IHS iSuppli announced that, according to its latest teardown analysis, Apple’s iPad 2 (32GB GSM/HSPA) tablet carries a bill of materials (BOM) of $326.60.

IHS iSuppli announced that, according to its latest teardown analysis, Apple’s iPad 2 (32GB GSM/HSPA) tablet carries a bill of materials (BOM) of $326.60.

For more information visit: www.isuppli.com

Unedited press release follows:

iPad 2 Carries Bill of Materials of $326.60, IHS iSuppli Teardown Analysis Shows

iPad 2 Carries Bill of Materials of $326.60, IHS iSuppli Teardown Analysis Shows

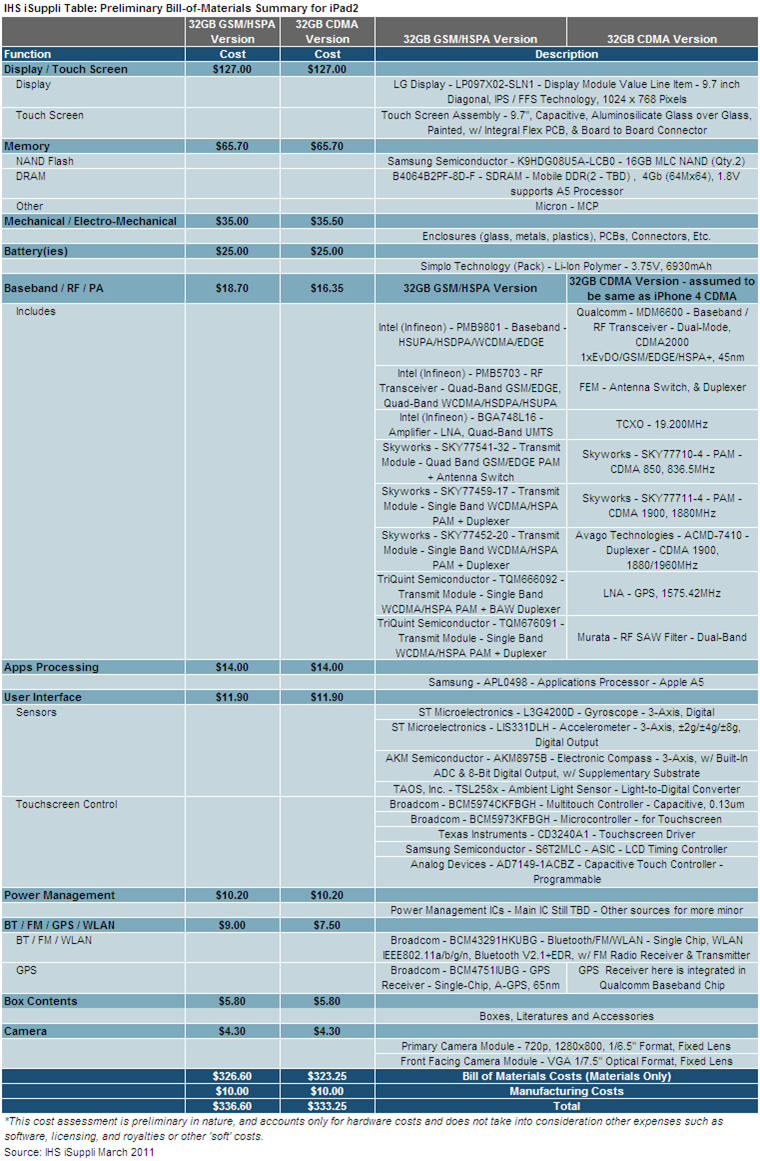

With the second-generation iPad, Apple Inc. has held the line on the bill of materials (BOM), maintaining virtually the same costs as the first version of the device, an IHS iSuppli teardown analysis of the product has revealed. The 32GB NAND flash memory version of the iPad 2 equipped the with Global System for Mobile Communications/high-speed packet access (GSM/HSPA) air standard carries a BOM of $326.60. The 32GB version equipped with the code division multiple access (CDMA) air standard carries a BOM of $323.25. The compares with $320 for the first-generation 32GB 3G iPad, based on pricing from April 2010.

