The Diffusion Group (TDG) announced its research suggests that short-term demand for 4K Ultra HDTVs continues to be hampered by a lack of consumer awareness and revulsion to the high equipment costs.

The Diffusion Group (TDG) announced its research suggests that short-term demand for 4K Ultra HDTVs continues to be hampered by a lack of consumer awareness and revulsion to the high equipment costs.

For more information visit: www.tdgresearch.com

Unedited press release follows:

TDG: Lack of Awareness and Price Sensitivities Plague Short-term 4K Demand

83% Unfamiliar with Ultra-HD/4K Television, Challenge Exacerbated by High Prices

Plano, TX — July 17, 2014 — According to research from The Diffusion Group (TDG), short-term demand for 4K/Ultra-HD televisions is hindered by two simple but structurally important fundamentals: a widespread lack of awareness among consumers and a marked sensitivity to the costs of these advanced sets.

TDG research indicates that more than eight in ten adult broadband users have never heard of or are unfamiliar with 4K/Ultra-HD televisions – hardly a favorable environment for those OEMs looking to grow unit sales. According to TDG President Michael Greeson, “The industry is counting on 4K/UHD to be the solution for slow television sales and declining unit prices.”

All major TV OEMs have 4K/UHD sets in market, with prices generally ranging from $1,500 on the low end, to as much as $10,000 on the high end. Unfortunately, even among those familiar with the technology, TDG’s research suggests that prices are still too expensive for many consumers.

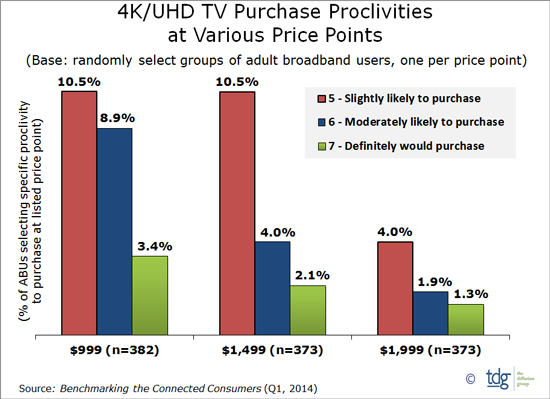

As noted in the graphic above, at a retail price of $1,499 – the midpoint of the three prices evaluated – only 6% of adult broadband users are moderately or highly likely to purchase a 4K/UHD TV. “This explicitly quantifies just how poor the demand for 4K/UHD televisions actually is,” said Greeson, “and clearly demonstrates that current prices are too high to stimulate new sales.”

To illustrate how rapidly this demand evaporates relative to price, only 3% of adult broadband users are moderately or highly likely to purchase a new 4K/UHD set at $1,999 a unit, a modest increase in price of $500 that results in a 50% decline in demand at $1,499.

“This is not to suggest that price is the only variable at play in the decision not to purchase a new 4K/UHD television,” says Greeson. “Nonetheless, it is two-to-one the primary reason cited by those unlikely to purchase a new 4K/UHD set. The next closest reason for a lack of interest was that non-buyers ‘were perfectly comfortable with the televisions they currently use,’ cited by 26% of this same segment.”

This last data point demonstrates a widespread complacency when it comes to purchasing new televisions. As Greeson adds, “There is no doubt that poor demand for televisions in general has impacted demand for 4K/UHD sets in particular. It would seem that 4K/UHD is falling far short of being the panacea the industry expected and needed.”

These insights are drawn from TDG’s most recent analysis of US adult broadband users, Benchmarking the Connected Consumer, which features 1,500 online interviews and covers a wide range of topics related to the use of various Internet-enabled video platforms, including in-home and mobile/portable devices. For more information about this research project, please contact sales(at)tdgresearch(dot)com.

About TDG Research

TDG provides actionable intelligence on the quantum market shifts impacting consumer technology and media behavior. Since 2004, our market research and advisory services have helped technology vendors, media companies, and service providers understand how consumers access, navigate, distribute, and consume broadband media — whenever and wherever they may be. For more information, visit our website at http://www.tdgresearch.com.