2 million units—enough to give the combined companies 40 percent of the HDD market, or a No. 2 finish for the year. Separately, Seagate’s shipment share in 2010 showed 195.2 million units, while Samsung’s HDD business brought in 66.0 million units. Without the merger, Seagate’s shipment share of market would have stood at 30 percent, and that of Samsung would have topped out at 10 percent.

Even with the combined shipments, however, Western Digital Corp. retains overall market leadership in HDDs, the primary storage medium for desktop PCs and most notebook computers. Only one month prior to the Seagate purchase, Western Digital had made its own acquisition by purchasing Hitachi Global Storage Technologies. Western Digital’s shipments of 203.7 million units, together with Hitachi’s 115.8 million, coalesced to produce total 2010 shipments of 319.5 million, putting owner Western Digital at No. 1 in the HDD space with 50 percent market share, as shown in the attached figure.

With the completion of the two mergers, the HDD battleground has been effectively whittled down to just three players from five. Left standing far behind in third place is Toshiba/Fujitsu—itself the eponymous product of a merger in 2009. Toshiba/Fujitsu had shipments in 2010 of 71.7 million units, or 10 percent share of the HDD market.

“Overall, the reduction from five to three manufacturers considerably improves the stability and efficiency of the HDD industry,” said Fang Zhang, analyst for storage systems at IHS. “However, the acquisition also signals a recognition by Seagate and Samsung that conditions in the storage space will become more challenging in the future.”

The transaction, valued at $1.38 billion, enhances Seagate’s access to Samsung’s NAND flash technology and gives Seagate access to Samsung’s clients in the Asian market. For Samsung, the acquisition reorients its storage focus on solid state drives, a rival technology for HDDs, while freeing the company to allocate resources and develop growth in other segments where the South Korean giant has interests, like the semiconductor foundry business.

By obtaining Samsung’s HDD business, Seagate also has made great strides in closing the gap with its perennial competitor, Western Digital. “Taken together, the mergers engineered by Seagate and Western Digital will be key to improving the sustainability of the HDD industry, IHS believes, demonstrating the industry’s nimble response to fast-occurring changes playing out in the storage environment,” said Ryan Chien, researcher for memory and storage at IHS.

Learn more about the hard drive market with the IHS report entitled: Samsung Steps Away, Leaving a Group of Three.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.