DisplaySearch announced that it has published its Quarterly Mobile Phone Shipment and Forecast Report.

DisplaySearch announced that it has published its Quarterly Mobile Phone Shipment and Forecast Report.

According to the statement, highlights include the growing demand for larger, higher-resolution displays driven by next generation smart phones as well as Apple’s success with the iPhone, which overtook Sony Ericsson to become the #5 global mobile phone manufacturer on a shipment basis.

For more information visit: www.displaysearch.com

Unedited press release follows:

Next Gen Smart Phones Driving Demand for Larger, Higher-Resolution Displays

Apple Overtakes Sony Ericsson in Q2’10 to Join Top 5 Global Mobile Phone Manufacturers

Santa Clara, Calif., November 3, 2010 — Despite the high saturation and worldwide penetration of mobile phones, manufacturers are initializing the next growth cycle in order to increase ASPs and maintain revenues. According to the DisplaySearch Quarterly Mobile Phone Shipment and Forecast Report, demand for larger screen sizes and higher resolution presents an opportunity for continued growth.

“The strong mobile phone results in Q2’10 demonstrate the popularity of smart phones, which require higher resolution and larger displays to enable applications such as social networking, navigation, and web surfing,” noted Calvin Hsieh, Mobile Phone Research Director of DisplaySearch. “This successful performance drove mobile phone main display revenues for the quarter.”

As a result of the growing iPhone success, in Q2’10, Apple overtook Sony Ericsson to become the #5 global mobile phone manufacturer on a shipment basis with a 3.1% share, up 127% Q/Q and 28% Y/Y from Q1’10. Nokia ranked first with a 31.3% share, followed by Samsung (17.5%), LG (7.1%) and RIM (4.1%). In terms of the rapidly growing Wideband Code Division Multiple Access (WCDMA), Apple ranked #4 with a 10.4% market share.

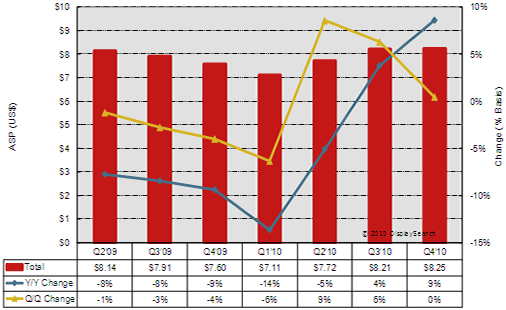

Revenue for main displays reached a remarkable $3B in Q2’10, up 14% Q/Q and 3% Y/Y. Shipments grew to 389.1 million, up 5% Q/Q and 8% Y/Y. Average selling prices for mobile phone displays grew 9% Y/Y to $7.72.

Figure 1. Average Selling Prices for Mobile Phone Displays

Source: Quarterly Mobile Phone Shipment and Forecast Report

In terms of resolution, QVGA (240×320) captured the largest market share in Q2’10, and is estimated to grow to a 24.4% share by the end of 2010. In addition, WVGA (480×800 and 480×864) grew from 2.6% in 2009 to 5.3% in Q2’10, up 62% Q/Q and 121% Y/Y.

Figure 2. Display Resolution Market Share

Source: Quarterly Mobile Phone Shipment and Forecast Report

Additional report highlights include:

* Si TFT LCD panel makers reported growth in shipments of larger sizes and higher resolutions of mobile phone displays in Q2’10, with Samsung Mobile leading on a shipment basis with a 26.7% share, followed by AUO (11.4%) and Chimei Innolux (11.3%).

* Average mobile phone display diagonal size reached 2.3” in Q2’10, up 3% Q/Q and 8% Y/Y. LTPS-based panels (AMOLED and LTPS TFT LCD) grew 7% Q/Q and 15% Y/Y, respectively.

* On a shipment basis, a-Si TFT LCD captured more than a 60% share in Q2’10, up 2% Q/Q and 19% Y/Y, taking share from CSTN, as well as LTPS TFT LCD which declined from 22.8% in 2008 to 20.4% in 2009. The LTPS TFT LCD shipment share will likely drop to less than 20% in 2011. Despite this, the smart phone trend will be helpful for LTPS TFT LCD and should slow its decline.

Based on detailed supplier surveys, the DisplaySearch research examines small/medium display shipment, revenue, and pricing data by key metrics, including market application, size, resolution, technology and supplier. Available research includes four quarterly reports focusing on different aspects of the market. The comprehensive Quarterly Small/Medium Shipment and Forecast Report provides a full market analysis while the Quarterly Small/Medium Pricing Report, Quarterly Mobile Phone Shipment and Forecast Report and Quarterly Small/Medium Value Chain Report focus on ASPs, mobile phone displays, and market share data, respectively.

Please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless.