Cinram International Income Fund announced its fourth quarter 2010 and year to date financial results.

Cinram International Income Fund announced its fourth quarter 2010 and year to date financial results.

According to the statement, fourth quarter highlights include:

• Prerecorded multimedia revenue was $261.9 million in 2010 compared to $456.3 million in 2009.

• DVD revenue was $211.6 million in 2010 compared to $402.5 million in 2009.

• Blu-ray Disc (BD) replication revenue was $13.1 million in 2010 compared to $7.8 million in 2009.

• CD revenue was $37.2 million in 2010 compared to $46.0 million in 2009.

• Video game revenue was $20.2 million in 2010 compared to $33.2 million in 2009.

Cinram trades on the TSX under the symbol CRW.UN

For more information visit: www.cinram.com

Unedited press release follows:

Cinram Reports 2010 Fourth Quarter and Year to Date Results

Earnings from continuing operations

$7.4 million in Q4 2010 versus loss of $9.3 million in 2009

$18.4 million full year 2010 versus a loss of $6.0 million in 2009

(All figures in U.S. dollars unless otherwise indicated)

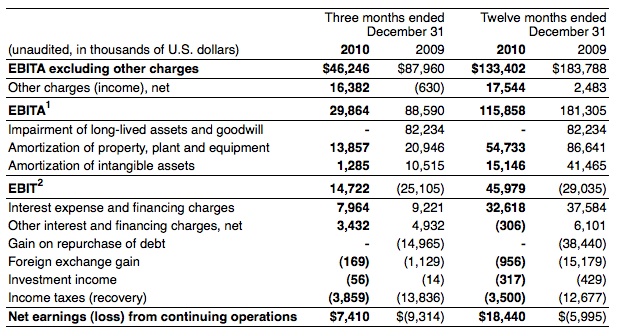

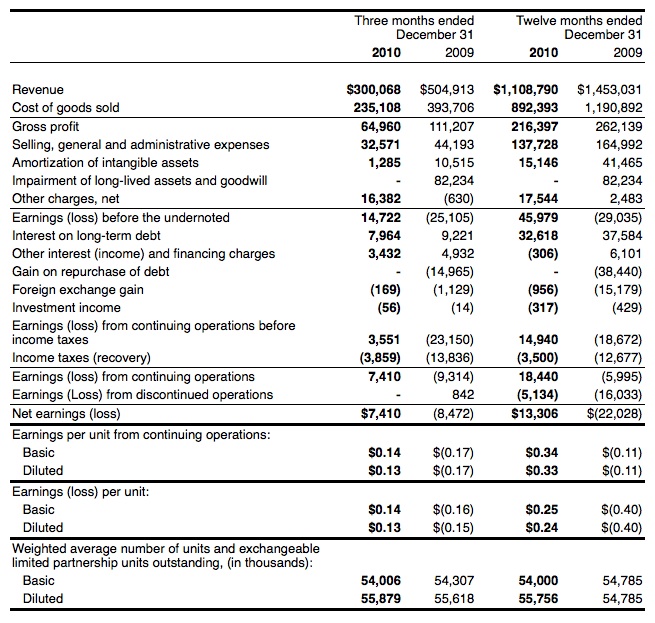

TORONTO, March 2 – Cinram International Income Fund (“Cinram” or the “Fund”) (TSX: CRW.UN) today reported its 2010 fourth quarter and year to date Consolidated financial results. The Fund reported revenue of $300.1 million in the 2010 fourth quarter compared to $504.9 million in the fourth quarter of 2009. Earnings from continuing operations for the 2010 fourth quarter increased to $7.4 million or $0.14 per unit (basic) compared with a net loss from continuing operations of $9.3 million or $0.17 per unit (basic) in 2009. Gross profit in the 2010 fourth quarter was $65.0 million (21.6% of revenue) compared with $111.2 million (22.0% of revenue) in the comparable period in 2009. Earnings before interest, taxes and amortization (EBITA1), excluding other charges was $46.2 million in the fourth quarter compared with $88.0 million in the fourth quarter of 2009. As a percent of revenue, EBITA excluding other charges was 15.4% in 2010 compared with 17.4% in 2009. As expected, the termination of the Warner Home Video (WHV) contract effective July 31, 2010 significantly impacted revenue and EBITA in the fourth quarter of 2010.

On a year to date basis, revenue was $1,108.8 million compared with $1,453.0 million in the prior year. Earnings from continuing operations improved to $18.4 million or $0.34 per unit (basic) compared with a loss of $6.0 million or $0.11 per unit (basic) in 2009. EBITA excluding other charges was $133.4 million in 2010 compared to $183.8 million in 2009. Despite a 24% drop in revenue, EBITA, as a percentage of revenue, decreased only slightly to 12.03% from 12.65% in 2009.