When manufacturing costs are added, the cost to produce the GSM/HSPA version rises to $336.60, and the CDMA version goes to $333.25. The attached table presents the IHS iSuppli preliminary BOM and manufacturing cost estimates for the two versions of the iPad 2 torn down by IHS iSuppli.

The component and vendor selection in the second-generation iPad 2 closely conforms with that of the original iPad. “Despite the obvious changes to iPad like the enclosure and the battery, and the less obvious changes in the touch screen, the iPad 2’s components and design are remarkably similar if not the same as those of the iPad 1,” Rassweiler observed. “The iPad 1 and iPad 2 use the same components and suppliers for the NAND flash, the multi-touch controllers and touch screen drivers, as well as the same core chip in the wireless section as was found in the iPhone 4. Many of the other components—including the apps processor and the Bluetooth/frequency/global positioning system/wireless local area network chips—have the same suppliers and are essentially new revisions of the chips found in the previous iPad and other iPhones.”

The touch screen in the iPad 2 has been modified and updated in the iPad 2, but the LG Display appears to be the same; and our cost estimates for the touch screen are markedly higher. The display and touch screen subsystem in the iPad 2 costs $127.00, compared to our initial $95.00 estimates for the iPad 1, based on pricing from April 2010. The difference is due almost entirely to the cost of the touch screen. The reason for the increase comes in large part from manufacturing challenges that the touch screen manufacturers have experienced since beginning production. Production yields, though they have been improving, has been very low throughout 2010, and drove prices to be much higher than initially expected. Furthermore, refinements in the touch screen specifications have driven the price point even higher for the iPad 2. Contributing factors to that cost increases include more expensive glue to improve the efficiency/performance in the bonding, thinner Gorilla cover glass and more detailed inspection process requiring additional equipment for optical and panel examination.

For the GSM/HSPA iPad 2, Apple is sticking with the same wireless baseband/radio frequency/power amplifier solution from Infineon—now owned by Intel—as is used in the iPhone 4 (GSM/HSPA version). Because of the use of a Qualcomm Inc. solution used in the recent iPhone 4 CDMA, we had initially speculated that Apple might consolidate suppliers for wireless chips and use a Qualcomm solution in the iPad 2 GSM/HSPA version. Instead the iPad 2 uses the same Intel chipset used in the iPhone 4 GSM/HSPA version. For the CDMA version of the iPad 2, it is assumed the chips and components from the CDMA version of the iPad 2 are those used in the iPhone 4 CDMA, and we have taken our wireless component list directly from our iPhone 4 CDMA teardown analysis.

The A5 processor in iPad 2 costs 75 percent more the A4 processor in the iPad 1, based on improvements in performance and inherent design changes. The A5 processor, whether produced by Samsung or another foundry, is based on Apple’s own designs. Apple owns the intellectual property, and as such, whoever builds the A5 processor for them is doing so as more of a foundry service—like a contract manufacturer—which gives Apple a huge competitive cost edge on the piece price of these processors. At $14, the A5 processor costs 75 percent more than the current A4 processor. The cost of this processor is expected to erode quickly over the course of the next year as Apple ramps production.

The iPad 2 employs an improved and more expensive battery compared to the iPad 1. The iPad 2 battery carries a cost of $25.00, compared to $21.00 for the iPad 1. The iPad 2’s battery is much thinner than the iPad 1’s and uses three cells, rather than two. Apple never takes a standard approach with batteries and challenges its vendors to create unique solutions to accommodate their desired form factor. Although other manufacturers are using similar flat pack batteries, these incredibly thin batteries, and special battery management circuitry just for Apple batteries, provide an exceptional result. Power management circuitry also plays a big role in the iPad 2, as well as in iPhones and iPods, and represent a major part of how Apple is able to maximize battery lifetime while minimizing size and weight.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.