IHS iSuppli announced that, according to its latest research, Apple’s share of the smartphone market grew to 19.2% in the first quarter of 2011 while Nokia’s portion dropped to 24.9%.

IHS iSuppli announced that, according to its latest research, Apple’s share of the smartphone market grew to 19.2% in the first quarter of 2011 while Nokia’s portion dropped to 24.9%.

For more information visit: www.isuppli.com

Unedited press release follows:

Apple Defies Decline in Smart Phone Market, Posts Best Growth Among Top Brands in Q1

El Segundo, Calif., May 9, 2011—Bucking a rare downturn in the burgeoning smart phone business, Apple Inc. in the first quarter achieved double-digit-percentage growth in iPhone shipments and posted the best performance among the Top 5 competitors, new IHS iSuppli (NYSE: IHS) research reveals.

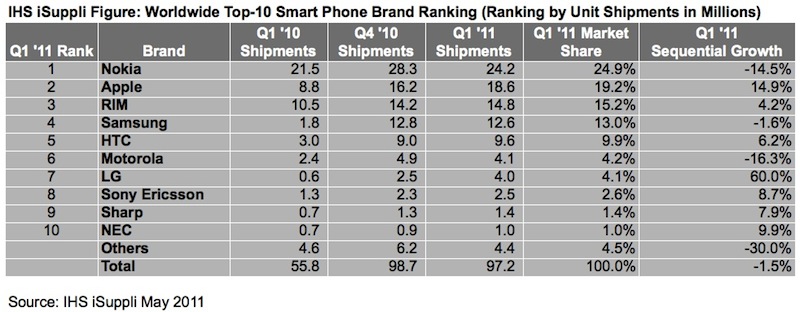

No. 2-ranked Apple in the first quarter of 2011 shipped 18.6 million iPhones, up 14.9 percent from 16.2 million in the fourth quarter of 2010, as shown in the attached table. Apple’s increase represented the highest percentage growth among the world’s Top 5 smart phone brands, with No. 5-ranked HTC coming in a distant second given its 6.2 percent growth. It also marked a standout performance in a smart phone market that suffered a 1.5 percent sequential decline in shipments during the first quarter.

“Apple’s smart phone market share in the first quarter was boosted by the introduction of its first iPhone model with code division multiple access (CDMA) as well as by the addition of Verizon Wireless as a carrier in the United States,” said Tina Teng, senior analyst, wireless communications, for IHS. “Not only did this allow Apple to expand its target market and boost shipments, it also placed additional pressure on rival smart phone brands—including Motorola, Samsung, LG and HTC—that focus on Verizon Wireless as a major customer.”

With its concentration on the U.S. market, Motorola was the one most impacted by Verizon’s addition of the iPhone, a factor contributing to Motorola’s 16.3 percent decline in shipments in the first quarter.

Gunning for No. 1

With shipments from Nokia, the No. 1 smart phone brand, declining by 14.5 percent during the first quarter, Apple made major strides toward achieving market leadership. Apple in the first quarter trailed Nokia by just 5.7 percentage points, compared to 12.2 points in the fourth quarter of 2010.

Nokia’s smart phone shipments declined to 24.2 million units in the first quarter, down from 28.3 million in the fourth quarter.

The company’s agreement with Microsoft Corp. to make Windows Phone 7 its principal operating system over the long term is having a negative near-term impact on its smart phone shipments. With the announcement of the deal, Nokia eliminated the incentive for consumers to buy its existing smart phone products, which are based on its Symbian and MeeGo operating systems. Meanwhile, the Microsoft deal is unlikely to yield any products for nearly one year.

A bump in the smart phone road

The decline in smart phone shipments in the first quarter represents the first sequential decrease since the beginning of 2009. While many electronic products typically suffer a sales slump during the beginning of the year following the peak selling sales season in the fourth quarter, the fast-growing smart phone has been immune to this phenomenon during most years.

However, IHS iSuppli does not believe the first-quarter results represent a long-term trend for the smart phone market.

“The reduction of shipments reflects inventory control efforts in the smart phone market, rather than weakening consumer demand,” Teng said. “This decline does not change the IHS iSuppli forecast of 60 percent growth in worldwide smart phone shipments for the entire year of 2011.”

Research in Motion outperforms the market

No. 3 smart phone brand Research in Motion (RIM) in the first quarter outperformed the overall market, with its shipments rising by 4.2 percent. The company benefited from success by expanding sales in regions outside North America. It also capitalized on the trend toward cell-phone-based monetary transactions with the announcement of several smart phone models that integrate near-field communications (NFC) technology. Furthermore, RIM continues to appeal to business customers who value the company’s focus on its service package and security as the key selling points.

Despite RIM’s above-average performance, the company lost ground on the No. 2 smart phone ranking to Apple. RIM in the first quarter trailed Apple by 4 percentage points, up from 2.1 points in the fourth quarter of 2010.

For more information on this topic, see Teng’s upcoming report, entitled: Nokia-Microsoft Partnership to Change Smart Phone OS Landscape.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s global business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.