“The results for the 2010 fourth quarter were consistent with our expectations given the termination of the Warner Home Video contract last July 31. As anticipated, revenues were below prior year by over $200 million. Notwithstanding, the Fund performed well and was able to maintain the financial metrics and performance margins despite the significant decline in revenue. The efforts of our senior management and dedicated staff to client service and at the same time, cost control initiatives is evident in our results,” commented Steve Brown, Chief Executive Officer.

On January 31, 2011 the Fund announced its acquisition of Los Angeles-based digital media company 1K Studios (“1K”). The acquisition is part of a broad initiative to advance Cinram further into digital platforms. 1K specializes in building enhanced consumer experiences for movies, TV shows, music, digital books and games. 1K has been a key service provider to many of the world’s top media and technology companies including Apple, Paramount Home Entertainment, Disney Worldwide Studios, HBO and Warner Bros Home Entertainment.

“The acquisition of 1K Studios adds a very sophisticated and well respected new expertise within Cinram,” stated Steve Brown. “As we move to change the nature of Cinram from a pure physical media company to one which offers services to our client base on multiple platforms, 1K Studios will play an ever increasing role in responding to our existing and new clients’ requirements as Cinram’s digital offerings continue to expand.”

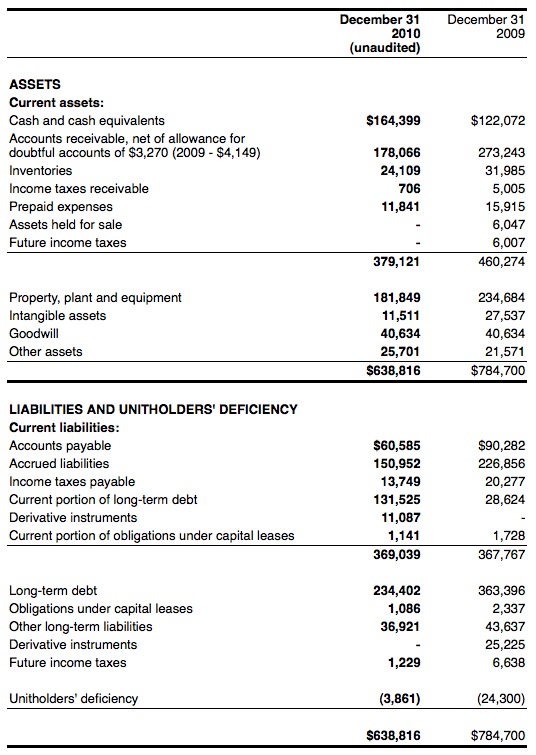

Balance sheet and liquidity

As of December 31, 2010, our net debt position (term debt excluding unamortized transaction costs, less cash and cash equivalents) improved to $202.3 million, compared with $273.3 million at the end of 2009, a further reduction of 26% from 2009. During 2010, our cash balance increased by $42.3 million to $164.4 million at December 31, 2010 from $122.1 million at the end of 2009.

As previously announced on February 17, 2011 the Fund has achieved 100% lender support for its previously announced proposed refinancing and recapitalization transaction (the “Refinancing and Recapitalization”). It is expected that the Refinancing and Recapitalization will close during March 2011.

“The refinancing and recapitalization transaction is a significant and positive development for Cinram and removes the uncertainty that has impacted the Fund following the announcement of the loss of the Warner Home Video contract a year ago,” commented John Bell, Cinram’s Chief Financial Officer.

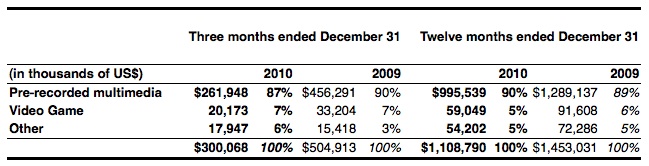

Segment revenue

Fourth quarter pre-recorded multimedia revenue (which includes replication and distribution of DVDs, Blu-ray discs and CDs) was $261.9 million in 2010 compared with $456.3 million in 2009.

DVD revenue was $211.6 million compared to $402.5 million in the fourth quarter of 2009 as a result of lower DVD unit shipments given the loss of the WHV contract effective July 31, 2010.

Blu-ray disc replication revenue increased by 68% in the fourth quarter to $13.1 million from $7.8 million in the comparable 2009 period.

CD revenue was $37.2 million during the fourth quarter of 2010 compared to $46.0 million in 2009 due to softening demand from our CD music label customers.

Video game revenue was $20.2 million in the fourth quarter of 2010 compared with $33.2 million in 2009 due to ongoing softness in the gaming industry combined with the loss of several customers.

Other revenue, which includes the wireless division and Cinram Retail Services (formerly the Vision Information Systems group) grew 16% in the fourth quarter. For the full year, revenue dropped primarily due to the withdrawal of the Fund from the wireless contract in Germany mid 2009.

