IHS iSuppli announced that, according to its latest research, wireless carriers in China plan to double their capital spending on 4G Long Term Evolution (LTE) networks in 2011.

IHS iSuppli announced that, according to its latest research, wireless carriers in China plan to double their capital spending on 4G Long Term Evolution (LTE) networks in 2011.

For more information visit: www.isuppli.com

Unedited press release follows:

China’s Wireless Carriers Double Capital Spending on 4G in 2011

El Segundo, Calif., March 3, 2011—China’s investment in the next-generation 4G wireless technology known as Long Term Evolution (LTE) is set to double in 2011 as the country’s major telecom carriers move to upgrade services, according to new IHS iSuppli research.

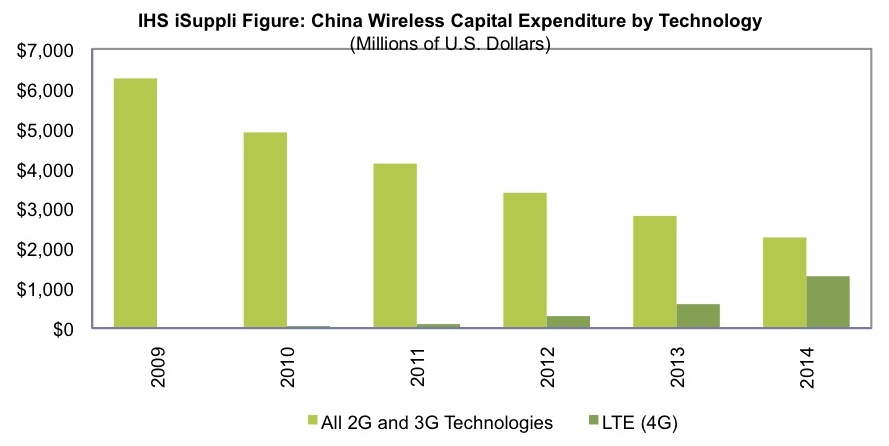

Although capital expenditures in China for LTE now are at miniscule levels, spending by the carriers will rise rapidly during the years to come. Capital spending for LTE in 2011 is projected to reach $100 million this year, double the $50 million of 2010. It then will triple in size to $300 million in 2012, jump to $600 million in 2013 and then hit $1.3 billion by 2014, as shown in the attached figure.

In comparison, combined capital expenditures will decline during the next three years for the older 2G and 3G wireless technologies that continue to operate throughout the country.

“China is the only place in the world to have three different 3G technologies in commercial use simultaneously, each offered by a separate carrier following a large-scale reorganization of the country’s state-run telecom sector in 2008,” said Kevin Wang, China research analyst at IHS. “But with 3G networks collectively being upgraded to 4G now and in the future, all three operators could shift to LTE.”

China Mobile, the biggest carrier in the country as well as the largest telecom operator in the world in terms of subscribers, is expected to launch LTE this year. Already, China Mobile has joined forces with Verizon and Vodafone in a cooperative LTE trial. Equipment vendors participating in the trial include Alcatel-Lucent, Ericsson, Motorola, Nokia Siemens Networks and Nortel. The trial aims to deploy more than 100 base station sites in each of six cities, covering more than 100 million subscribers.

For China Telecom and China Unicom, the country’s two other carriers will be deploying LTE between 2012 and 2013. China Telecom is waiting for LTE technology to mature before taking the full plunge, IHS has learned, while China Unicom will deploy LTE first in large cities like Shanghai and Beijing, as well as consider a move to commercial LTE after 2013.

The individual timetables by each operator notwithstanding, the move to next-generation 4G has the support of the Chinese government. To this end, equipment vendors should get into a position where they can leverage current wireless operations toward the upcoming standard if they wish to make a positive early impact on the market, especially as Chinese carriers conduct business in an increasingly competitive environment, IHS believes.

The 3G technologies at present command the lion’s share of wireless capital spending in China. However, 3G will account for just 55 percent of spending by 2014, down from 67 percent this year. China wireless spending on LTE, in contrast, will jump from a virtually negligible share in 2011 to approximately 36 percent of the total after three years, IHS iSuppli research shows.

Learn more about the latest developments in the China wireless market with Wang’s report, entitled: China Mobile Communications: LTE Leading the Way to 4G.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.