“Although not our largest business segments, these two divisions – the wireless logistic group and our Retail Services group, just completed a very exciting year,” reported Steve Brown. “The wireless operation added a number of new services to its business including mobile phone repair services as well as expanding its distribution services to include set top boxes and a new entry into the fast growing tablet market. The Cinram Retail Services group recently launched the newest version of its popular vendor managed inventory software – Vision 2.0 – to a very responsive market.”

Geographic revenue

Fourth quarter North American revenue was $178.6 million compared to $265.0 million in 2009, principally as a result of lower DVD and CD revenues. North America accounted for 60 per cent of fourth quarter consolidated revenue compared with 52 percent in the prior year period.

European revenue was $121.5 million during the 2010 fourth quarter compared to $239.9 million in the prior year period. The revenue erosion was primarily due to the loss of the WHV business during the fourth quarter of 2010, combined with the foreign exchange impact associated with a weaker Euro relative to the U.S. dollar during the fourth quarter of 2010 compared to the same period in the prior year. Fourth quarter European revenue represented 40 percent of consolidated revenue compared with 48 percent in the fourth quarter of 2009.

Other financial highlights

Selling, general and administrative expenses decreased in the fourth quarter of 2010 to $32.6 million from $44.2 million in 2009. As a percentage of consolidated revenues, selling, general and administration expenses were 11% compared with 9% in 2009. For the year ended December 31, 2010, selling, general and administrative expenses dropped over $27 million, to $137.7 million from 2009.

Capital expenditures for 2010 were $14.7 million, compared to $42.2 million in 2009. The company added additional Blu-ray manufacturing capacity in Germany and in the United States in order to meet the ever increasing demand for replication capacity in this medium.

Unit data

For the three month period ended December 31, 2010, the basic weighted average number of units and exchangeable limited partnership units outstanding was 54.0 million, compared with 54.3 million in the prior year. For the year ended December 31, 2010, the basic weighted average number of units and exchangeable limited partnership units outstanding was 54.0 million compared with 54.8 million in the prior year.

Reconciliation of EBITA and EBIT to net earnings (loss) from continuing operations

1 EBITA is defined as earnings (loss) from continuing operations before interest expense, foreign exchange gain, investment income, gain on repurchase of debt, other interest and financing charges, income taxes and amortization. It is a standard measure that is commonly reported and widely used in the industry to assist in understanding and comparing operating results. EBITA is not a defined term under generally accepted accounting principles (GAAP). Accordingly, this measure may not be comparable with other issuers and should not be considered as a substitute or alternative for net earnings or cash flow, in each case as determined in accordance with GAAP. See reconciliation of EBITA to net earnings under GAAP as found in the table above.

2 EBIT is defined as earnings (loss) from continuing operations before interest expense, foreign exchange gain, investment income, gain on repurchase of debt, other interest and financing charges and income taxes, and is a standard measure that is commonly reported and widely used in the industry to assist in understanding and comparing operating results. EBIT is not a defined term under GAAP. Accordingly, this measure may not be comparable with other issuers and should not be considered as a substitute or alternative for net earnings or cash flow, in each case as determined in accordance with GAAP. See reconciliation of EBIT to net earnings under GAAP as found in the table above.

About Cinram

Cinram International Inc., an indirect, wholly-owned subsidiary of the Fund, is one of the world’s largest providers of pre-recorded multimedia products and related logistics services. With facilities in North America and Europe, Cinram International Inc. manufactures and distributes pre-recorded DVDs, Blu-ray discs, audio CDs, and CD-ROMs for motion picture studios, music labels, publishers and computer software companies around the world. Cinram also provides distribution and logistics services to the telecommunications industry in North America through its wireless subsidiary. The Fund’s units are listed on the Toronto Stock Exchange under the symbol CRW.UN. For more information, visit our website at www.cinram.com.

Certain statements included in this release constitute “forward-looking statements” within the meaning of applicable securities laws. Such forward-looking statements include statements concerning the possible effects of the transactions described herein, and the likelihood of their successful completion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Fund, or results of the multimedia replication industry, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Such factors include, among others, the following: the Fund’s ability to retain major customers; general economic and business conditions, which will, among other things, impact the demand for the Fund’s products and services; multimedia replication industry conditions and capacity; the ability of the Fund to implement its business strategy; the Fund’s ability to invest successfully in new technologies and other factors which are described in the Fund’s filings with the securities commissions. These risks may affect the achievement of the expected results of the transactions described herein. There can be no assurance that the said transactions will be successfully completed or that, if completed, the expected consequences will result in whole or in part, and the deviations from such expectations may be material.

CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands of U.S. dollars)

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

(unaudited, in thousands of U.S. dollars, except per unit/exchangeable LP unit amounts)

CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS (LOSS)

CONSOLIDATED STATEMENTS OF COMPREHENSIVE EARNINGS (LOSS)

(In thousands of U.S. dollars)

CONSOLIDATED STATEMENTS OF CASH FLOWS

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands of U.S. dollars)